Free Promissory Note Template For Personal Loan

What is free promissory note template for personal loan?

A free promissory note template for personal loan is a legal document that outlines the terms and conditions of a loan agreement between two parties. It serves as a written agreement that establishes the borrower's promise to repay the loaned amount over a specified period of time. This template is provided free of charge and can be customized to suit the needs of the borrower and lender.

What are the types of free promissory note template for personal loan?

There are different types of free promissory note templates for personal loans, each catering to specific needs and circumstances. Some common types include: 1. Installment Promissory Note: This type of template outlines a loan agreement where the borrower agrees to repay the loaned amount through regular installment payments. 2. Balloon Promissory Note: This template includes a larger final payment, often referred to as a balloon payment, which is due at the end of the loan term. These templates can be customized and used based on the specific requirements of the loan agreement.

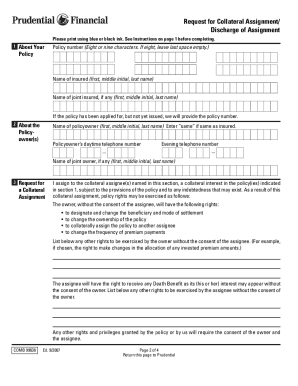

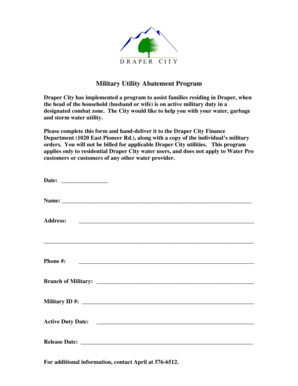

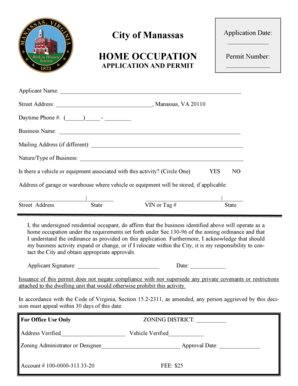

How to complete free promissory note template for personal loan

Completing a free promissory note template for personal loan is easy and straightforward. Follow these steps to ensure a properly filled-out template: 1. Begin by entering the names and contact information of the borrower and lender at the beginning of the template. 2. Specify the loan amount, interest rate, and repayment terms in detail. 3. Include any additional terms and conditions, such as late payment penalties or collateral requirements. 4. Both parties should review the completed template and make any necessary revisions. 5. Sign and date the document to make it legally binding. By following these steps, you can successfully complete a free promissory note template for personal loan and establish a clear agreement between both parties.

pdfFiller is an excellent online platform that empowers users to create, edit, and share documents online, including free promissory note templates for personal loans. With its unlimited fillable templates and powerful editing tools, pdfFiller provides everything you need to easily complete your promissory note template. Whether you need to create a new document or make edits to an existing one, pdfFiller is the only PDF editor you'll need to get your documents done efficiently and professionally.