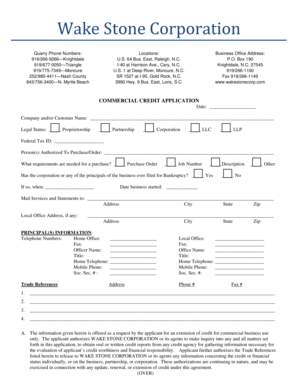

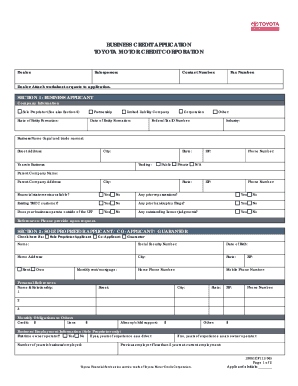

Corporation Credit Application Form

What is Corporation Credit Application Form?

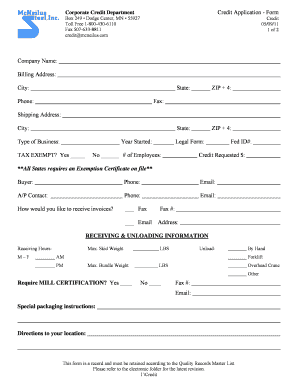

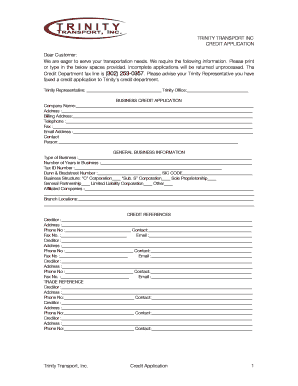

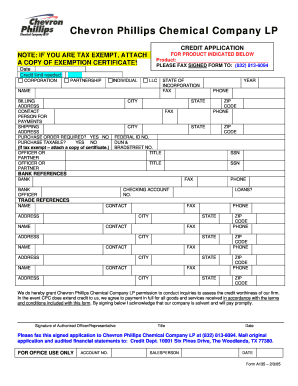

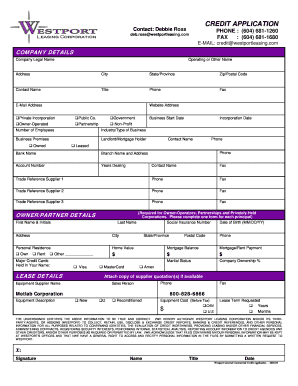

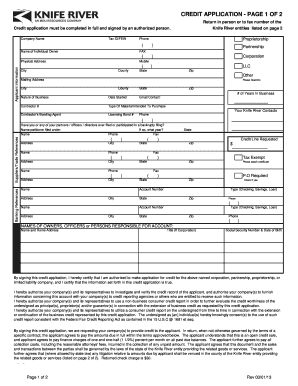

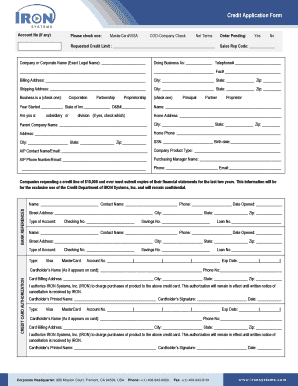

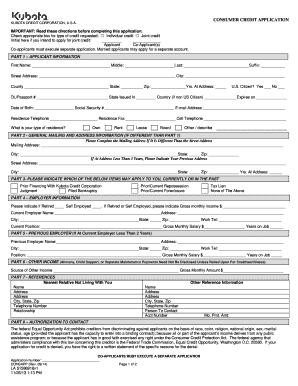

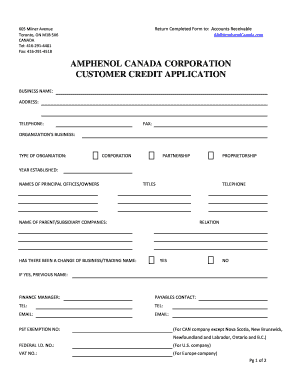

A Corporation Credit Application Form is a document that businesses use to apply for credit from other companies or financial institutions. It is a standardized form that helps credit providers assess the creditworthiness of the corporation and make informed decisions about extending credit.

What are the types of Corporation Credit Application Form?

Corporation Credit Application Forms come in various types to cater to different industries and requirements. Some common types include:

How to complete Corporation Credit Application Form?

Completing a Corporation Credit Application Form is a straightforward process. Here are the steps to follow:

pdfFiller is an online platform that empowers users to create, edit, and share documents easily. With its unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to efficiently manage their documents.