SF 1199A 2012 free printable template

Get, Create, Make and Sign

How to edit standard form 1199a online

SF 1199A Form Versions

How to fill out standard form 1199a 2012

How to fill out standard form 1199a?

Who needs standard form 1199a?

Video instructions and help with filling out and completing standard form 1199a

Instructions and Help about 1199a form

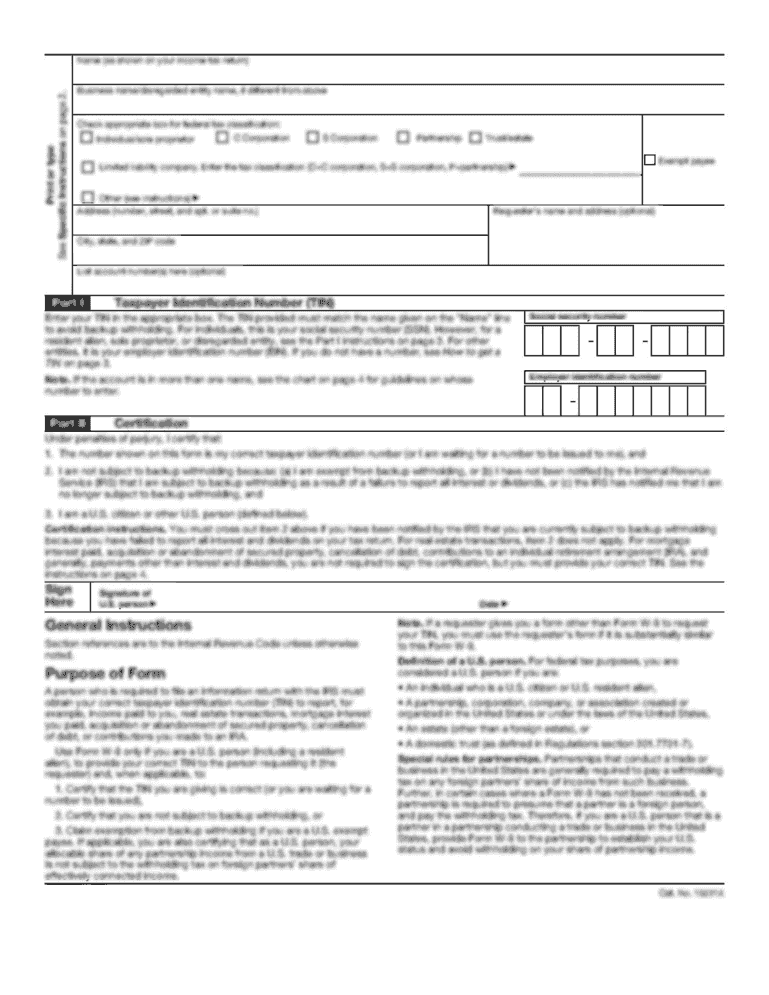

Hello I'm Staff Sergeant Travis Reed, and today I'm going to go over with you how to fill out the SF 1199 alpha which is simply your direct deposit form you've probably filled out plenty of these four jobs in the past but this time we're filling it out for your retirement pension so in section one block a have several things to fill out the first one is name of payee that is simply your last name first name middle initial directly below that you will have your address it will be your street address if that is where you receive mail, or it will be a P o box that that is where you receive mail it does not have to be the physical address it is the mailing address directly under that you have the city state and zip code below that line you have your telephone number this will be the best point of contact it does not have to be a house number it can be a cell phone remember to include the area code first your next section is section b there you will put name of person or persons entitled to payment this name will be an exact same format as a name of payee which is last name first name middle initial and again this will be the retirees name right under there you have Block C which is claim or payroll ID number this is your social security number without the dashes over to the right back to the top across from a have D type of depositor account this will simply be checking or savings if it's a money market account put it as savings below that you have Block E which is depositor account number this will be the account number whether it be checking savings or money market your routing number this is at the bottom of the page, and we will review that and shortly right after E you have Block F this is type of payment it will always and only be military retiree you do not have to write anything in the blank just put an X here in the block black G is not applicable this block you will leave blank after you have filled up this top half of the form you will go to the left middle section where it says payee joint payee certification you will sign and date only the top line in section 2 you have government agency name this is D F an s which stands for Department of Finance and Accounting services, but you can simply put d f8 s beside it, you have government agency address in this line you will not need a whole address you will simply put London comma KY for Kentucky skip down to section 3 and here on the left side you will need name and address of financial institution for the purpose of this presentation I will use State Employees Credit Union which is SEC you and the address that you see on the screen to your right is where you will put your routing number as stated earlier ensure you have one number in each block of the routing number all routing numbers have nine digits right below the routing number you have depositor account to title this will be the name in first name middle initial last name format so unlike a and B above this will be written out as you...

Fill sf1199a direct deposit form : Try Risk Free

People Also Ask about standard form 1199a

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your standard form 1199a 2012 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.