Financial Hardship Form Template

What is Financial hardship form template?

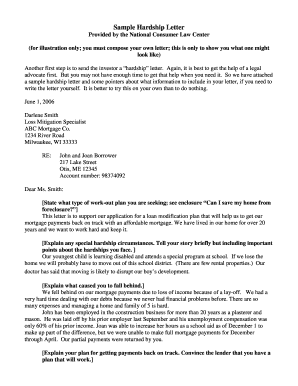

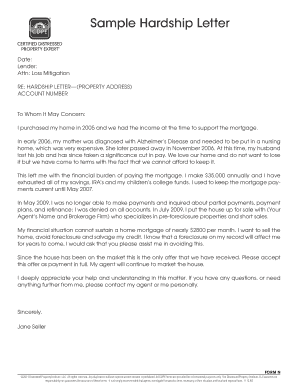

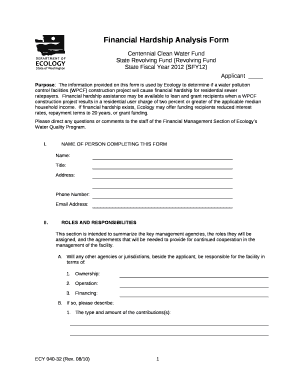

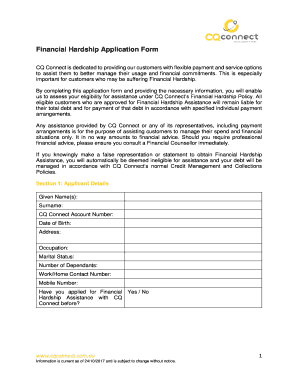

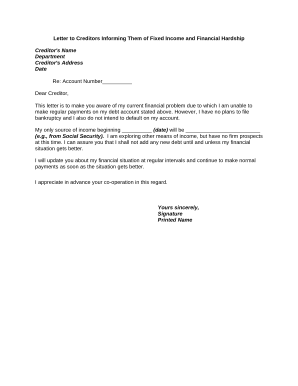

A Financial hardship form template is a document that individuals can use to request assistance or relief from financial obligations due to unforeseen circumstances such as job loss, medical emergencies, or natural disasters. This form helps individuals communicate their financial difficulties to creditors, lenders, or government agencies in a structured manner.

What are the types of Financial hardship form template?

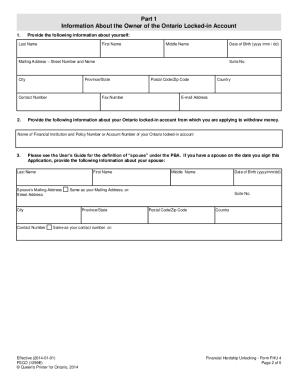

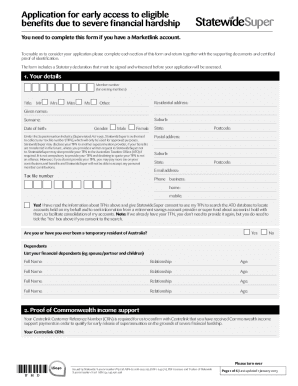

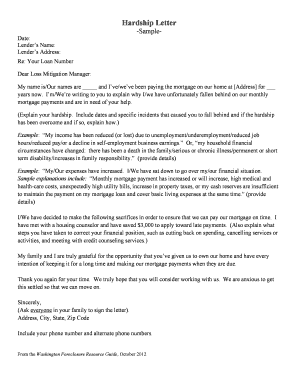

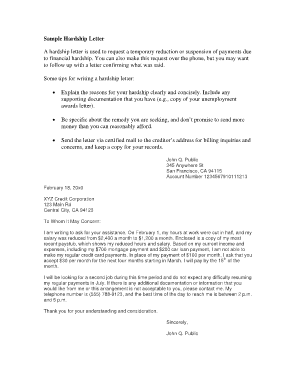

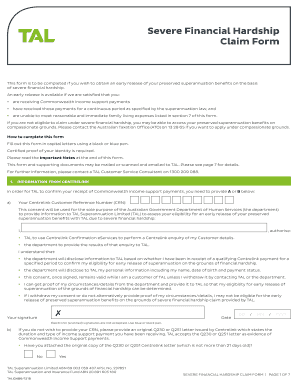

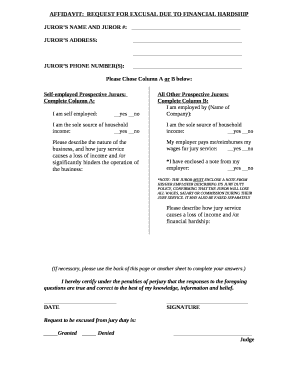

There are several types of Financial hardship form templates available depending on the specific situation or requirement. Some common types include:

How to complete Financial hardship form template

Completing a Financial hardship form template is a simple process that can be done by following these steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.