What is weekly certified payroll form?

The weekly certified payroll form is a document that employers are required to complete on a weekly basis to demonstrate compliance with prevailing wage laws. It includes information such as the wages paid to each employee, the number of hours worked, and any deductions made on their paycheck.

What are the types of weekly certified payroll form?

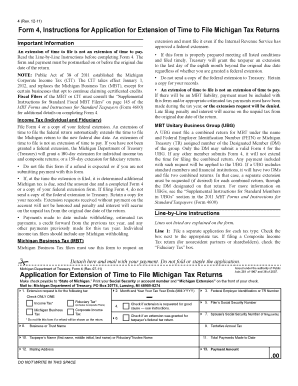

There are two main types of weekly certified payroll forms: the WH-347 form and the WH-348 form. The WH-347 form is used for construction projects subject to the Davis-Bacon Act or related acts, while the WH-348 form is used for construction projects subject to the Contract Work Hours and Safety Standards Act. Both forms require employers to provide detailed information about the wages paid to their employees.

How to complete weekly certified payroll form

Completing the weekly certified payroll form may seem daunting at first, but with the right approach, it can be done accurately and efficiently. Here are the steps to complete the form:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.