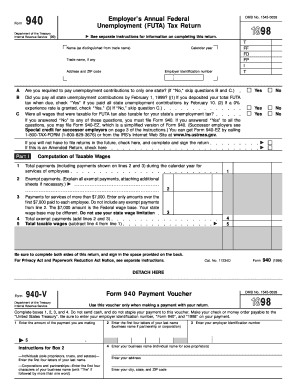

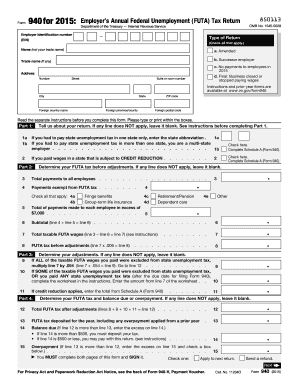

Form 940 - Page 2

What is Form 940?

Form 940 is a tax form used by employers to report Federal Unemployment Tax Act (FUTA) taxes. FUTA taxes are paid by the employer to provide funds for unemployment compensation to workers who have lost their jobs.

What are the types of Form 940?

There is only one type of Form 940, and that is the Annual Federal Unemployment (FUTA) Tax Return.

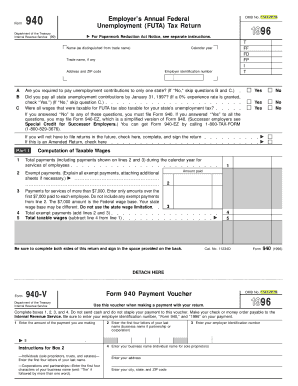

Annual Federal Unemployment (FUTA) Tax Return

How to complete Form 940

Completing Form 940 may seem daunting, but with the right guidance, it can be a straightforward process. Here are the steps to complete Form 940:

01

Gather all the necessary information, such as employer identification number (EIN), total payroll, and any exempt wages.

02

Fill in the employer information section, including EIN and name.

03

Report the total payroll for the tax year, including exempt wages.

04

Calculate the FUTA tax owed based on the applicable tax rate.

05

Complete the payment voucher if you owe taxes.

06

Sign and date the form before mailing it to the appropriate IRS address.

Remember, pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to get your documents done.

Video Tutorial How to Fill Out Form 940

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Where do I file a paper return with or without payment 940?

Mailing Addresses for Forms 940 Mail return without payment Mail return with payment Internal Revenue Service P.O. Box 409101 Ogden, UT 84409Internal Revenue Service P.O. Box 932000 Louisville, KY 40293-20004 more rows • Sep 15, 2022

Can Form 940 be filed electronically?

You can e-file any of the following employment tax forms: 940, 941, 943, 944 and 945. Benefits to e-filing: It saves you time. It is secure and accurate.

Who needs to fill out Form 940?

Employers who've paid $1,500 or more to any W-2 employee OR had at least 1 employee for 20 or more weeks of the year must file Form 940.

How do I fill out Form 940?

0:41 3:51 How to Fill Out Form 940 (FUTA Tax Return) - YouTube YouTube Start of suggested clip End of suggested clip Form 940 has seven parts start by providing the employer identification. Number full name trade nameMoreForm 940 has seven parts start by providing the employer identification. Number full name trade name and registration. Address.

How do I file Form 940?

You're encouraged to file Form 940 electronically. Go to IRS.gov/EmploymentEfile for more information on electronic filing. If you file a paper return, where you file depends on whether you include a payment with Form 940. Mail your return to the address listed for your location in the table that follows.

How do you file Form 940 online?

How to E-File Form 940 Online for 2022 Tax Year with TaxBandits? 1 Choose Tax Year. 2 Enter the Employer Details. 3 Enter FUTA Tax Information. 4 Choose IRS Payment Method. 5 Review Your Form 940. 6 Transmit Your Form 940 to the IRS.

Related templates