Personal Net Worth Statement Form

What is personal net worth statement form?

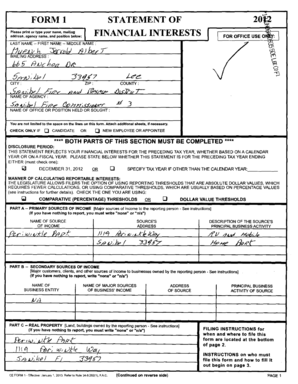

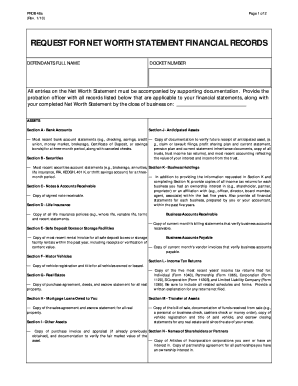

A personal net worth statement form is a financial document that provides an overview of an individual's assets, liabilities, and net worth. It helps individuals track their financial progress and make informed decisions regarding their personal finances. By documenting their assets (such as cash, investments, real estate, and personal property) and liabilities (such as debts and mortgages), individuals can calculate their net worth, which is the difference between their assets and liabilities. This information is essential for setting financial goals, evaluating financial health, and making informed financial decisions.

What are the types of personal net worth statement form?

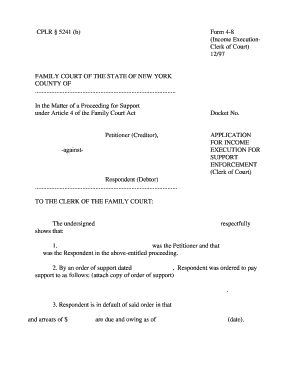

There are various types of personal net worth statement forms available, including:

How to complete personal net worth statement form

Completing a personal net worth statement form is a straightforward process. Here are the steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.