Apply For Apartments Based On Income

What is apply for apartments based on income?

Applying for apartments based on income is a process that allows individuals with lower income levels to rent affordable housing options. These apartments are specifically designed to cater to the needs of individuals or families who meet certain income requirements. By considering an individual's income level, these apartments aim to make housing more accessible and affordable for those who may not be able to afford traditional market-rate rentals.

What are the types of apply for apartments based on income?

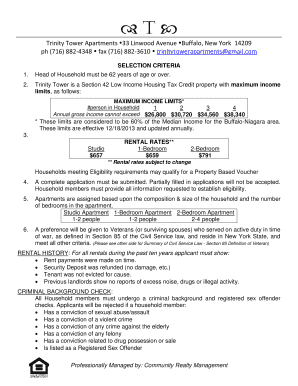

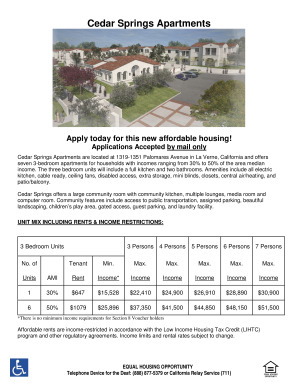

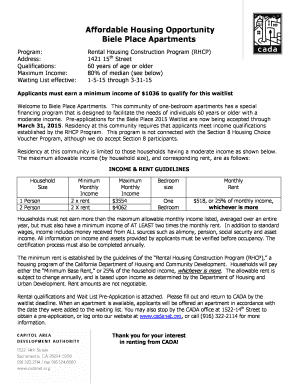

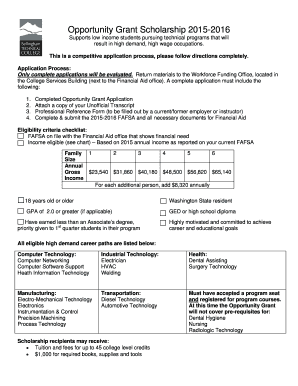

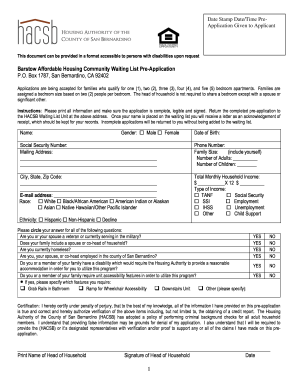

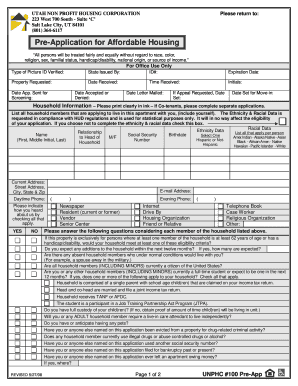

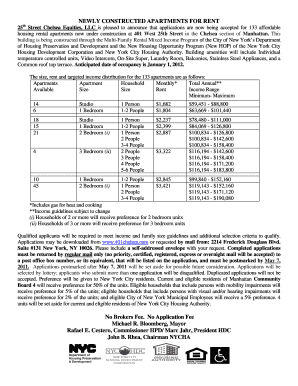

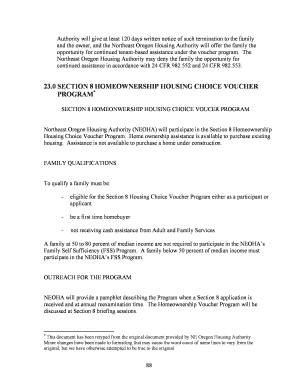

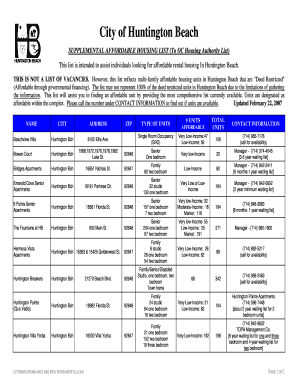

There are different types of programs available for individuals looking to apply for apartments based on income. Some common types include: 1. Section 8 Housing Choice Vouchers: This program provides rental assistance to eligible low-income individuals and families by allowing them to choose privately owned rental housing. 2. Low-Income Housing Tax Credit (LIHTC) Program: This program provides tax incentives to developers to create affordable housing options for individuals or families with low income. 3. Subsidized Housing: Subsidized housing programs offer rental assistance to individuals or families based on their income level. 4. Public Housing: Public housing complexes are owned and operated by the government, providing affordable rental options to low-income individuals and families.

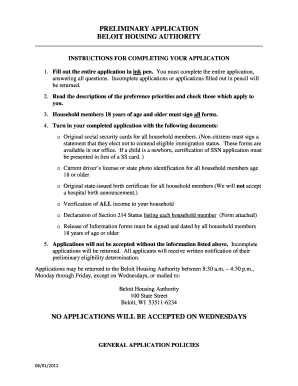

How to complete apply for apartments based on income

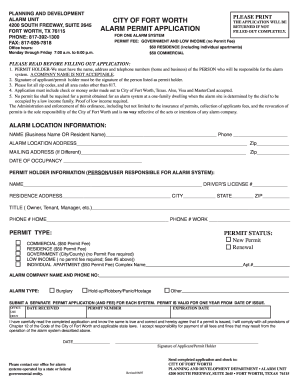

Completing the application process for apartments based on income requires a few important steps to follow: 1. Determine Eligibility: Before starting the application process, ensure that you meet the income requirements set by the specific program or housing provider. 2. Gather Required Documents: Prepare necessary documents such as proof of income, identification, and any other documents specified by the program or housing provider. 3. Find Available Listings: Search for apartments or housing units that participate in the income-based programs you are interested in. This can be done through online platforms, local housing authorities, or community organizations. 4. Submit Application: Fill out the application form for each desired housing option accurately and completely. Attach the required documents and submit it within the given deadline. 5. Follow Up: After submitting the application, follow up with the housing provider to ensure they received your application and to inquire about the next steps in the process.

pdfFiller is an excellent resource that empowers users to create, edit, and share documents online. With unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to get your documents done efficiently. Take advantage of pdfFiller's features to simplify the application process for apartments based on income and ensure your paperwork is organized and professional.