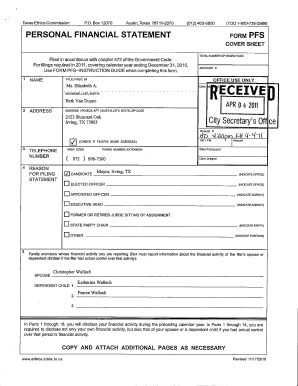

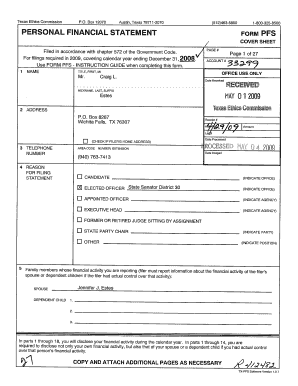

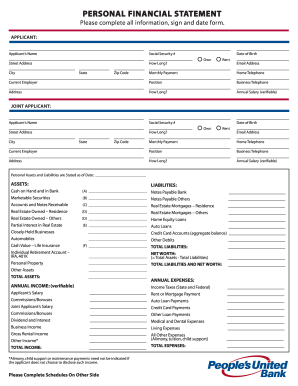

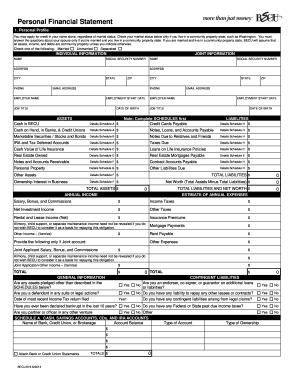

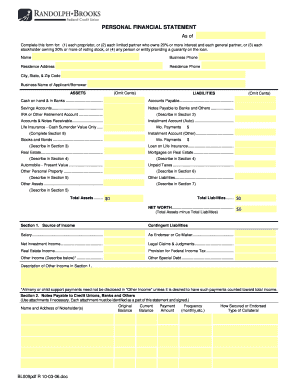

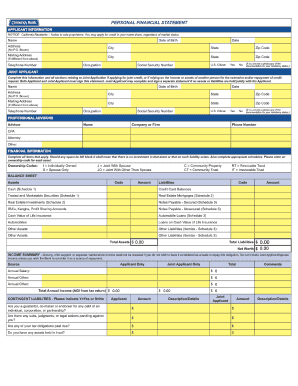

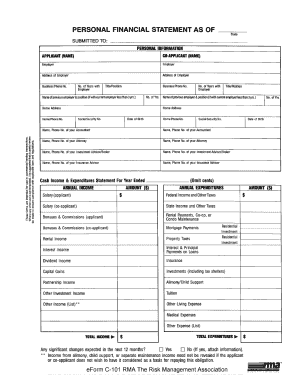

Personal Financial Statement Form

What is Personal Financial Statement Form?

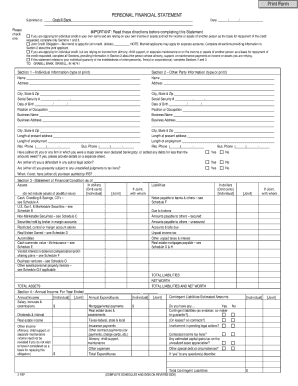

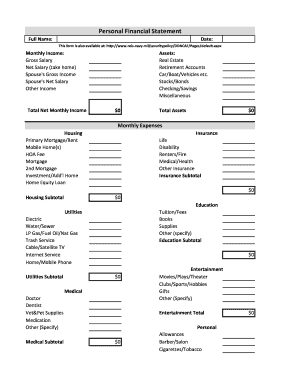

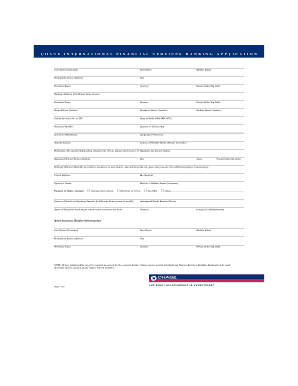

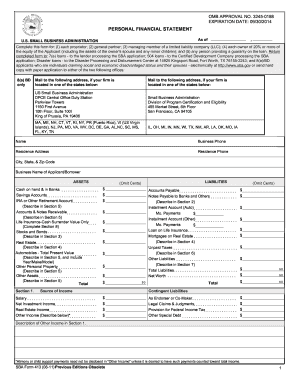

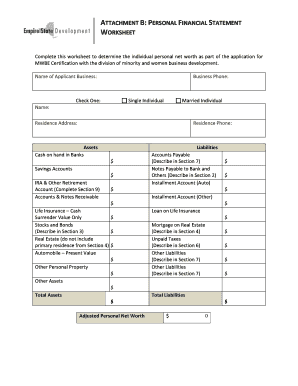

A Personal Financial Statement Form is a document that provides a snapshot of an individual's financial standing. It includes information about their assets, liabilities, income, and expenses. This form is commonly used by individuals and businesses to assess their financial health and make informed decisions regarding their finances.

What are the types of Personal Financial Statement Form?

There are two main types of Personal Financial Statement Form: individual and joint. An individual form is used when a single person wants to assess their personal financial situation. A joint form is used when multiple individuals, such as spouses or business partners, want to combine their financial information.

How to complete Personal Financial Statement Form

Completing a Personal Financial Statement Form may seem overwhelming, but by following the steps below, you can easily navigate through the process:

With the help of pdfFiller, completing a Personal Financial Statement Form has never been easier. You can create, edit, and share your form online, all in one convenient platform. pdfFiller offers unlimited fillable templates and powerful editing tools to ensure that you have everything you need to get your financial documents done with ease.