Loan Amortization Schedule Excel Download

What is loan amortization schedule excel download?

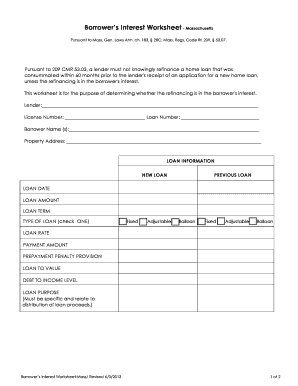

Loan amortization schedule excel download is a tool used to calculate the repayment schedule of a loan. It is a spreadsheet template that can be downloaded and used on Microsoft Excel or similar software. This tool helps borrowers and lenders to determine how much of each payment will go towards the principal and the interest of the loan.

What are the types of loan amortization schedule excel download?

There are three common types of loan amortization schedule excel download:

Fixed-rate amortization schedule: This type of schedule is used for loans with a fixed interest rate. The monthly payments remain the same throughout the loan term.

Variable-rate amortization schedule: This type of schedule is used for loans with a variable interest rate. The monthly payments may change over time.

Interest-only amortization schedule: This type of schedule allows borrowers to make interest-only payments for a certain period before starting to pay off the principal.

How to complete loan amortization schedule excel download

Completing a loan amortization schedule excel download is a straightforward process. Here are the steps to follow:

01

Open the loan amortization schedule excel download template on Microsoft Excel or similar software.

02

Enter the loan amount, interest rate, and loan term in the designated cells.

03

The template will automatically calculate the monthly payment, as well as the breakdown of principal and interest for each payment.

04

You can customize the schedule by adjusting the payment frequency or adding extra payments towards the principal.

05

Save the completed loan amortization schedule for future reference.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out loan amortization schedule excel download

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I calculate amortization?

How to Calculate Amortization of Loans. You'll need to divide your annual interest rate by 12. For example, if your annual interest rate is 3%, then your monthly interest rate will be 0.25% (0.03 annual interest rate ÷ 12 months). You'll also multiply the number of years in your loan term by 12.

How do I create a loan amortization schedule?

Starting in month one, take the total amount of the loan and multiply it by the interest rate on the loan. Then for a loan with monthly repayments, divide the result by 12 to get your monthly interest. Subtract the interest from the total monthly payment, and the remaining amount is what goes toward principal.

How do I create a loan amortization schedule in Excel?

How to make a loan amortization schedule with extra payments in Excel Define input cells. As usual, begin with setting up the input cells. Calculate a scheduled payment. Set up the amortization table. Build formulas for amortization schedule with extra payments. Hide extra periods. Make a loan summary.

How do I calculate principal and interest on a loan in Excel?

1:15 5:10 How to find Interest & Principal payments on a Loan in Excel YouTube Start of suggested clip End of suggested clip We already know what that is let's go ahead and get the principal. All we're gonna do is equal PP MTMoreWe already know what that is let's go ahead and get the principal. All we're gonna do is equal PP MT open parentheses the next we're gonna run want the rate. And the rate is going to be the monthly.

How do I manually calculate an amortization schedule?

How to Calculate Amortization of Loans. You'll need to divide your annual interest rate by 12. For example, if your annual interest rate is 3%, then your monthly interest rate will be 0.25% (0.03 annual interest rate ÷ 12 months). You'll also multiply the number of years in your loan term by 12.

What is the amortization function in Excel?

View More. An amortization schedule is a table format that lists periodic payments on a loan or mortgage over a period of time. It breaks down each payment into principal and interest and shows the remaining balance after each payment.

Related templates