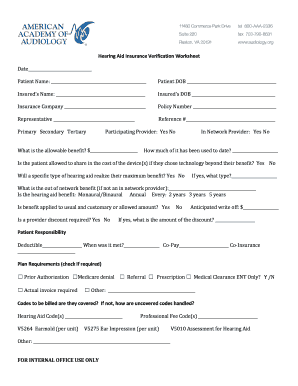

Free Insurance Verification Form Template

What is Free insurance verification form template?

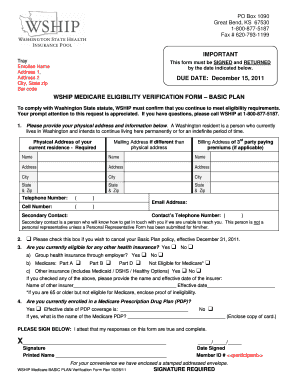

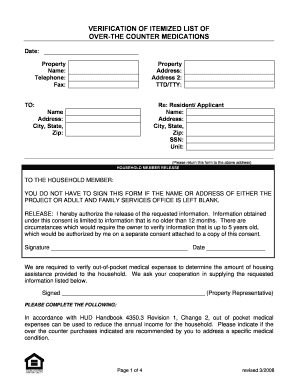

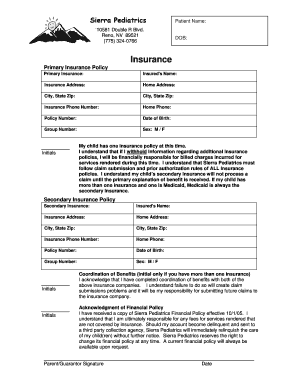

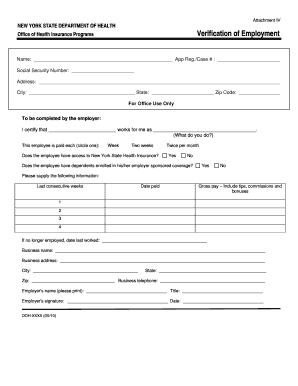

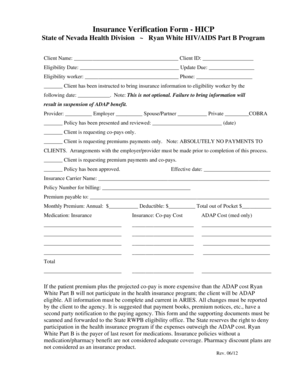

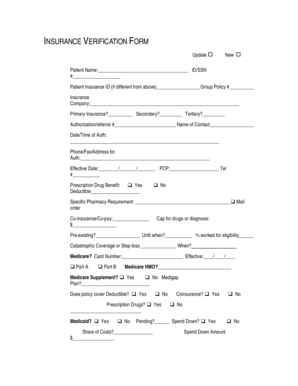

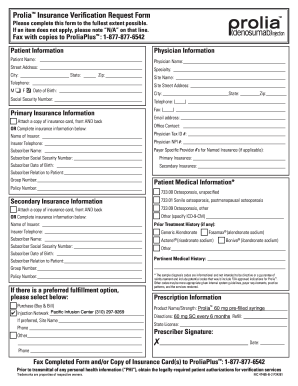

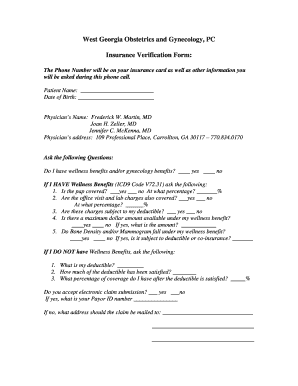

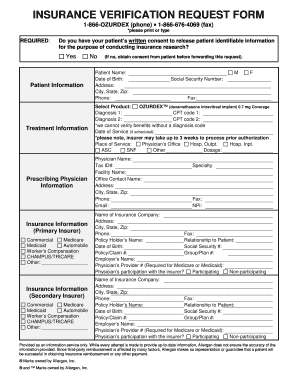

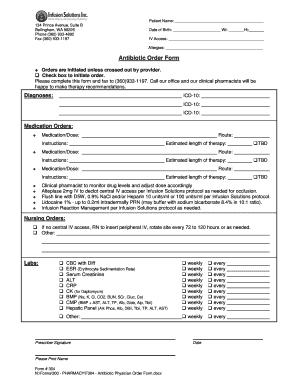

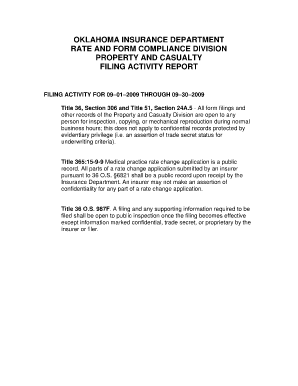

The Free insurance verification form template is a document used by insurance agencies and medical institutions to collect and verify insurance information from patients. This form is crucial for ensuring that patients are covered for the services they receive.

What are the types of Free insurance verification form template?

There are two main types of Free insurance verification form templates: basic insurance verification form and comprehensive insurance verification form. The basic form collects essential information such as policy number, patient's name, and insurance provider. The comprehensive form includes additional details like coverage limits, deductible amounts, and pre-authorization requirements.

How to complete Free insurance verification form template

Completing the Free insurance verification form template is simple and straightforward. Follow these steps to accurately fill out the form:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.