501c3 Grant Agreement

What is a 501c3 grant agreement?

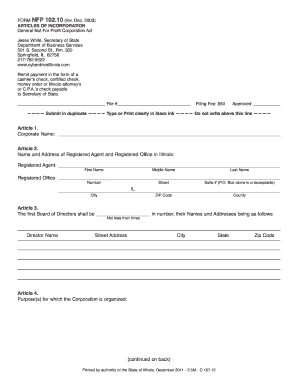

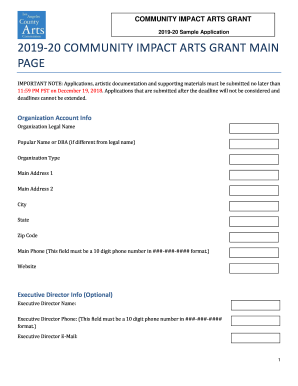

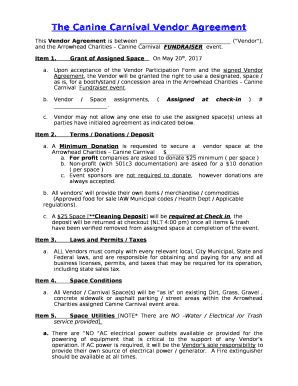

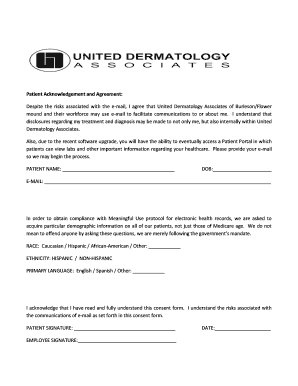

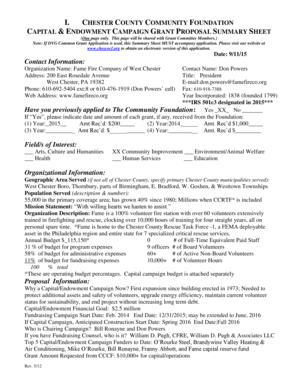

A 501c3 grant agreement is a legal document that formalizes the terms and conditions under which a nonprofit organization receives funding or grants from a donor or foundation. It outlines the responsibilities of both parties and ensures that the funds are used for the intended purpose.

What are the types of 501c3 grant agreements?

There are several types of 501c3 grant agreements that nonprofits can enter into, including:

General operating support grants

Project-specific grants

Capacity-building grants

Restricted grants

How to complete a 501c3 grant agreement

Completing a 501c3 grant agreement is a crucial step in securing funding for your nonprofit organization. Here are some key steps to follow:

01

Read the agreement carefully and understand the terms and conditions

02

Fill in all required information accurately

03

Sign the agreement and have it signed by the donor or foundation

04

Keep a copy of the signed agreement for your records

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out 501c3 grant agreement

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

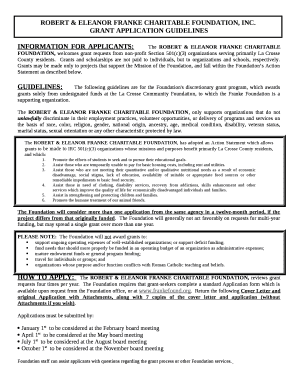

What should be included in a grant agreement?

In addition to standard terms describing grant amounts and purposes, agreements also include provisions regarding intellectual property rights, reporting requirements, and indemnification, among other subjects. Special provisions are included that deal with international philanthropy.

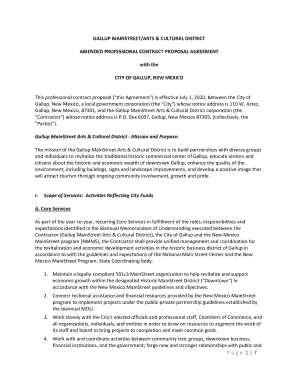

What is the difference between a grant agreement and a service contract?

Grants are awards of financial assistance, usually from a governmental agency or foundation, primarily for carrying out a public purpose of support or stimulation. A grant is distinguished from a contract, which is used to acquire property or services for the government's direct benefit or use.

How do you write a non profit grant proposal?

Below you will find the key components of most grant proposals: Program Title. Executive Summary. Description and Background of the Organization. Problem Statement/Need for the Program. Program Description. Goals & Objectives. Implementation Plan: Activities, Timeline, & Staff. Evaluation Plan. Budget/Budget Narrative.

Is a subaward a grant or contract?

Applying the Classification to Your Proposal Budget Once you have determined whether the funds should be classified as a subaward or a vendor procurement, the activity should be correctly categorized in your proposal budget. Subawards are listed as contractual agreements in the proposal and itemized in your budget.

What is a federal Subgrant?

Subaward. An award provided by a pass-through entity to a subrecipient for the subrecipient to carry out part of a Federal award received by the pass-through entity. It does not include payments to a contractor or payments to an individual that is a beneficiary of a Federal program.

What is the difference between a subsidy and a grant?

Grants are sums that usually do not have to be repaid but are to be used for defined purposes. Subsidies, on the other hand, refer to direct contributions, tax breaks and other special assistance that governments provide businesses to offset operating costs over a lengthy time period.