Get the free the low income rental program lirp of the new york city form - nyc

Show details

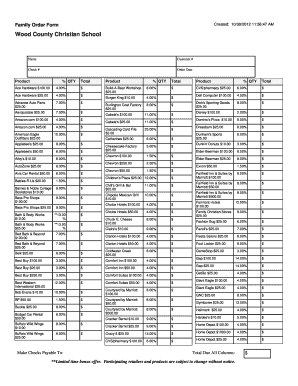

NEWLY CONSTRUCTED APARTMENTS FOR RENT

Douglass Park is pleased to announce that applications are now being accepted for 69 affordable housing apartments now under construction at 300 West 128th Street

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your the low income rental form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your the low income rental form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit the low income rental online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit the low income rental. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

How to fill out the low income rental

How to fill out form low income rental:

01

Start by gathering all the necessary information and documents, such as proof of income, identification, and any supporting documents required by the form.

02

Carefully read through the instructions provided with the form to ensure you understand what information is being asked for and how to complete each section.

03

Begin filling out the form by providing your personal information, including your name, address, and contact details.

04

If applicable, provide information about your current living situation, such as whether you are renting or own a property, and the details of your landlord or property owner.

05

Fill in the sections related to your income, including any employment or government assistance you receive. Be sure to provide accurate and up-to-date information.

06

If the form asks for details about your household members, such as their names and ages, provide these as well.

07

If there are any sections that you are unsure about or that do not apply to your situation, seek clarification from the form provider or leave them blank if allowed.

08

Once you have filled out all the required sections, review the form to ensure everything is accurate and complete. Make any necessary corrections or additions.

09

Sign and date the form, if required, and keep a copy for your records.

10

Submit the form through the designated method, whether it be by mail, email, or in person. Follow any additional instructions provided on how to submit the form.

Who needs form low income rental?

01

Individuals or families who meet the criteria for low income and are seeking affordable rental housing options.

02

Applicants who are required by landlords or housing authorities to provide proof of their low income status to determine eligibility for low-income rental units or rental assistance programs.

03

Individuals or families who are in need of financial assistance for their housing and are seeking support from government housing programs, non-profit organizations, or other entities providing low-income rental options.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form low income rental?

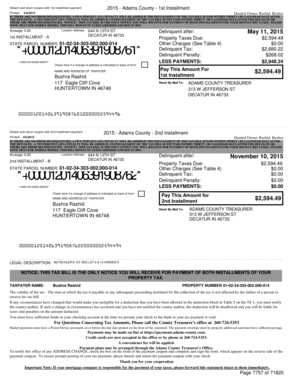

Form low income rental, also known as Form 8609, is a tax form used by individuals or organizations that own or manage low-income rental properties to claim the Low-Income Housing Tax Credit (LIHTC). The form is used to report information about the units, tenants, and eligible costs associated with providing affordable housing.

Who is required to file form low income rental?

Property owners or managers who have low-income rental properties and want to claim the Low-Income Housing Tax Credit (LIHTC) must file Form 8609. This form is typically filed by individuals or organizations who are participating in affordable housing programs.

How to fill out form low income rental?

To fill out Form 8609, you will need to provide information about the low-income rental property, such as the property name, address, and identification number. You will also have to report details about the tenants, including their names, Social Security numbers, and income levels. Additionally, you will need to calculate and report the eligible costs associated with providing affordable housing. The form includes instructions and guidance to help you accurately fill it out.

What is the purpose of form low income rental?

The purpose of Form 8609 is to allow property owners or managers to claim the Low-Income Housing Tax Credit (LIHTC). This tax credit incentivizes the provision of affordable housing by providing a credit against federal income tax liabilities. By filing this form, individuals or organizations can potentially reduce their tax burden while supporting low-income rental housing.

What information must be reported on form low income rental?

On Form 8609, you must report various information related to the low-income rental property and its tenants. This includes details such as the property's location, identification number, and the number of low-income units. You will also need to report the tenants' names, Social Security numbers, and income levels. Additionally, you must provide information on eligible costs, qualified basis, and any other required documentation as instructed on the form.

When is the deadline to file form low income rental in 2023?

The specific deadline to file Form 8609 for the year 2023 may vary depending on various factors and any potential extensions granted by the Internal Revenue Service (IRS). It is advisable to consult the IRS website or a tax professional to determine the exact deadline and any updates or changes that may have been made to the filing requirements.

What is the penalty for the late filing of form low income rental?

The penalty for late filing of Form 8609 or failing to file it can vary depending on the circumstances and the discretion of the IRS. It is important to file the form within the designated deadline to avoid potential penalties and interest charges. It is recommended to consult the IRS guidelines, regulations, or seek professional advice to understand the specific penalties associated with late filing or non-compliance with the filing requirements.

How can I modify the low income rental without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your the low income rental into a dynamic fillable form that you can manage and eSign from anywhere.

How do I fill out the the low income rental form on my smartphone?

Use the pdfFiller mobile app to complete and sign the low income rental on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How do I edit the low income rental on an iOS device?

You certainly can. You can quickly edit, distribute, and sign the low income rental on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

Fill out your the low income rental online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.