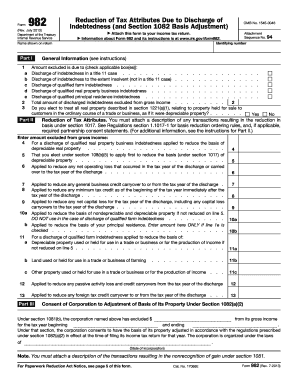

What is 982 Form?

The 982 Form is an important document used in certain circumstances to help individuals reduce or eliminate their tax debt. It is specifically designed for taxpayers who qualify for debt forgiveness or cancellation by meeting certain criteria.

What are the types of 982 Form?

There are three main types of 982 Forms, each serving a different purpose:

Form 982 for Mortgage Forgiveness: This type of form is used when a taxpayer has had mortgage debt forgiven or canceled.

Form 982 for Insolvency: This form is applicable if a taxpayer's liabilities exceed their assets at the time the debt was canceled.

Form 982 for Bankruptcy: This type of form is used when debt is discharged in bankruptcy proceedings.

How to complete 982 Form

Completing the 982 Form may seem overwhelming, but with the right guidance, it can be a straightforward process. Here is a step-by-step guide to help you complete the form correctly:

01

Download the official 982 Form from the IRS website or use a trusted online platform like pdfFiller.

02

Read the instructions carefully to understand the eligibility criteria and the type of debt cancellation or forgiveness you are claiming.

03

Gather all the necessary information and documents related to your financial situation, including proof of mortgage forgiveness, insolvency, or bankruptcy.

04

Fill in your personal information, including your name, address, and Social Security number.

05

Provide details about the debt cancellation or forgiveness, including the amount and the type of debt involved.

06

Complete the sections related to insolvency or bankruptcy, if applicable, providing accurate information about your financial state at the time of debt cancellation.

07

Double-check all the information and make sure you have included any required supporting documents.

08

Sign the form electronically or by hand, depending on your preferred method.

09

Save a copy of the completed 982 Form for your records, and submit it to the appropriate tax authority according to the instructions provided.

Remember, completing the 982 Form accurately is crucial to ensure you receive the benefits you are entitled to. If you're unsure about any aspect, seek advice from a tax professional or use a reliable online platform like pdfFiller, which empowers users to create, edit, and share documents online.