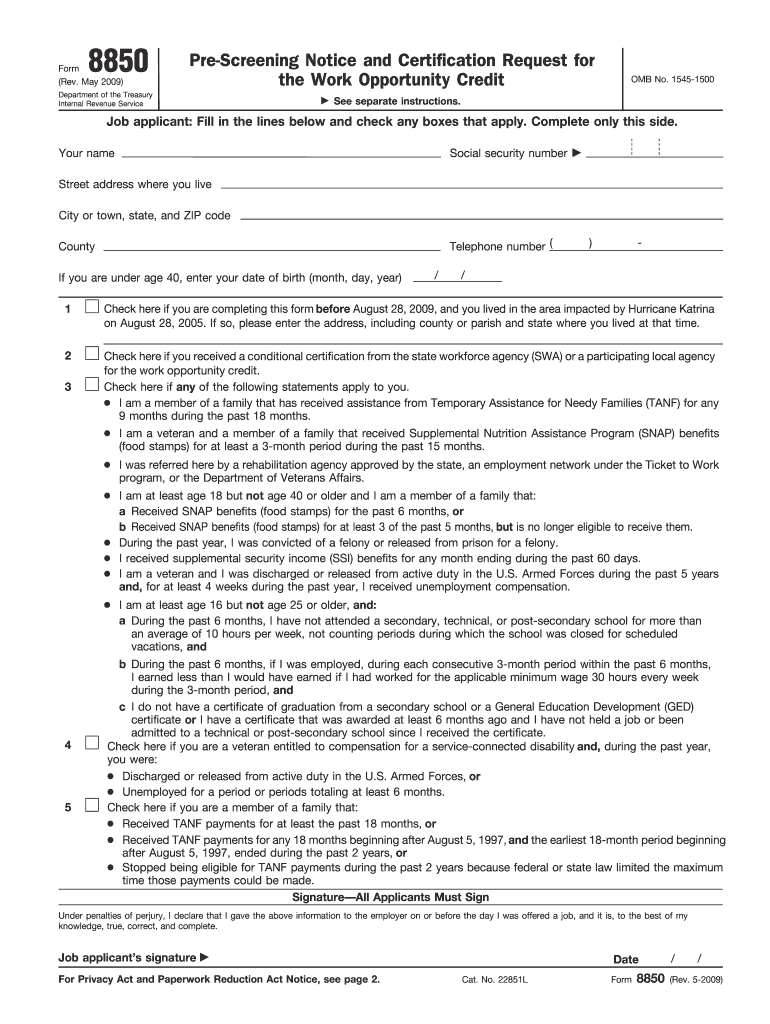

What is form 8850?

Employers file this pre-screener form with the state workforce agency (SWA) to see if they qualify for a work opportunity tax credit. If an organization hires an individual in a WOTC targeted group, it can claim a tax credit.

Who should file form 8850?

Employers who believe that a new employee is a member of a targeted group should file form 8850 to receive a certification that will enable them to claim the tax credit.

What information do you need when you file form 8850?

New employees should complete page 1 with personal details, including name, address, and phone number. Next, they should mark the checkboxes with applicable statements. Finally, the applicant must sign and date the form on Page 1.

Page 2 is for an employer to fill out. It includes fields for the employer's name, address, phone number, and employment details (hire date, start, and end dates, etc.). The employer must date and sign the form and provide the signer's title.

How do I fill out form 8850 in 2010?

You can quickly fill out the 8850 form online with pdfFiller. To do that:

- Click Get Form to open the document in pdfFiller

- Fill it out by entering the required information

- Print out the document

- Sign and date it (must be signed by the employer and employee)

- Send the form to the SWA of your state

Is form 8850 accompanied by other forms?

Make sure to fill out and submit ETA form 9061 or 9062 to SWA along with IRS form 8850 to complete the application.

Additionally, a job applicant of the Qualified Long-Term Unemployment Recipient (LTUR) targeted group may complete ETA form 9175.

When is form 8850 due?

File the form within 28 days of the new employee’s start date.

Where do I send form 8850?

You must submit it to the SWA of the state where the new employee works. Find the form 8850 instructions on SWA's website of your state.