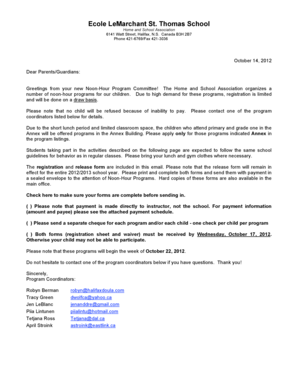

Secured Promissory Note Template

What is secured promissory note template?

A secured promissory note template is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower. It provides a written promise from the borrower to repay the borrowed amount, along with any interest or fees, within a specified period of time. The secured aspect of the note refers to the borrower providing collateral to secure the loan, such as a property or valuable asset.

What are the types of secured promissory note template?

There are various types of secured promissory note templates available depending on the specific requirements of the loan agreement. These may include: 1. Real Estate Secured Promissory Note: This type of note is used when the borrower pledges a real estate property as collateral. 2. Vehicle Secured Promissory Note: This note is utilized when a vehicle or other form of transportation is used as collateral. 3. Personal Property Secured Promissory Note: This note is used when personal property such as jewelry, electronics, or artwork is offered as collateral. 4. Business Secured Promissory Note: This type of note is used in business transactions where the borrower's business assets are used as collateral.

How to complete secured promissory note template

Completing a secured promissory note template is a straightforward process. Follow these steps: 1. Begin by downloading a secured promissory note template from a reputable source. 2. Fill in the borrower's and lender's information, including names, addresses, and contact details. 3. Specify the loan amount, interest rate, repayment terms, and any additional fees or charges. 4. Clearly state the details of the collateral being used to secure the loan. 5. Include any provisions or clauses specific to the loan agreement. 6. Review the completed template for accuracy and make any necessary revisions. 7. Sign the promissory note along with the borrower and lender, and have it notarized if required. 8. Keep copies of the signed promissory note for both parties' records.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.