How Does Lease With Option To Buy A House Work

What is how does lease with option to buy a house work?

A lease with an option to buy a house is a legal agreement between a landlord and a tenant, allowing the tenant to rent the property with the option to purchase it at a later date. This type of arrangement provides flexibility for those who are not ready to commit to buying a house immediately but may want to do so in the future. It gives the tenant the opportunity to live in and test out the property before deciding if they want to proceed with the purchase.

What are the types of how does lease with option to buy a house work?

There are two main types of lease with option to buy arrangements: 1. Lease Option: In this type, the tenant has the option to buy the property at the end of the lease term, but is not obligated to do so. They can choose to exercise their option and purchase the house or simply walk away. 2. Lease Purchase: In this type, the tenant is obligated to buy the property at the end of the lease term. They are legally bound to complete the purchase, regardless of any change in circumstances or the property's market value.

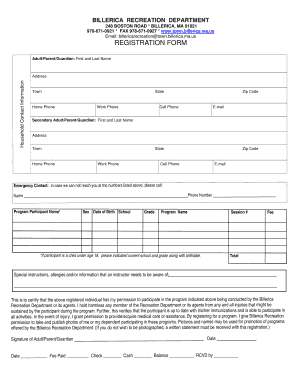

How to complete how does lease with option to buy a house work

To complete a lease with an option to buy a house, follow these steps: 1. Find a property: Start by finding a property that is available for lease with an option to buy. You can search online, through real estate agents, or in local classifieds. 2. Negotiate terms: Once you find a property, discuss and negotiate the terms of the lease and the option to buy with the landlord. Make sure you understand all the details and obligations. 3. Sign the agreement: Once the terms are agreed upon, sign the lease agreement with the option to buy. Ensure that all parties involved have a copy of the signed agreement. 4. Move in and evaluate: Move into the property and evaluate if it meets your needs. Take note of any repairs or maintenance that may be required. 5. Decide whether to buy: During the lease period, assess if you want to exercise the option to buy. Consider factors such as your financial situation, property value, and personal circumstances. 6. Complete the purchase: If you decide to buy, notify the landlord of your intent, secure financing if necessary, and proceed with the purchase according to the terms outlined in the agreement.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.