Checkbook Ledger

What is Checkbook Ledger?

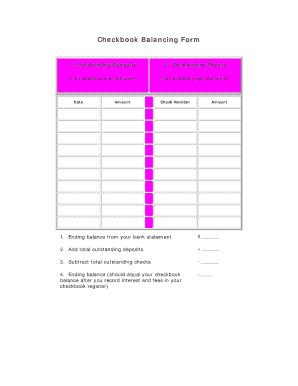

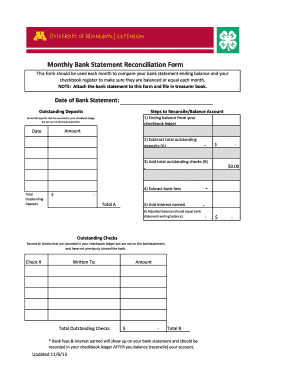

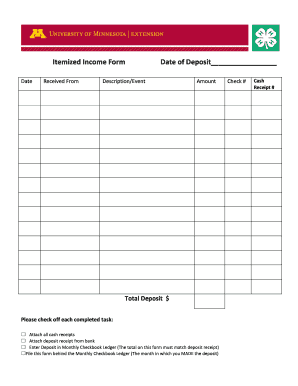

Checkbook Ledger is a simple tool used to track and manage your personal or business finances. It helps you keep a record of all your transactions, including checks, deposits, and withdrawals. By maintaining a Checkbook Ledger, you can easily monitor your financial activities and ensure that your account balances are accurate.

What are the types of Checkbook Ledger?

There are two main types of Checkbook Ledgers:

Paper Checkbook Ledger: This traditional type of ledger is a physical booklet where you manually write down your transactions using a pen or pencil. It provides a tangible and hands-on approach to tracking your finances.

Digital Checkbook Ledger: With the advancement in technology, digital Checkbook Ledgers have become popular. These can be either desktop or mobile applications that allow you to input and manage your financial transactions digitally. They often come with added features such as automatic calculation, budget tracking, and the ability to generate reports.

How to complete Checkbook Ledger

Completing a Checkbook Ledger is a straightforward process. Here are the steps:

01

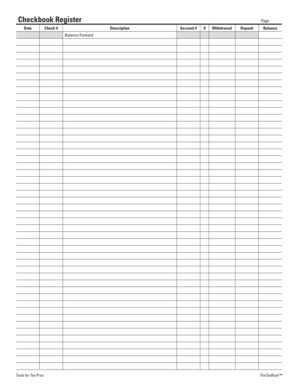

Start by recording the opening balance of your account. This is the amount of money you have in your account at the beginning of the ledger period.

02

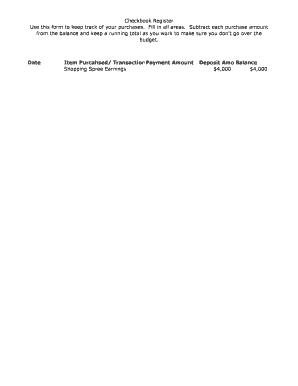

Record each transaction in the corresponding sections of the ledger, including the date, description, check number (if applicable), and the amount.

03

For deposits, enter the amount in the 'Deposit' column and add it to the running balance. For withdrawals, enter the amount in the 'Withdrawal' column and subtract it from the running balance.

04

Keep track of any fees, interest earned, or other adjustments in separate columns if provided in the ledger.

05

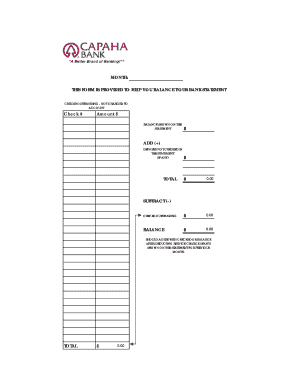

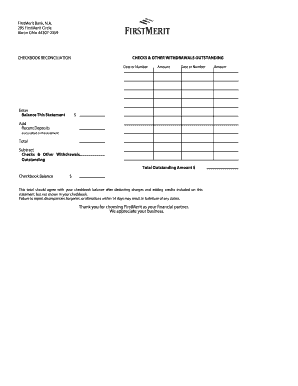

Regularly reconcile your Checkbook Ledger with your bank statements to ensure that all transactions match and the account balance is accurate.

06

At the end of the ledger period, calculate the closing balance by adding or subtracting the total deposits and withdrawals from the opening balance.

By following these steps, you can effectively maintain your Checkbook Ledger and have a clear overview of your financial activities.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I find my templates in Excel?

Open Microsoft Excel. On the right side of the Home tab, click More templates. Scroll through the displayed list of templates to find the one that suits your needs. If you don't find one you like, you can use the Search for online templates text field to see if there is a template online for what you need.

Where can I find free Excel templates?

Go to Office.com. Click Templates at the top of the page. On the Templates page, click Excel. Tip: To see more templates, under BROWSE BY CATEGORY, click the category (like Calendars) that you want to see.

Do banks give free check registers?

Where do you get a checkbook register? Checkbook registers are usually free when you order new checks or are available at your local bank.

What can I use instead of a check register?

Daily Online Check-In With Your Bank Since banks are able to update the transactions that clear your account in real time, you can recreate much of the same benefit of keeping and balancing a check register by simply logging into your account online every day.

How do I create a checkbook register in Excel?

4:43 10:56 Create a Checkbook Register in Excel - YouTube YouTube Start of suggested clip End of suggested clip So minus cell d3 and then plus F 3. So since there's nothing at F 3 it's just going to be a thousandMoreSo minus cell d3 and then plus F 3. So since there's nothing at F 3 it's just going to be a thousand minus 20 dollars which is 980.

How do I fill out a checkbook ledger?

To fill out a checkbook, open your checkbook register to the first page and write your starting balance on the top line. Every time you write a check, write down the check number, the date of the transaction, the name of the recipient or what the check was used for, and the amount of the check.

Related templates