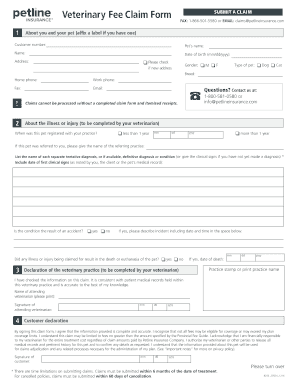

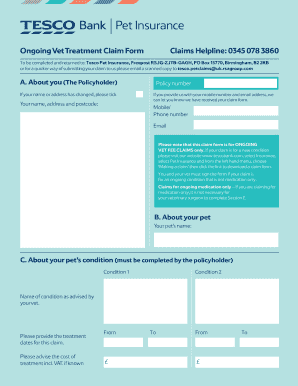

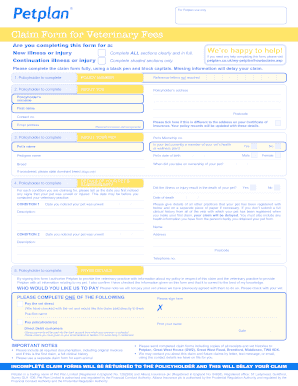

Pet Insurance Claim Form Templates

What are Pet Insurance Claim Form Templates?

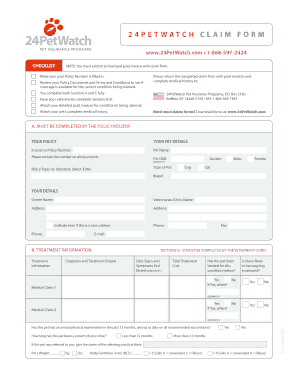

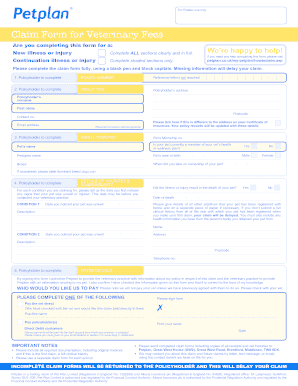

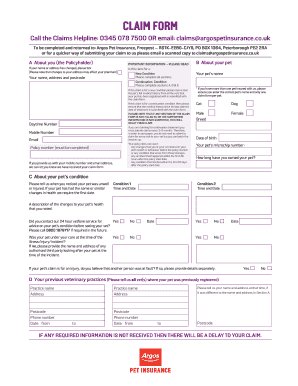

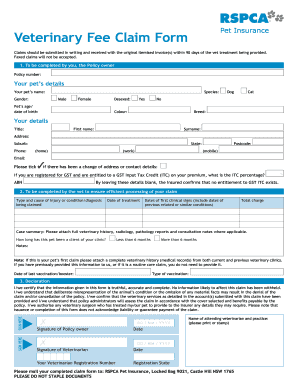

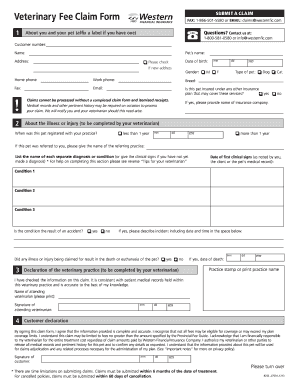

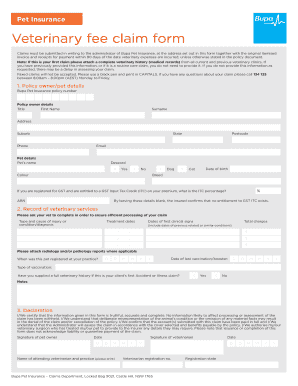

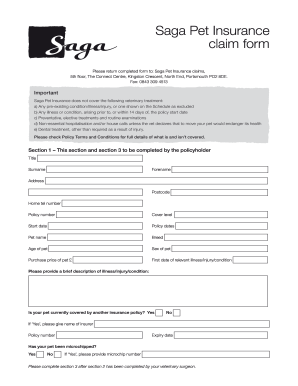

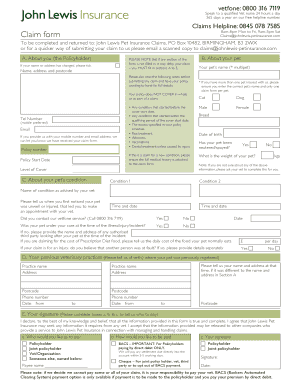

Pet Insurance Claim Form Templates are pre-designed documents that pet owners can use to file insurance claims for their pets' medical expenses. These templates streamline the process and ensure all necessary information is included in the claim.

What are the types of Pet Insurance Claim Form Templates?

There are several types of Pet Insurance Claim Form Templates available, including:

Veterinary Invoice Template

Medical Treatment Authorization Form

Claim Submission Form

Pet Insurance Claim Checklist

How to complete Pet Insurance Claim Form Templates

Completing Pet Insurance Claim Form Templates is easy and straightforward. Follow these steps:

01

Fill in your pet's details, including name, age, breed, and any identification numbers.

02

Provide details of the medical treatment or service received by your pet.

03

Include the date of the treatment and the total cost of the service.

04

Attach any relevant invoices or receipts for the expenses incurred.

05

Sign and date the form before submitting it to your insurance provider.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Pet Insurance Claim Form Templates

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What are the most common claims for pet insurance?

In 2021, the five most common pet insurance claims included skin conditions, gastrointestinal issues, ear infections, seizures, and urinary tract infections.

What is a good reimbursement for pet insurance?

Reimbursement is the amount a pet insurance company pays you for veterinary expenses. It is expressed as a percentage ranging from 60% to 100% depending on the plan you choose. The most popular pet insurance plans have a reimbursement of 80% to 90% of your total vet bills.

Why would pet insurance deny a claim?

The claim may have been denied because you haven't yet met your annual deductible, for example. If you insured your pet only recently, you may still be within the waiting period after your date of enrolment.

What is the average excess on pet insurance?

The percentage can vary from policy to policy, but 10% or 20% is common. The insurance firm then meets most of the cost. What is a policy excess and how much is it? All pet insurance policies carry a policy excess which is a fixed amount that you pay towards the cost of a claim.

How do I fight pet insurance denial?

If your claim is denied by the pet insurance provider, and you disagree with the decision, you have the option to appeal. To do so, contact the insurer's customer care department.

What are the different types of pet claims?

Different types of pet insurance Lifetime. Covers your pet for their entire life providing you renew every year. Time-limited. Allows you to make a claim for a medical condition up to a specified amount for a limited time. Accident-only. Only covers vet fees for sudden, unexpected injuries. Maximum benefit.

Related templates