1040es Form 2013 - Page 2

What is 1040es Form 2013?

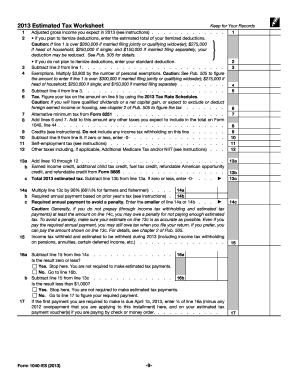

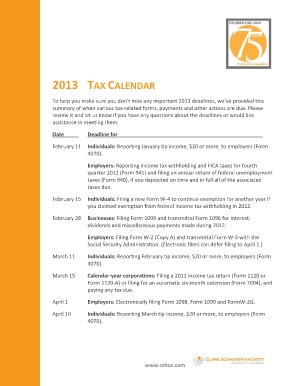

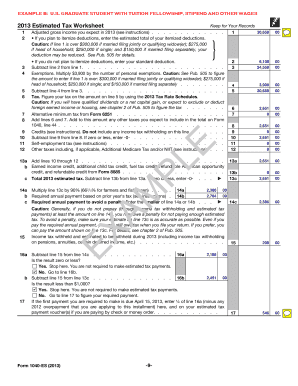

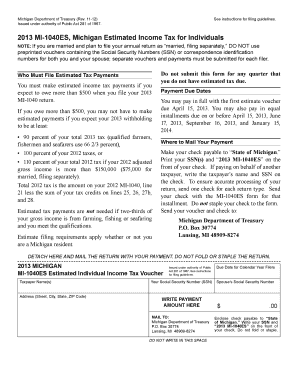

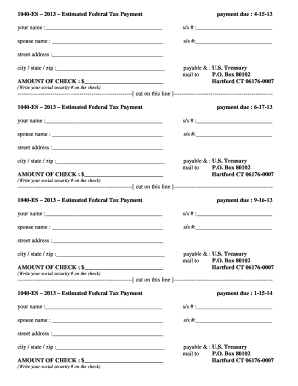

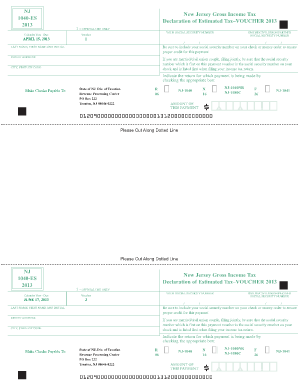

The 1040es Form 2013 is an IRS tax form used by individuals who need to make estimated tax payments for the year. It is specifically designed for taxpayers who do not have their taxes withheld by their employer or who have additional income that is not subject to withholding. The purpose of the form is to ensure that taxpayers pay their taxes in a timely manner throughout the year, rather than waiting until the end of the year to pay in one lump sum.

What are the types of 1040es Form 2013?

There are two types of 1040es Form 2013: the regular form and the simplified form. The regular form is used by taxpayers who have more complex financial situations, such as self-employed individuals or those with multiple sources of income. The simplified form is for taxpayers who have a more straightforward financial situation, such as those who only have one job and no additional income. Both forms serve the same purpose of helping taxpayers calculate and pay their estimated taxes.

How to complete 1040es Form 2013

Completing the 1040es Form 2013 is a straightforward process. Here is a step-by-step guide to help you:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.