Simple Personal Financial Statement

What is Simple Personal Financial Statement?

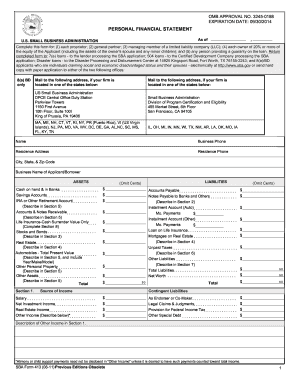

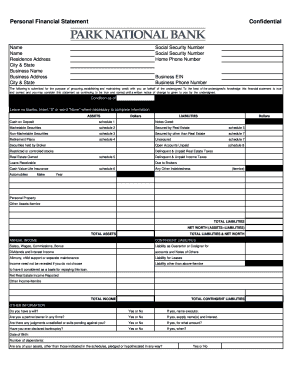

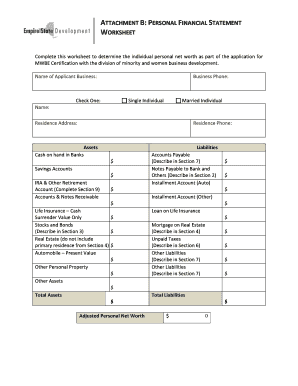

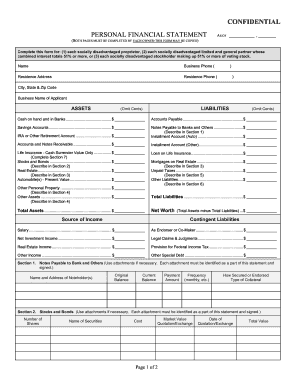

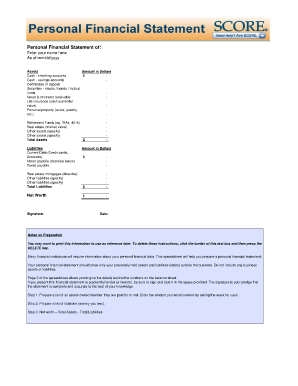

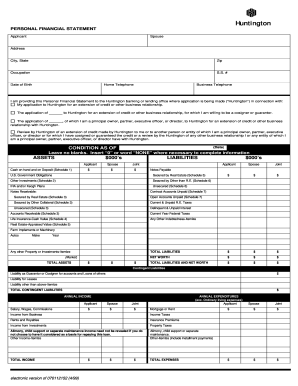

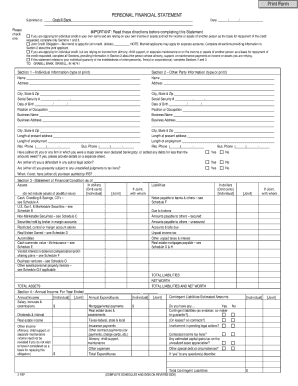

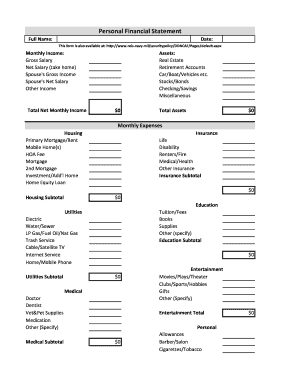

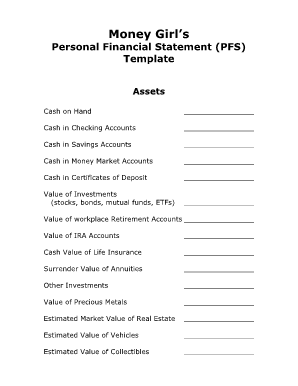

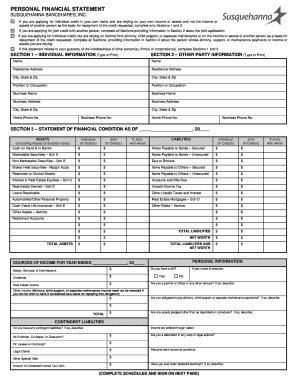

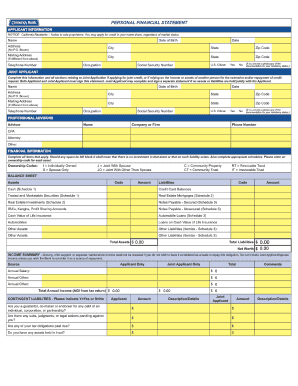

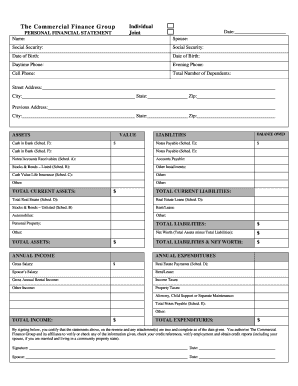

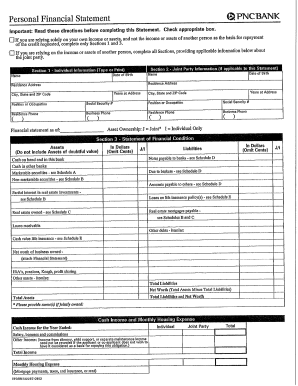

A Simple Personal Financial Statement is a document that provides an overview of an individual's financial situation. It includes information about their income, expenses, assets, and liabilities. This statement helps individuals gauge their financial health and make informed decisions about their personal finances.

What are the types of Simple Personal Financial Statement?

There are several types of Simple Personal Financial Statements that individuals can choose from based on their specific needs. Some common types include:

How to complete Simple Personal Financial Statement

Completing a Simple Personal Financial Statement is easy when you follow these steps:

By following these steps, you can easily complete a Simple Personal Financial Statement and gain a better understanding of your financial status. Remember, using a reliable online platform like pdfFiller can simplify the process by providing fillable templates and powerful editing tools.