Simple Loan Agreement Template

What is a Simple Loan Agreement Template?

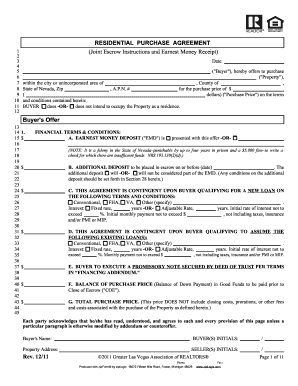

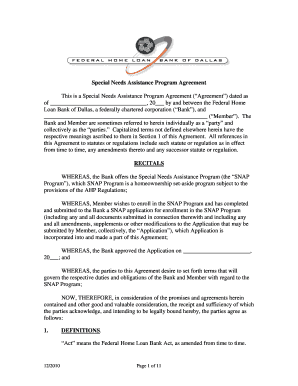

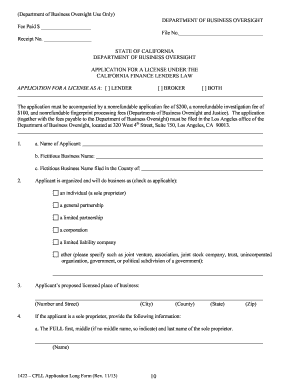

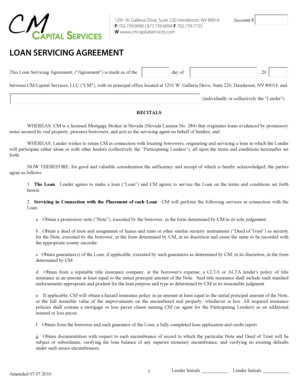

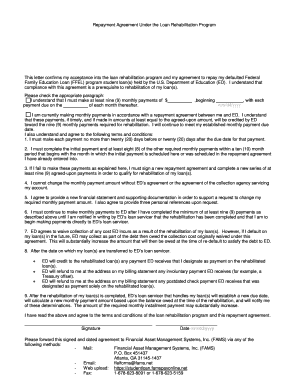

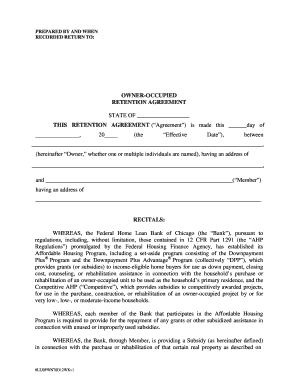

This document is an agreement between a lender and a borrower. It is specially created to record everything negotiated between these two parties. When they have come to an agreement, it is necessary to officially and legally determine the terms and conditions. For such a purpose, it is much easier to use a template to save time. It is a contract signed by both a lender and a borrower, including all conditions that they have previously approved.

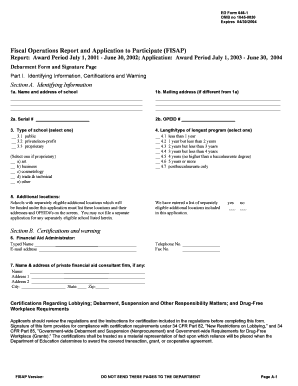

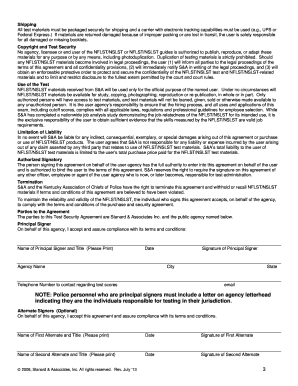

There are 6 basic types of the agreement: a family loan agreement, loan release form, IOU (I Owe You), personal loan agreement, unsecured promissory note and secured promissory note.

How to Write a Simple Loan Agreement

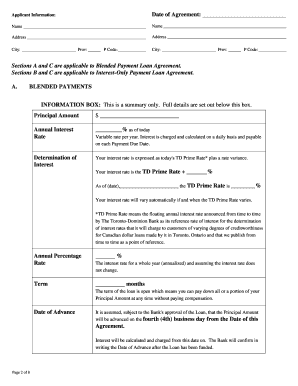

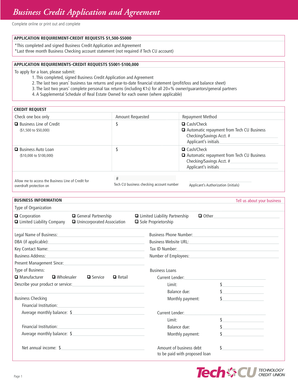

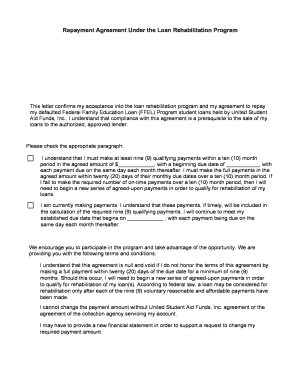

A simple loan agreement template requires some time to be completed. Generally, there are several main points to include in the document. First of all, indicate the amount of the loan agreed to by both parties. After that, you include information about the parties: names, addresses, contact information, etc. Payment information comes next. Check the box that indicates the repayment preference of the lender. It is important to indicate the interest and sign the agreement.

According to this simple loan template, you must keep a record of all money-related issues as it is a legal document. Moreover, it is possible to download a PDF or Word sample and fill it out right on your computer, laptop or any device. You will not only save time using this method but also get the chance to edit the information, make notes and add more fillable fields if it is necessary.