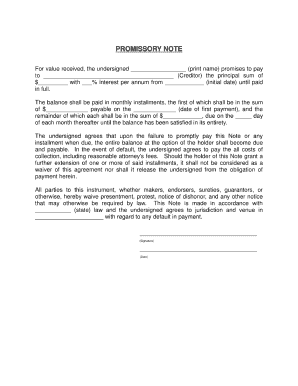

Promissory Note Template

Fill out the Promissory Note Digitally

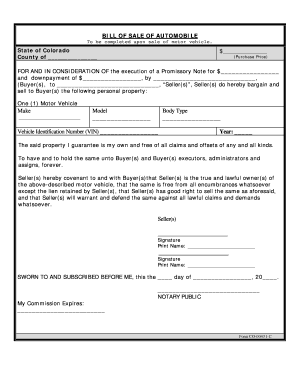

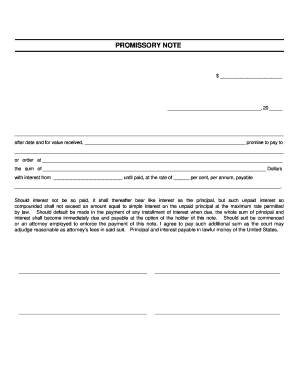

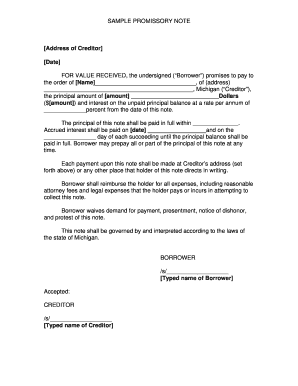

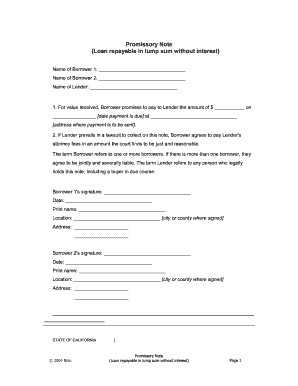

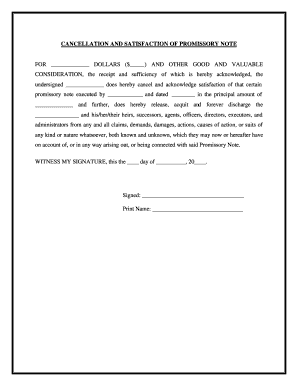

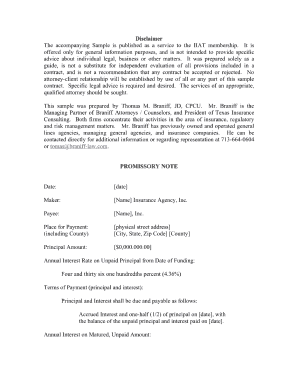

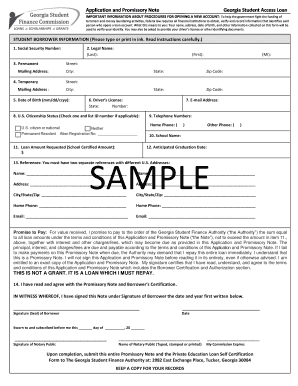

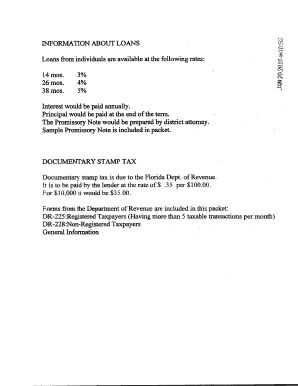

When somebody borrows money from someone else, it is common practice for the lender to create a written promise of repayment for the borrower to sign, clarifying when and how the money will be given back. The promissory note can also be used to clarify any misunderstandings regarding interest rates, or the amount of time one has to repay any debt.

Here are just a few instances when this document can be used:

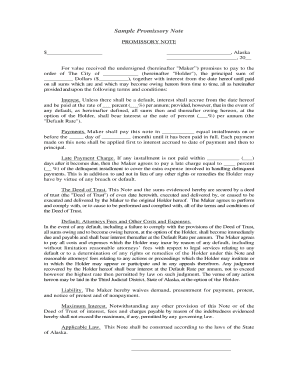

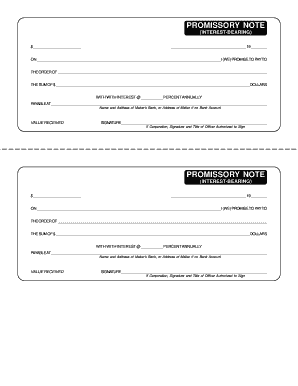

This form usually contains the amount of the loan and the interest rate connected with it. Also, it has the terms and conditions for late or missed payments and the measures to be undertaken in such cases. It is obligatory to fulfill all the requirements, as the penalties and demand notices will be enforced.

Now you can complete this document electronically in PDF, without worrying about losing any paper copies. You just need to open your own template or select one of the samples stored in the PDFfiller digital library and fill it out.

How to Complete the Promissory Note Online

Once the sample is in your personal account, you need to open it and remember these tips: