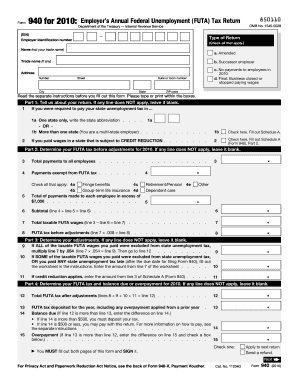

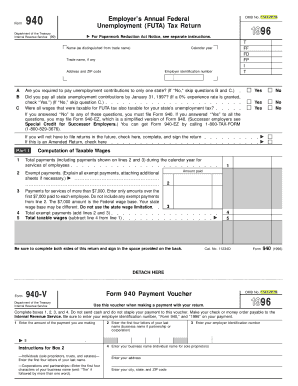

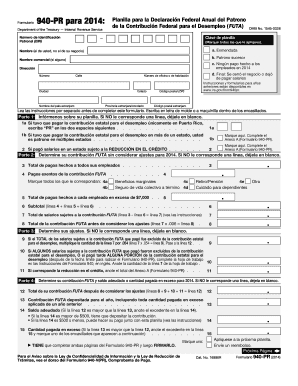

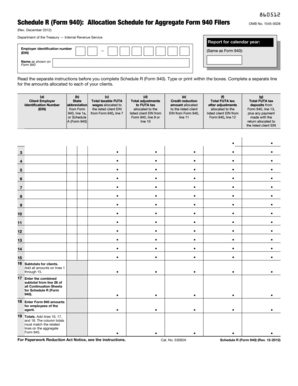

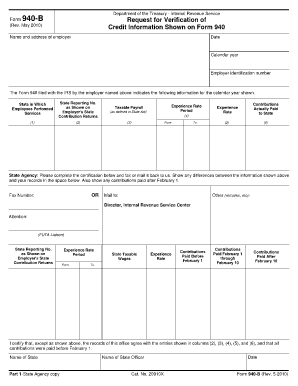

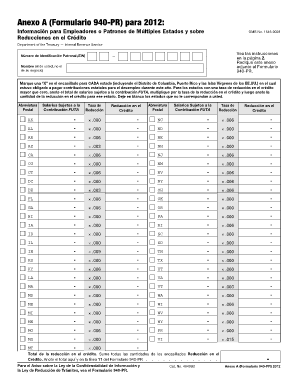

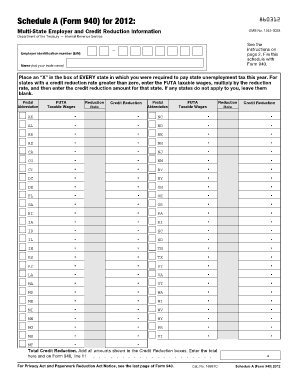

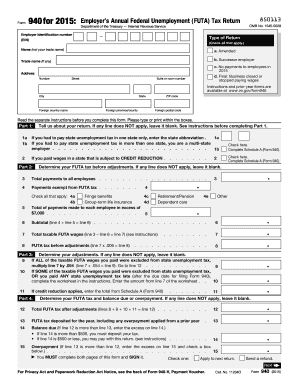

2012 Form 940

What is 2012 Form 940?

The 2012 Form 940 is a tax form used by employers to report their annual Federal Unemployment Tax Act (FUTA) tax liability. It is also used to calculate and determine the amount of unemployment tax owed by employers for the year 2012. This form is important for businesses to ensure compliance with federal tax regulations.

What are the types of 2012 Form 940?

There is only one type of 2012 Form 940, which is the standard annual form used by employers to report their FUTA tax liability for the year. This form is applicable to all employers who paid wages to employees subject to FUTA tax during the year 2012.

How to complete 2012 Form 940

Completing the 2012 Form 940 is a straightforward process. Follow these steps to ensure accurate and timely filing:

Remember, using advanced online tools like pdfFiller can simplify the process of completing the 2012 Form 940. pdfFiller allows you to create, edit, and share documents online effortlessly. With its unlimited fillable templates and powerful editing tools, pdfFiller is the ultimate PDF editor that will help you get your documents done quickly and efficiently.