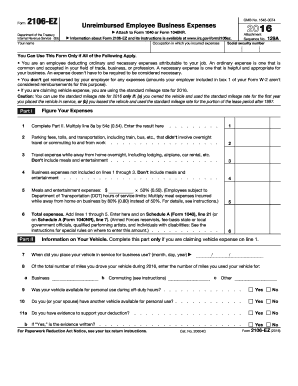

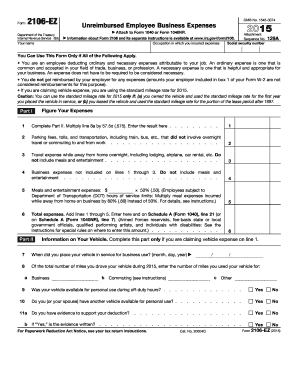

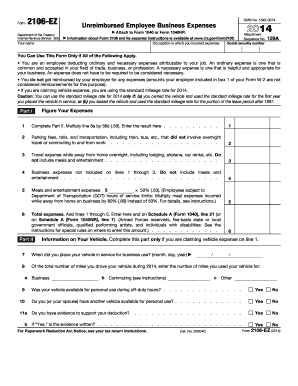

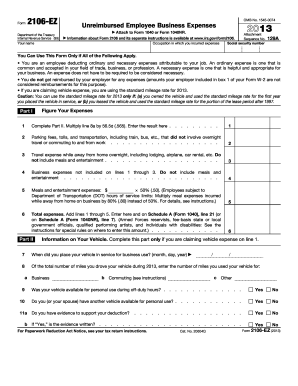

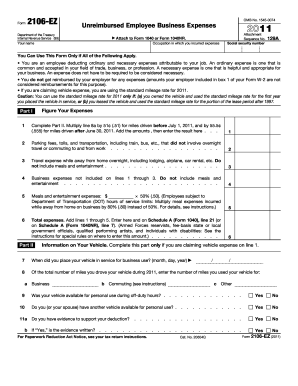

2106-EZ Form

What is 2106-EZ Form?

The 2106-EZ Form is an IRS tax form used by taxpayers who want to claim unreimbursed employee business expenses. It is specifically designed for employees who are qualified to deduct these expenses and meet certain criteria. By completing this form, employees can potentially reduce their taxable income and increase their tax refund.

What are the types of 2106-EZ Form?

There is only one type of 2106-EZ Form available. This simplified version of Form 2106 is intended to make it easier for eligible employees to report their business expenses without the need for complex calculations or extensive documentation. The 2106-EZ Form is suitable for most employees who meet the necessary requirements.

How to complete 2106-EZ Form

Completing the 2106-EZ Form is a straightforward process that can be done in a few simple steps. Here's a quick guide to help you get started:

By following these steps, you can easily complete the 2106-EZ Form and claim your eligible business expenses. Remember to consult with a tax professional if you have any specific questions or concerns about your situation.