Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

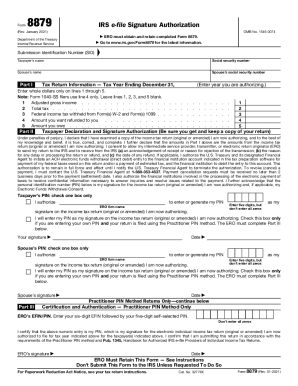

What is arizona form az 8879?

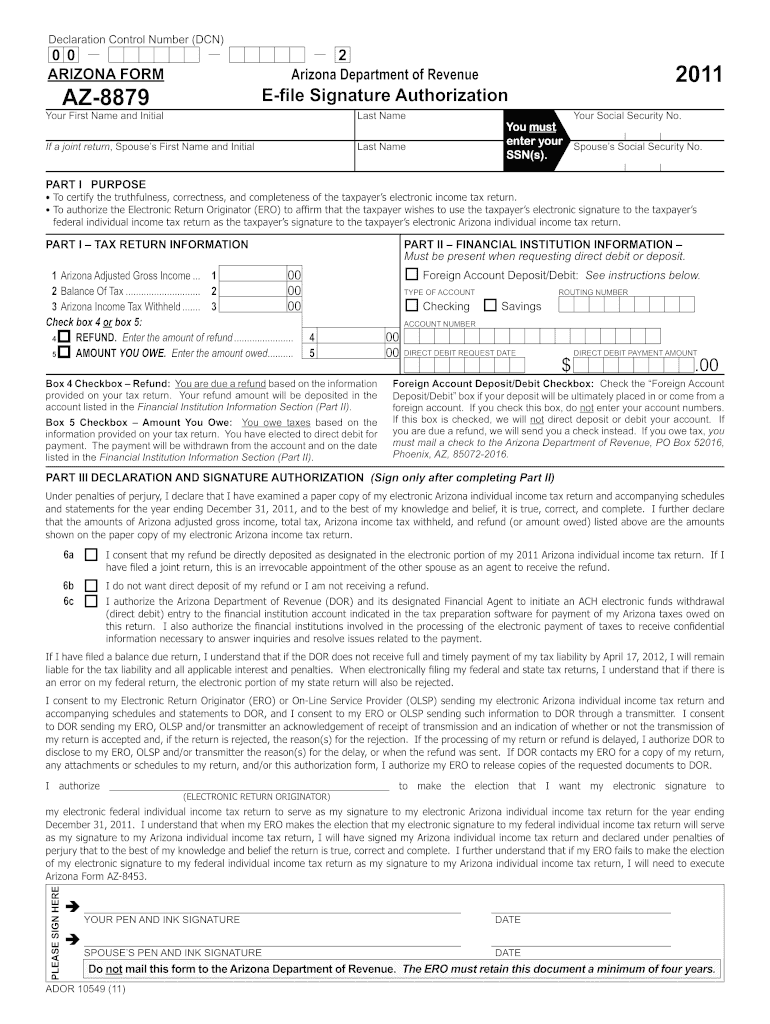

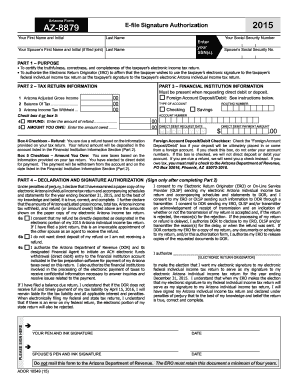

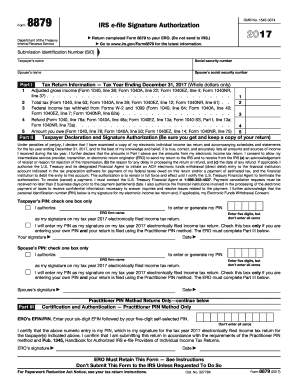

Arizona form AZ 8879 is a signature authorization form used by taxpayers to authorize an electronic return originator (ERO) to electronically file their state income tax return. The form grants permission for the ERO to enter the taxpayer's PIN (Personal Identification Number) on their behalf when electronically filing their return. By signing the form, the taxpayer confirms that all the information on the return is true and accurate to the best of their knowledge.

Who is required to file arizona form az 8879?

The Arizona Form AZ 8879, also known as the E-File Signature Authorization for Partnerships and Corporations, is required to be filed by tax practitioners who electronically file Partnership and Corporate income tax return forms on behalf of their clients in Arizona. This form allows the tax practitioner to electronically sign and submit the tax returns on behalf of their clients.

How to fill out arizona form az 8879?

To fill out the Arizona Form AZ 8879, you will need to follow these steps:

1. Obtain the form: Download a copy of the Arizona Form AZ 8879 from the official Arizona Department of Revenue website or obtain a physical copy from a tax office or library.

2. Provide your information: Fill in your personal information at the top of the form. This includes your name, social security number, address, and filing status.

3. Include your spouse's information: If you are married and filing jointly, provide your spouse's information in the designated section.

4. Calculate your tax liability: Fill in the appropriate boxes to calculate your tax liability, including income, deductions, and exemptions. You may need to refer to your tax documents and other supporting documents to accurately fill in this section.

5. Determine withholding and payments: If you made any payments throughout the year to the Arizona Department of Revenue, enter those amounts in the appropriate boxes. This includes any withholding taxes, estimated tax payments, and any other payments made towards your tax liability.

6. Complete the signature section: The Arizona Form AZ 8879 requires a signature from both the taxpayer and the preparer. Sign and date the form in the designated areas.

7. Attach any necessary documentation: If there are any additional documents or schedules required to support your tax return, attach those documents to the completed form.

8. Submit the form: Make a copy of the completed form and all supporting documents for your records. Mail the original form to the Arizona Department of Revenue address provided on the form. It's often a good idea to send the form using certified mail with a return receipt, so you have proof that the form was delivered.

Note: This is a general guide, and it's recommended to consult the instructions provided with the form for specific details on filling out the Arizona Form AZ 8879. Additionally, for complex tax situations, it may be helpful to seek assistance from a tax professional to ensure accuracy.

What is the purpose of arizona form az 8879?

The purpose of Arizona Form AZ 8879 is to provide taxpayers with an option to electronically sign their tax returns. This form acts as a declaration that the taxpayer has reviewed and approves the content of their electronically filed return before it is officially submitted. By signing this form, taxpayers authorize their tax preparer or electronic return originator to electronically file their tax return.

What information must be reported on arizona form az 8879?

The Arizona Form AZ 8879 is an e-file authorization form which requires the following information to be reported:

1. Paid Preparer Information: The name and address of the authorized e-file provider, their EFIN (Electronic Filing Identification Number), and the Preparer Tax Identification Number (PTIN).

2. Taxpayer Information: The taxpayer's name, Social Security Number (SSN), filing status, address, and daytime phone number.

3. Spouse Information: If applicable, the spouse's name, SSN, and address.

4. Filing Year and Return Information: The tax year being filed and the type of return being filed (individual, corporate, partnership, etc.).

5. Primary and Secondary Identification: The driver's license number (or other government-issued identification) of the taxpayer and spouse (if applicable).

6. Declaration: The taxpayer must sign and date the form, confirming that they have reviewed the tax return and that it is true, correct, and complete. If applicable, the taxpayer's spouse must also sign and date the form.

It is important to review the form carefully and ensure that all the required information is accurately provided before signing and submitting it.

What is the penalty for the late filing of arizona form az 8879?

There is no specific penalty stated for the late filing of Arizona Form AZ 8879. However, there may be other penalties associated with the late filing of tax returns or non-compliance with Arizona tax laws. It is recommended to consult with a tax professional or the Arizona Department of Revenue for specific information regarding penalties for late filing.

How can I manage my arizona form az 8879 directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign arizona form az 8879 and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I edit arizona form az 8879 online?

With pdfFiller, it's easy to make changes. Open your arizona form az 8879 in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I fill out arizona form az 8879 on an Android device?

Use the pdfFiller Android app to finish your arizona form az 8879 and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.