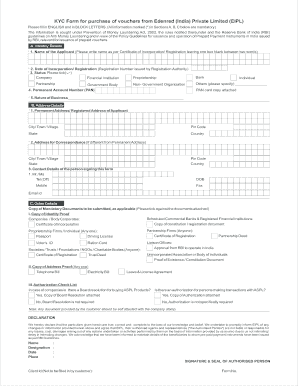

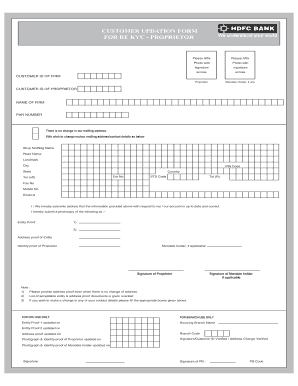

Kyc Form Bank Of India

What is kyc form bank of india?

A KYC (Know Your Customer) form is a document used by Bank of India to verify the identity and address of their customers. It is a mandatory requirement for opening a new bank account or updating the customer's information.

What are the types of kyc form bank of india?

Bank of India offers different types of KYC forms based on the customer's profile and purpose. The common types of KYC forms include Individual KYC Form, Non-Individual KYC Form, and Simplified KYC Form.

Individual KYC Form

Non-Individual KYC Form

Simplified KYC Form

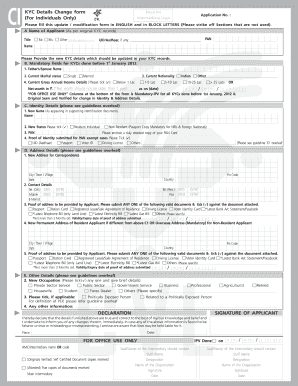

How to complete kyc form bank of india

To complete the KYC form for Bank of India, follow these simple steps:

01

Fill in the personal details section accurately, providing your full name, address, date of birth, occupation, etc.

02

Attach the necessary documents as prescribed, such as proof of identity, proof of address, and passport-sized photographs.

03

Review the filled form and attached documents for any errors or omissions.

04

Submit the completed form along with the supporting documents to the nearest Bank of India branch or as instructed by the bank.

05

Wait for the bank's verification process to be completed.

06

Once the verification is done, your KYC will be deemed complete.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out kyc form bank of india

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

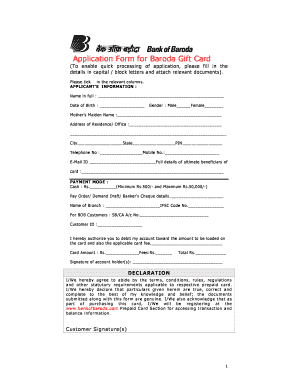

How do I KYC my bank account?

KYC process includes ID card verification, face verification, document verification such as utility bills as proof of address, and biometric verification. Banks must comply with KYC regulations and anti-money laundering regulations to limit fraud. KYC compliance responsibility rests with the banks.

What is KYC form online?

For Individuals.

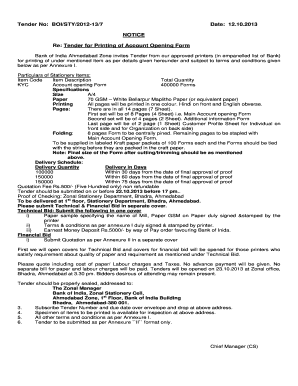

What are the documents required for KYC in Bank of India?

Officially valid documents (OVDs) for KYC purpose include: Passport, driving licence, voters' ID card, PAN card, Aadhaar letter issued by UIDAI and Job Card issued by NREGA signed by a State Government official.

Is KYC form free?

No matter what sort of financial institution you're a part of, you can use this free KYC Form to seamlessly receive client information and signed declarations online.

Can we update KYC online in Bank of India?

They do not require you to physically visit the bank to update the KYC.

How do I complete KYC in BOI?

Steps to Complete Bank of India KYC Online Step 1: Link/Update email ID in your Bank of India account. Step 2: Gather Documents, Required for Online KYC in BOI. Step 3: Find the email ID of your BOI home branch. Step 4: Write and send the email for the Bank of India online KYC updating.

Related templates