What Is A 1040 Tax Form

What is a 1040 tax form?

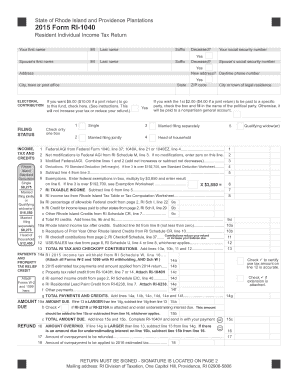

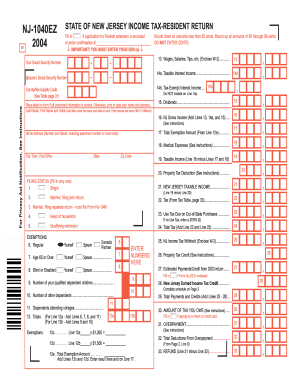

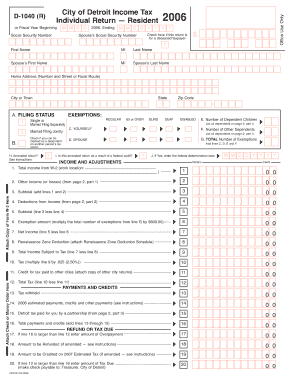

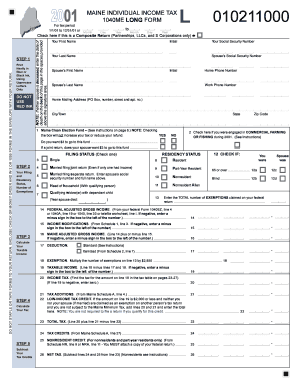

A 1040 tax form is the standard IRS form that individuals use to file their annual income tax return. It is used to report various types of income, deductions, and credits, and calculate the amount of tax owed or refunded. The form is named after its IRS form number, which is 1040.

What are the types of 1040 tax form?

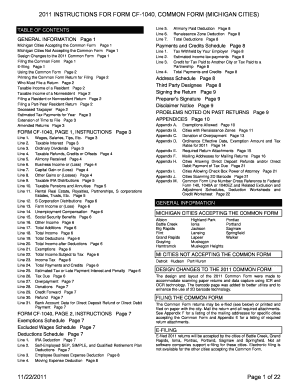

There are several types of 1040 tax forms that individuals may need to use depending on their specific tax situation: 1040, 1040A, and 1040EZ. The standard 1040 form is the most comprehensive and allows for the reporting of all types of income, deductions, and credits. The 1040A form is a simplified version that is available to individuals with less complex tax situations. The 1040EZ form is the simplest form and is only available to individuals with certain criteria, such as a single filing status, no dependents, and a taxable income of less than $100,000.

How to complete a 1040 tax form

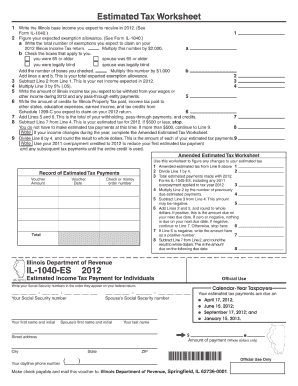

Completing a 1040 tax form may seem daunting, but with the right tools and guidance, it can be a manageable task. Here are the steps to complete a 1040 tax form:

Completing a 1040 tax form can be made easier with the help of online tools like pdfFiller. pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.