What is certified payroll forms excel format?

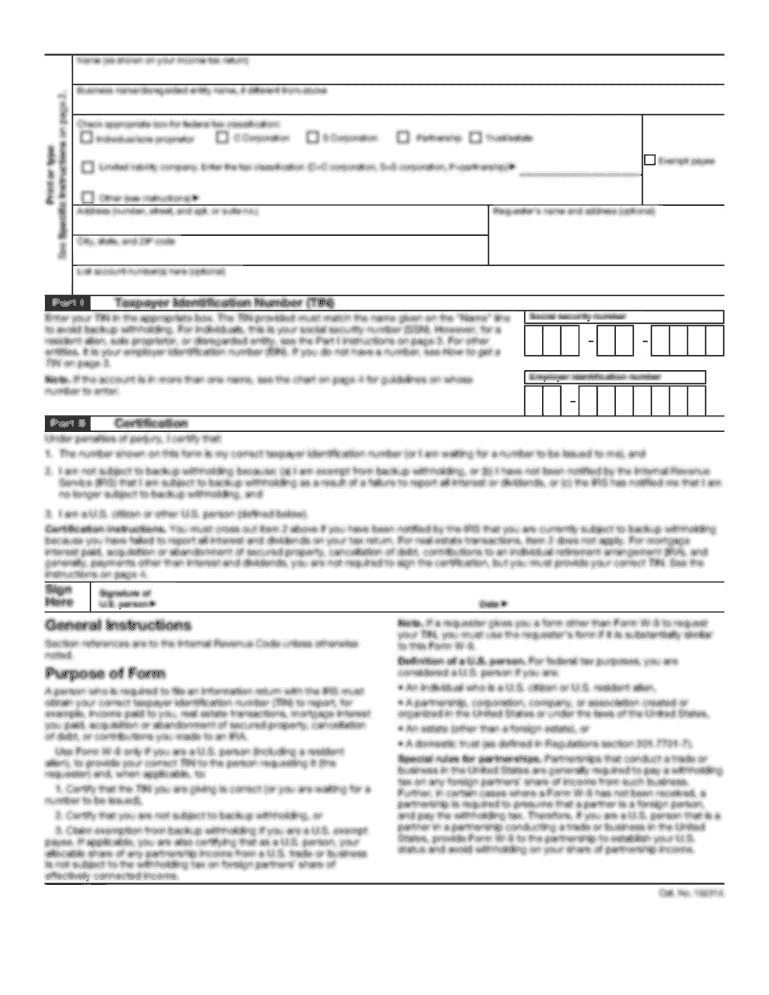

Certified payroll forms excel format is a standardized template used in the construction industry to record and report details of employee wages and hours worked on a project. This format is designed to ensure compliance with federal and state labor laws, specifically the Davis-Bacon Act and Related Acts. By using the certified payroll forms excel format, contractors and subcontractors can accurately track and document payroll information, including employee names, job classifications, hours worked, and rates of pay.

What are the types of certified payroll forms excel format?

There are several types of certified payroll forms available in excel format, each serving a specific purpose:

Certified Payroll Form WH-This form is used by contractors and subcontractors working on federal construction contracts or federally assisted contracts exceeding $2,It requires detailed information on employee wages and hours worked.

Certified Payroll Form WH-This form is used for weekly payroll reporting on federal projects subject to the Davis-Bacon and Related Acts.

Certified Payroll Form WH-348a: This form is used for monthly payroll reporting on federal projects subject to the Davis-Bacon and Related Acts.

Certified Payroll Form WH-This form is used for weekly payroll reporting on federal projects subject to the Copeland Anti-Kickback Act, in addition to the Davis-Bacon and Related Acts.

How to complete certified payroll forms excel format

Completing certified payroll forms in excel format requires attention to detail and accuracy. Here are the steps to follow:

01

Open the certified payroll form excel template using a spreadsheet software such as Microsoft Excel or Google Sheets.

02

Enter the project information, including the name, address, and contract number.

03

Provide details of each employee, including their name, job classification, social security number, and rates of pay.

04

Input the hours worked by each employee for each day of the reporting period.

05

Calculate the gross wages for each employee based on the hours worked and rates of pay.

06

Verify the accuracy of the information entered.

07

Save the completed form and make a copy for your records.

08

Submit the certified payroll form as required by the contracting agency or relevant authorities.

pdfFiller, a leading online document management platform, empowers users to easily create, edit, and share certified payroll forms online. With unlimited fillable templates and powerful editing tools, pdfFiller is the ultimate solution for efficiently managing certified payroll forms in excel format.