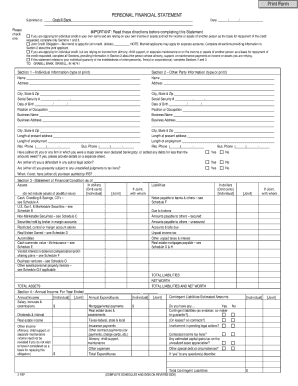

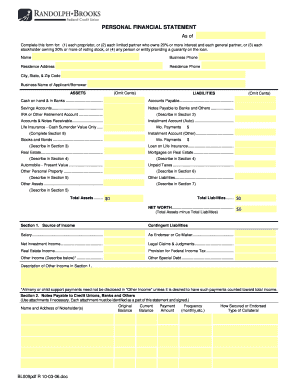

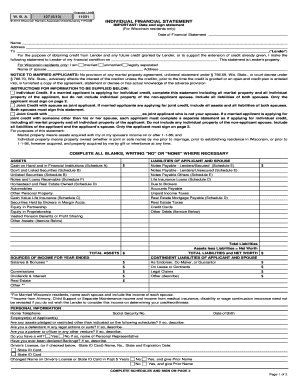

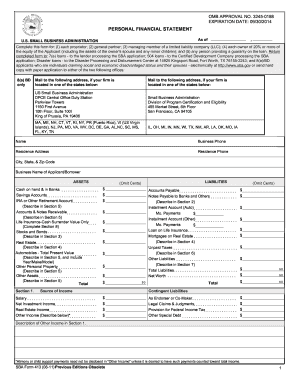

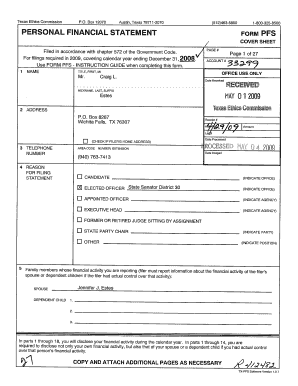

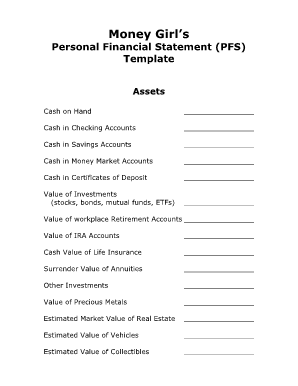

What is Blank Financial Statement?

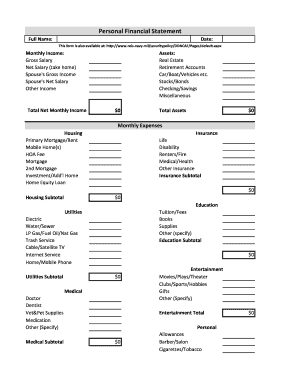

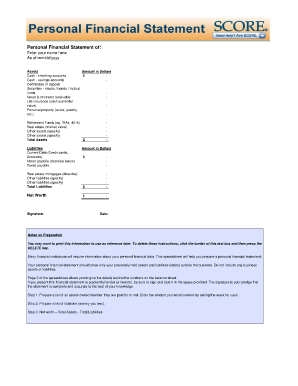

A Blank Financial Statement is a document that records a person or a company's financial activities, including income, expenses, assets, and liabilities. It provides a snapshot of the financial health and performance of an individual or an organization. With a Blank Financial Statement, you can track your financial progress, identify areas for improvement, and make informed decisions about your financial future.

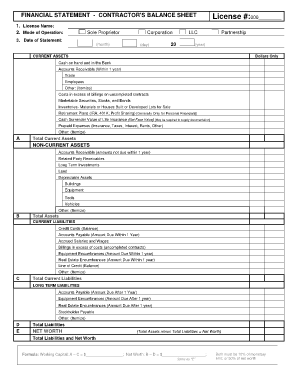

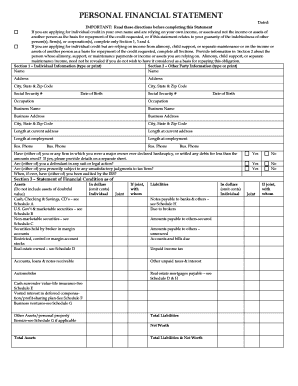

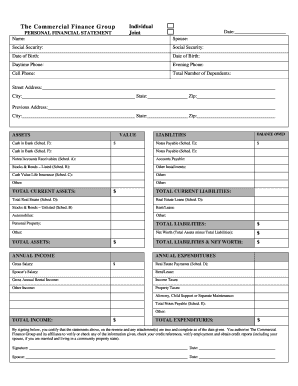

What are the types of Blank Financial Statement?

Blank Financial Statements come in various forms, each serving a specific purpose. The most common types include:

Income Statement: This statement focuses on a company's revenues, expenses, gains, and losses over a specific period, usually a month or a year.

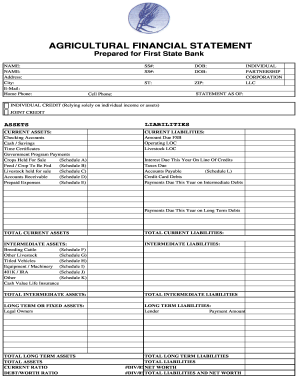

Balance Sheet: Also known as a Statement of Financial Position, it provides an overview of a company's financial position at a specific point in time, showing its assets, liabilities, and shareholder's equity.

Cash Flow Statement: This statement tracks the inflow and outflow of cash in a company, indicating how changes in balance sheet accounts and income affect cash and cash equivalents.

Statement of Retained Earnings: This statement shows changes in a company's retained earnings over a specific period, accounting for net income, dividends, and other adjustments.

How to complete Blank Financial Statement

Completing a Blank Financial Statement may seem daunting at first, but with the right approach, it can be a straightforward process. Here are the steps to follow:

01

Gather all relevant financial documents, such as bank statements, receipts, and invoices.

02

Organize your financial information into appropriate categories, such as income, expenses, assets, and liabilities.

03

Enter the financial data accurately into the respective sections of the Blank Financial Statement.

04

Double-check all the entered information for any errors or discrepancies.

05

Review the completed Blank Financial Statement to ensure it accurately reflects your financial situation.

06

If necessary, seek professional assistance or advice to understand complex financial matters and ensure the accuracy of your statement.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.