1099 Int Fillable Form

What is 1099 int fillable form?

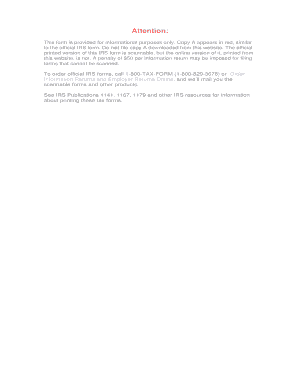

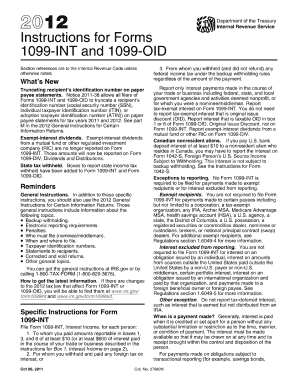

The 1099 int fillable form is a document used for reporting interest income to the Internal Revenue Service (IRS). This form is typically used by individuals and businesses that have received interest payments in a given tax year. By filling out this form, you can accurately report your interest income and ensure compliance with IRS regulations.

What are the types of 1099 int fillable form?

There are several different types of 1099 int fillable forms, depending on the specific situation. Here are some common types:

How to complete 1099 int fillable form

Completing the 1099 int fillable form is a straightforward process. Here are the steps you need to follow:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.