W-8

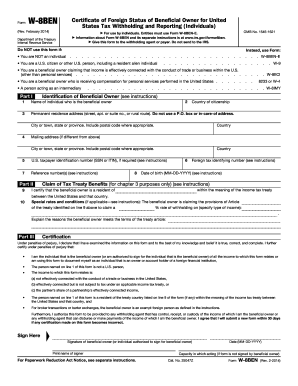

What is w-8?

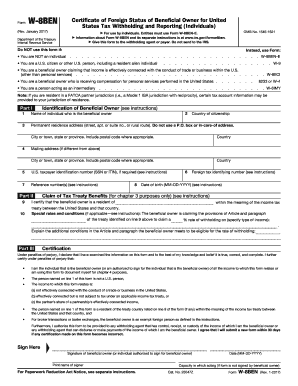

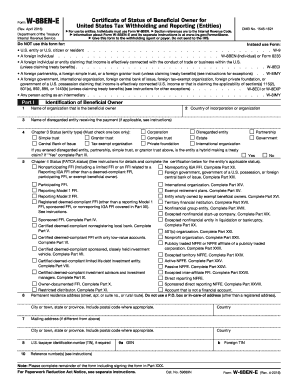

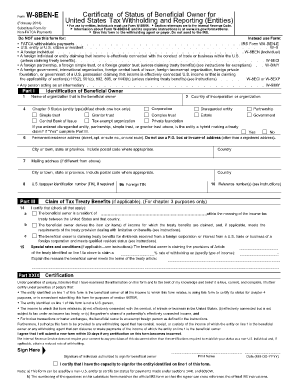

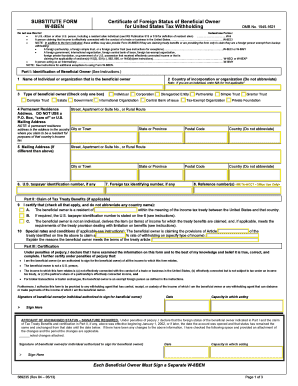

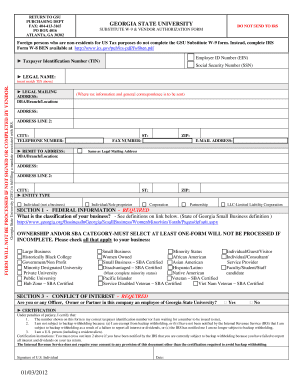

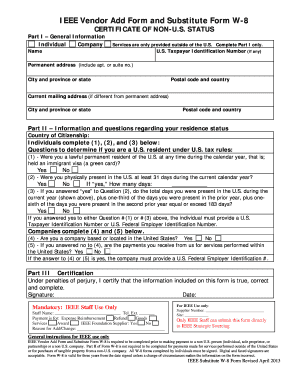

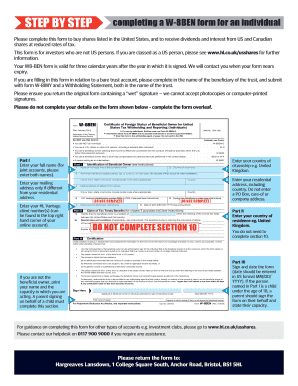

The w-8 form is an IRS tax form that is used to certify a foreign person's status for tax withholding purposes in the United States. It is required for certain types of income earned by non-US individuals or entities that are subject to US tax laws. This form helps determine the appropriate withholding amount based on the individual's or entity's tax residency and treaty status.

What are the types of w-8?

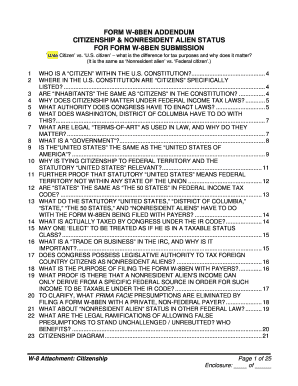

There are several types of w-8 forms, each catering to different categories of foreign individuals or entities. The most commonly used types of w-8 forms include: 1. W-8BEN: Used by individuals who are not US citizens or residents but receive income from US sources. 2. W-8BEN-E: Designed for foreign entities such as corporations, partnerships, or trusts that receive income from US sources. 3. W-8ECI: Used by foreign individuals or corporations who conduct trade or business within the US and claim exemption from withholding on income effectively connected with that US business.

How to complete w-8 form?

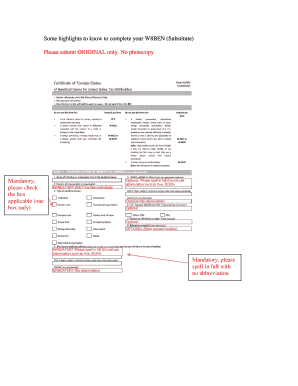

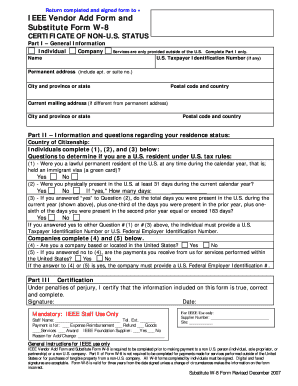

Completing the w-8 form is a straightforward process. Here are the steps to follow: 1. Begin by entering your personal or entity information, such as name, address, and taxpayer identification number (if applicable). 2. Indicate the appropriate type of w-8 form you are filling out (e.g., W-8BEN, W-8BEN-E, or W-8ECI). 3. Provide any additional information that may be required based on your specific circumstances, such as treaty benefits or claim of exemption from withholding. 4. Sign and date the form. 5. Submit the completed form to the relevant party requesting the w-8 form, such as your employer, financial institution, or withholding agent.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.