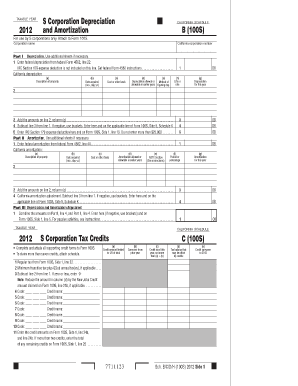

Printable Amortization Schedule

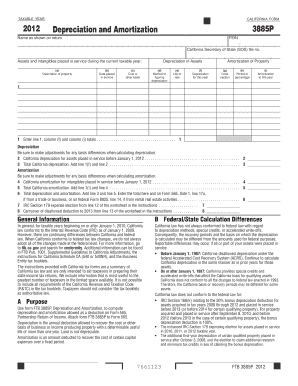

What is printable amortization schedule?

A printable amortization schedule is a document that shows the breakdown of mortgage loan payments, including the principal amount and the interest that needs to be paid each month. It helps borrowers understand how their payments are being applied to the loan balance and how much interest they need to pay over the life of the loan. This schedule is called 'printable' because it can be easily printed for offline reference or documentation purposes.

What are the types of printable amortization schedule?

There are two main types of printable amortization schedules: 1. Monthly Amortization Schedule: This type of schedule provides a detailed breakdown of the monthly payments, including the principal and interest components, for the entire loan term. 2. Yearly Amortization Schedule: This type of schedule provides a summary of the monthly payments for each year of the loan term. It shows the total principal and interest paid during each year, along with the remaining loan balance at the end of the year.

How to complete printable amortization schedule

To complete a printable amortization schedule, follow these steps: 1. Gather necessary information: Collect all the relevant details of the mortgage loan, including the loan amount, interest rate, loan term, and start date. 2. Use a reliable amortization calculator: There are numerous online tools and software available that can help you generate an accurate printable amortization schedule. Input the required information into the calculator and select the desired schedule format. 3. Generate the schedule: Once you have entered all the necessary information, click on the 'calculate' or 'generate schedule' button to obtain the printable amortization schedule. 4. Review and verify: Double-check the generated schedule to ensure that all the details are accurate and match your loan terms. Pay attention to the payment dates, amounts, and remaining balances for each period. 5. Save or print the schedule: If you need a physical copy, you can save the schedule as a PDF or print it directly from the amortization calculator or software.

pdfFiller empowers users to create, edit, and share documents online, including printable amortization schedules. With unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to efficiently manage their documents.