Guarantee Letter Sample For Product

What is guarantee letter sample for product?

A guarantee letter sample for a product is a document that provides assurance to the customers regarding the quality and reliability of the product. It serves as a written promise from the manufacturer or seller, stating that they will repair or replace the product in case of any defects or issues within a specified time frame.

What are the types of guarantee letter sample for product?

There are different types of guarantee letter samples for products, including: 1. Limited Warranty: This type of guarantee offers coverage for a specific period of time or specific parts of the product. 2. Lifetime Warranty: This type guarantees the product for the entire lifespan of the purchaser. 3. Money-Back Guarantee: This type assures customers that they can return the product and receive a refund if they are not satisfied with it. 4. Extended Warranty: This type extends the standard warranty period for an additional fee.

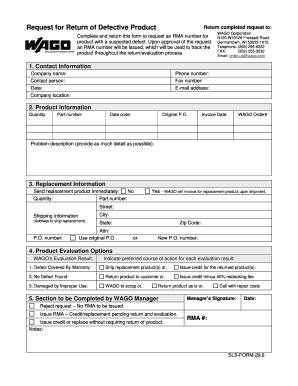

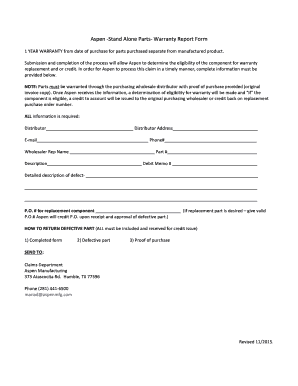

How to complete guarantee letter sample for product

Completing a guarantee letter sample for a product is a simple process. Follow these steps: 1. Start with a professional salutation, addressing the customer by name. 2. Clearly state the purpose of the letter and mention the product in question. 3. Provide details about the warranty period, coverage, and any terms and conditions. 4. Include contact information for customer support or warranty claims. 5. Close the letter with a polite and positive note, expressing willingness to assist the customer with any concerns. Remember to proofread the letter before sending it to ensure accuracy and clarity.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.