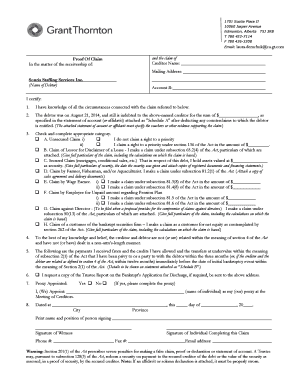

Proof Of Income Letter From Accountant

What is a proof of income letter from accountant?

A proof of income letter from an accountant is a document that verifies an individual's income as reported by their accountant. It is typically used by individuals or organizations to provide evidence of their income when applying for loans, renting a property, or applying for government benefits.

What are the types of proof of income letter from accountant?

There are several types of proof of income letters that can be provided by an accountant depending on the specific purpose:

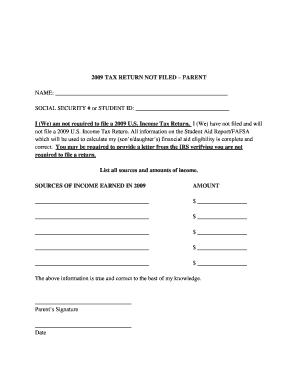

Employment Verification Letter: This type of letter confirms an individual's employment status and provides information about their income, job title, and length of employment.

Self-Employment Verification Letter: For self-employed individuals, this letter verifies their self-employment status, income sources, and business details.

Income Confirmation Letter: This letter confirms the income reported on an individual's tax return and may be required for various financial or legal purposes.

Financial Assistance Letter: This type of letter is provided by an accountant to support an individual's application for financial assistance, such as scholarships or grants.

Rental Verification Letter: This letter is used to verify an individual's income and employment when applying for rental properties.

How to complete a proof of income letter from accountant

To complete a proof of income letter from an accountant, follow these steps:

01

Gather necessary information: Collect all the relevant information, such as the individual's full name, contact details, employment or self-employment details, and any other required financial information.

02

Draft the letter: Begin by addressing the recipient, providing your accountant's details, and introducing the purpose of the letter. Include all the necessary information mentioned earlier in a clear and concise manner.

03

Proofread and edit: Review the letter for any errors or inconsistencies and ensure that the information provided is accurate.

04

Sign and date: Add your signature and date the letter to validate its authenticity.

05

Save or send the letter: Save a copy of the letter for your records and send it to the intended recipient either by mail or electronically, depending on their preferences.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out proof of income letter from accountant

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Does a 1099 count as self-employment?

If payment for services you provided is listed on Form 1099-NEC, Nonemployee Compensation, the payer is treating you as a self-employed worker, also referred to as an independent contractor. You don't necessarily have to have a business for payments for your services to be reported on Form 1099-NEC.

What can I use to prove my income?

10 forms of proof of income Pay stubs. A pay stub, which most people who work corporate jobs receive at the end of each pay period, is the most common form of proof of income. Bank statements. Tax returns. W2 form. 1099 form. Employer letter. Unemployment documentation. Disability insurance.

How do I write a letter of income note?

Provide details about your basic income. You should outline how much money you make, how you make your money, how long you have been making that much money, and how long you anticipate being able to maintain the same (or greater) income.

How do I write a letter of proof of income?

My name is [full name] and I am [professional position and how it relates to the employee or former employee]. I'm writing to confirm that [employee name] has worked for [company name] for [length of time worked] as an [employee job title]. [Employee name] earns [hourly, monthly or yearly salary or wages].

Can I write my own proof of income letter?

Employees can also write their own proof of income letter if they want, as long as the details are confirmed by their employer, accountant, or another relevant individual, depending on the circumstances.

What do I write for proof of income?

If Employed: Income Tax Return BIR 2316. Certificate of Employment with monthly income (issued within the last 3-6 months) Payslips (dated within the last 3 months) Payroll bank account statement, web screenshots of online banking payroll credits or mobile banking app.

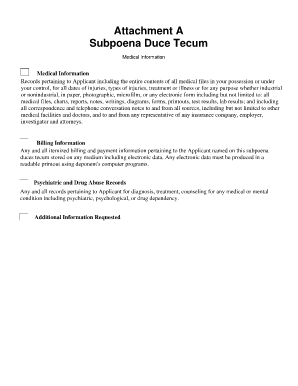

Related templates