What is Budget Spreadsheet Excel?

Budget Spreadsheet Excel is a powerful tool used to manage finances and track expenses. With Excel's built-in formulas and functions, users can easily create a budget plan, calculate and analyze income and expenses, and generate reports. Excel's spreadsheet format allows for easy organization and customization, making it a popular choice for individuals and businesses alike.

What are the types of Budget Spreadsheet Excel?

There are several types of Budget Spreadsheet Excel that cater to different financial needs and preferences. Some common types include:

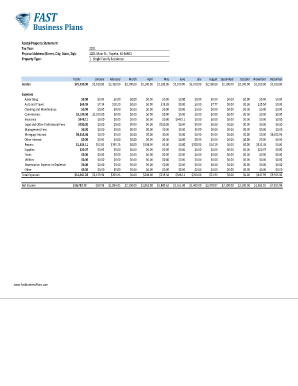

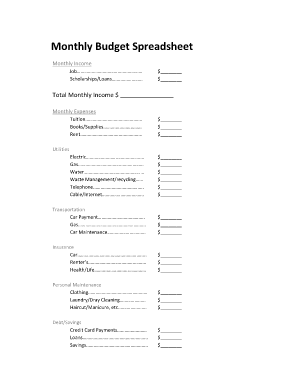

Personal Budget Spreadsheet: Designed for individuals to manage their personal finances and track their expenses.

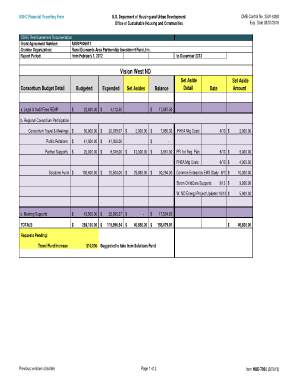

Business Budget Spreadsheet: Tailored for businesses to plan and analyze their financial activities, including income, expenses, and projections.

Project Budget Spreadsheet: Used to track and manage expenses related to specific projects, such as construction or event planning.

Household Budget Spreadsheet: Helps households manage their overall budget, including income, expenses, and savings.

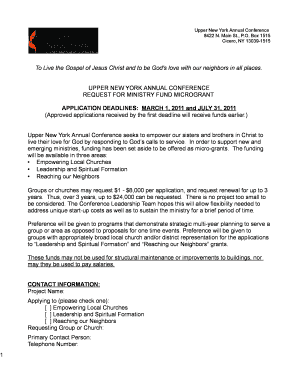

Event Budget Spreadsheet: Specifically created for planning and managing expenses for events, such as weddings, parties, or conferences.

How to complete Budget Spreadsheet Excel

Completing a Budget Spreadsheet Excel involves several steps to ensure accurate financial management. Here is a step-by-step guide to help you:

01

Gather financial information: Collect all relevant financial documents, such as bank statements, receipts, invoices, and pay stubs.

02

Set financial goals: Determine your financial objectives, such as saving a certain amount each month or reducing expenses in specific categories.

03

Create categories: Define categories for income and expenses, such as salary, utilities, groceries, and entertainment.

04

Enter data: Input your financial information into the spreadsheet, categorizing each transaction accordingly.

05

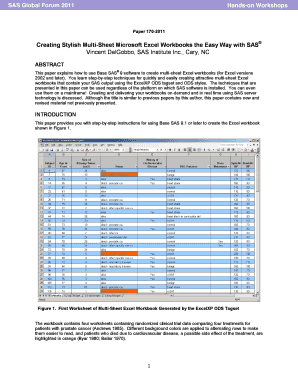

Use formulas: Utilize Excel's formulas to calculate totals, averages, and other useful metrics for analyzing your budget.

06

Review and analyze: Regularly review your budget spreadsheet to track your progress, identify areas for improvement, and make necessary adjustments.

07

Share and collaborate: If needed, share your budget spreadsheet with others, such as family members or colleagues, to collaboratively manage finances.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.