Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

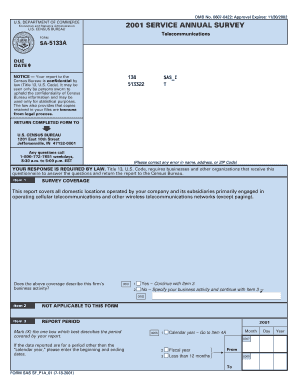

13 online form is a web-based application developed by the Internal Revenue Service (IRS) that allows taxpayers to submit their tax returns electronically. It is used by individuals, businesses, and other organizations to file their taxes online. The form is available on the IRS website and can be filled out and submitted directly to the IRS.

What is the purpose of 13 online form?

The purpose of an online form is to collect data from users, such as contact information or feedback. This data can then be used for a variety of purposes, such as creating customer profiles, collecting customer feedback, or allowing customers to register for an event.

What is the penalty for the late filing of 13 online form?

The penalty for the late filing of 13 online forms depends on the type of form. Generally, the late filing of a form can result in fines or penalties, depending on the laws of the jurisdiction.

Who is required to file 13 online form?

Form 13 is typically used by individuals or businesses who want to reorganize their financial affairs. This form is required to be filed by debtors, specifically those filing for bankruptcy under Chapter 11.

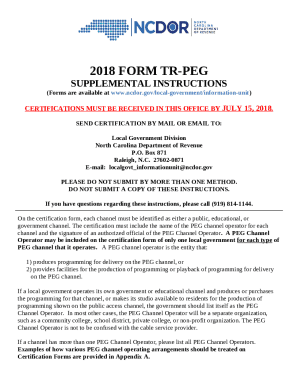

How to fill out 13 online form?

To fill out an online form, follow these steps:

1. Open the online form on your web browser.

2. Read the instructions or guidelines provided on the form to understand the information required and any specific format to follow.

3. Start from the top of the form and work your way down, entering the requested information in the appropriate fields. Common fields may include your name, email address, phone number, and address.

4. Use the tab key or your cursor to navigate to the next field after entering each piece of information.

5. Make sure to fill in all required fields, denoted by asterisks (*) or any other indicator.

6. Pay attention to the form's formatting requirements, such as using proper capitalization or specific date formats.

7. If there are optional fields, consider if it's necessary or relevant to provide additional information.

8. Keep an eye out for checkboxes or radio buttons that require your response. Select the appropriate option by clicking or tapping on the box or button.

9. If the form allows you to upload files, ensure that the files are in a supported format, and follow the instructions to attach and submit them.

10. Once you have completed filling out the entire form, review it carefully to check for any mistakes or missing information.

11. If possible, take advantage of any preview or review feature provided by the website or application to ensure the form appears as intended before submitting.

12. Finally, click the submit button or follow the submission process provided by the website to complete the form submission.

Remember to save a copy of the filled-out form for your records before submitting, if it's possible to do so.

What information must be reported on 13 online form?

The specific information that must be reported on a Form 13 online form may vary depending on the context or purpose for which the form is being used. It is important to refer to the specific instructions or guidelines provided by the organization or authority requiring the form. However, some common pieces of information that might be required on a Form 13 online form could include:

1. Personal information: Name, address, contact details of the person filling the form.

2. Date and time: The date and time when the form is being submitted.

3. Identification: Identification numbers, such as social security number or driver's license number.

4. Financial information: Details related to financial transactions, income, expenses, or assets if relevant to the form.

5. Employment details: Current or previous employment information, including employer name, address, and job title.

6. Legal or regulatory details: Any legal or regulatory details pertinent to the purpose of the form.

7. Signatures: Electronic or digital signatures to confirm the authenticity of the form submission.

Again, the specifics will depend on the purpose and requirements of the Form 13, so it is important to refer to the specific instructions provided with the form.

How do I make edits in 13 online form - without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing 13 online form - and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How can I edit 13 online form - on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing 13 online form -, you can start right away.

Can I edit 13 online form - on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign 13 online form - on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.