Get the free Caution: DRAFT

Show details

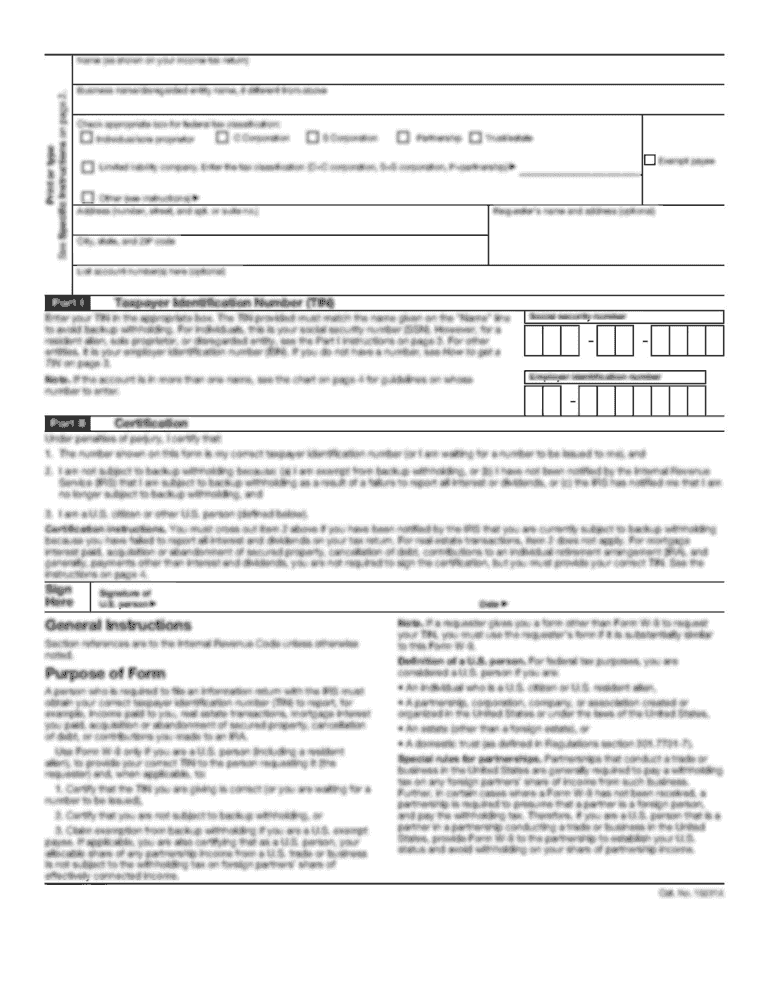

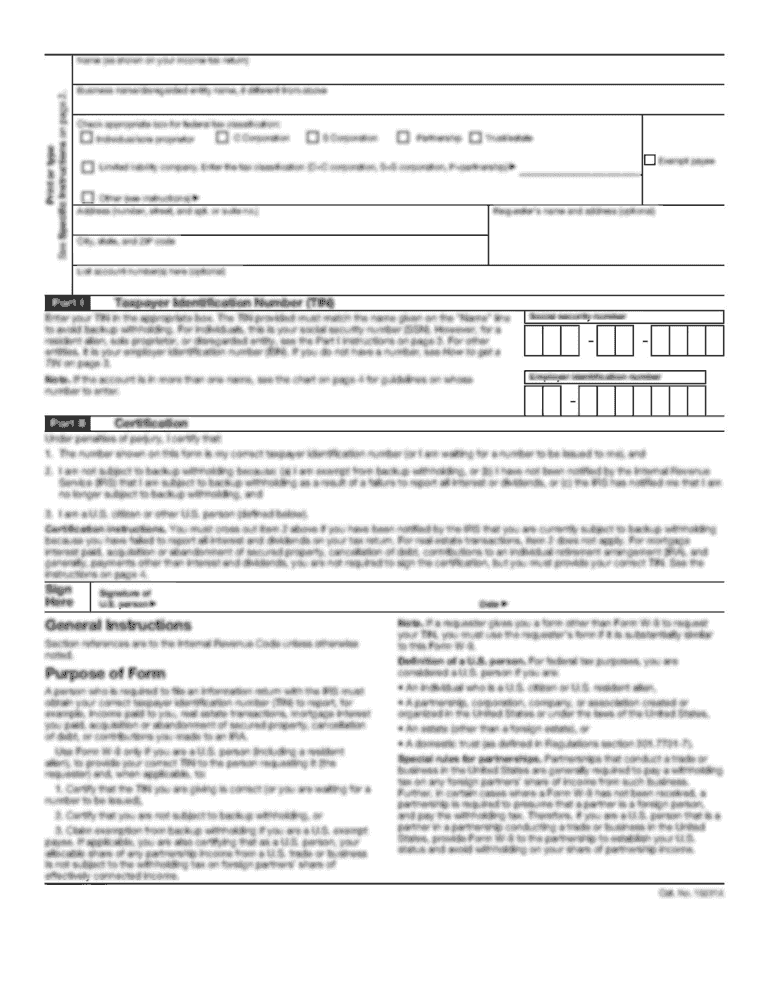

Caution: DRAFT?NOT FOR FILING

This is an early release draft of an IRS tax form, instructions, or

publication, which the IRS is providing for your information as a

courtesy. Do not file draft forms.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your caution draft form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your caution draft form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit caution draft online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit caution draft. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to deal with documents.

How to fill out caution draft

How to fill out a caution draft:

01

Start by entering the date at the top of the document.

02

Write the title "Caution Draft" in bold or highlight it for emphasis.

03

Include a brief introduction explaining the purpose of the caution draft.

04

Provide clear instructions or guidelines for the reader to follow.

05

Organize the information in a logical and easy-to-understand manner.

06

Use bullet points or numbering to break down each step or point.

07

Leave enough space for the reader to fill in their specific information.

08

Ensure that all necessary fields or sections are included in the caution draft.

09

Double-check for any spelling or grammatical errors before finalizing the document.

10

Save and distribute the caution draft to the appropriate individuals or groups.

Who needs caution drafts:

01

Individuals or organizations involved in certain legal or sensitive matters.

02

Professionals working in industries such as law enforcement, finance, or compliance.

03

Anyone who wants to provide a warning or reminder to others regarding potential risks or dangers.

Note: The specific need for caution drafts may vary depending on the context or situation. It's important to assess the relevance and necessity of caution drafts based on individual requirements.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is caution draft?

Caution draft is a legal document that allows a party to put a hold on certain funds or assets to prevent their transfer or disposal.

Who is required to file caution draft?

Any party who wishes to prevent the transfer or disposal of funds or assets can file a caution draft.

How to fill out caution draft?

To fill out a caution draft, you need to provide information about the funds or assets to be held, the reasons for the caution, and any supporting evidence.

What is the purpose of caution draft?

The purpose of caution draft is to protect the interests of a party by preventing the transfer or disposal of funds or assets until a dispute is resolved.

What information must be reported on caution draft?

On a caution draft, you must report details such as the amount and nature of the funds or assets, the parties involved, the reasons for the caution, and any relevant supporting documents.

When is the deadline to file caution draft in 2023?

The deadline to file a caution draft in 2023 will depend on the specific jurisdiction and applicable regulations. It is advisable to consult with a legal professional or local authority for accurate information.

What is the penalty for the late filing of caution draft?

The penalty for the late filing of a caution draft can vary depending on the jurisdiction and specific circumstances. It may involve monetary fines, loss of rights, or other legal consequences. It is recommended to seek legal advice or consult relevant regulations for accurate information.

How can I edit caution draft from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your caution draft into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How do I execute caution draft online?

pdfFiller has made filling out and eSigning caution draft easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

Can I edit caution draft on an Android device?

You can make any changes to PDF files, like caution draft, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

Fill out your caution draft online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.