Corporation Loan To Shareholder

What is corporation loan to shareholder?

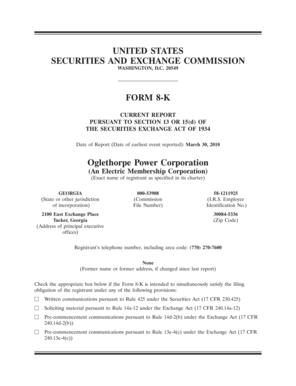

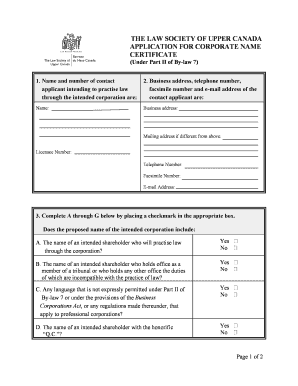

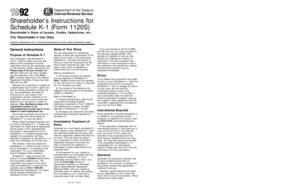

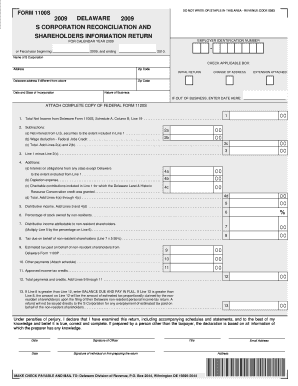

A corporation loan to shareholder refers to a financial arrangement where a corporation provides a loan to one of its shareholders. This loan is typically made for various purposes such as personal expenses, investment opportunities, or even to meet business needs. It is important to note that the loan must be properly documented and adhere to legal and tax requirements.

What are the types of corporation loan to shareholder?

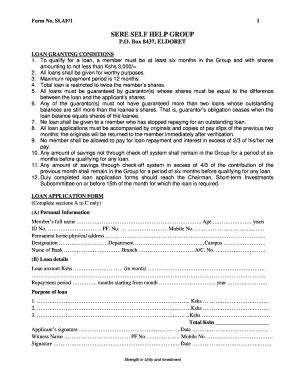

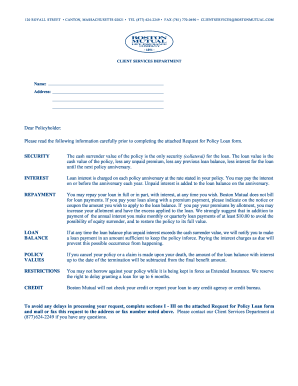

There are several types of corporation loans to shareholders, including: 1. Demand loans: These loans can be called back by the corporation at any time. 2. Term loans: These loans have a specific repayment period and interest rate. 3. Shareholder advance: It allows the shareholder to withdraw funds from the corporation, which will be accounted for as a loan. 4. Non-interest-bearing loans: These loans do not require the payment of interest by the shareholder. 5. Loans secured by collateral: These loans are backed by assets or securities provided by the shareholder. 6. Loans with forgiveness: In some cases, corporations may forgive a portion or all of the loan, resulting in a tax advantage for the shareholder.

How to complete corporation loan to shareholder

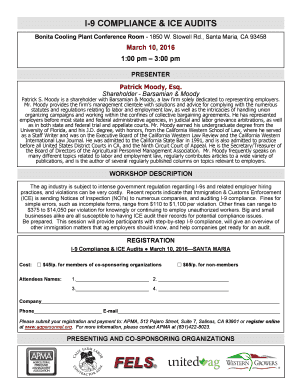

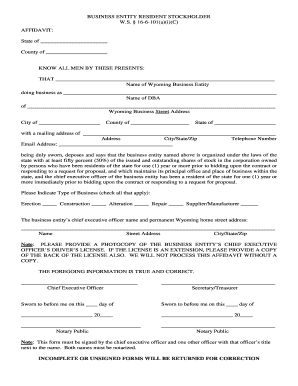

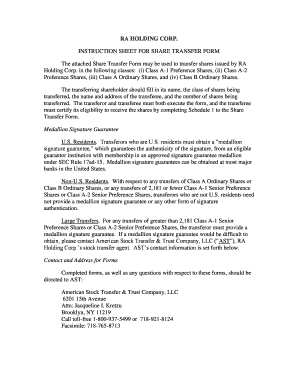

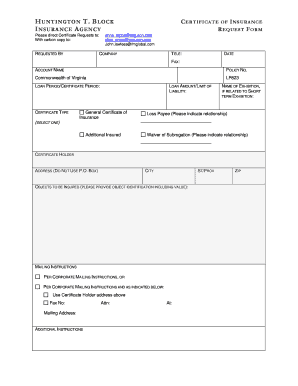

Completing a corporation loan to shareholder involves several steps to ensure legal compliance and proper documentation. Here's a guide on how to complete it: 1. Consult with a legal and tax professional: Before proceeding with a loan, it's crucial to seek advice from experts who can provide guidance on legal and tax implications specific to your jurisdiction. 2. Draft a loan agreement: Prepare a comprehensive loan agreement that outlines the terms and conditions of the loan, including the loan amount, interest rate, repayment schedule, and any collateral if applicable. 3. Execute the loan agreement: Both the corporation and the shareholder must sign the loan agreement to acknowledge their responsibilities and obligations. 4. Maintain proper records: Keep records of all loan-related documents, including repayment receipts, interest calculations, and any amendments or modifications to the loan agreement. 5. Stay compliant: Regularly review and update the loan agreement to ensure compliance with any changes in legal or tax regulations.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.