Ontario Renewal Form Investor/Lender Disclosure Statement 2009-2024 free printable template

Get, Create, Make and Sign

Editing disclosure to borrower form ontario online

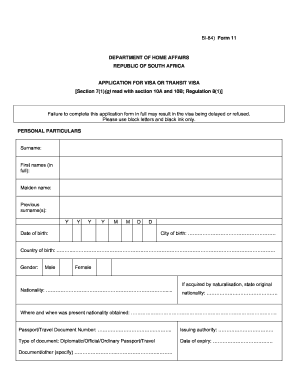

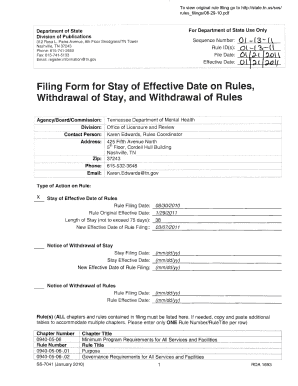

How to fill out disclosure to borrower form

To fill out the disclosure to borrower form, follow these steps:

Video instructions and help with filling out and completing disclosure to borrower form ontario

Instructions and Help about mortgage broker disclosure form

Ah, just have to say that hi everyone this is RJ with loan officer 9-1-1 and today's blog topic is going to be the disclosure about disclosures that's right this crazy mortgage industry that we're in we have to put our clients through how with paperwork so what I want to talk about is the three stage disclosure process so whether you are buying or refinancing a home loan every client has to go through this process of receiving documents to sign and disclose so let's talk about the three disclosures first set is let's get talking about getting a loan that's right we send out an initial disclosure statement to you letting you know we're in the conversation of getting a loan I know this sounds silly it's stupid I know but by law three days after a loan application has been signed a property's been identified an address borrower all that rigmarole we have to send out an initial set of disclosures they have to be signed and deed typically in the set of disclosures the important thing is signing the initial loan application also borrower's consent form there's also what's called a 45 oh 16 which is a government disclosure regarding your tax returns to verify the information you've given the loan officer is the same information you report to the government it's what we call it full doc the boat was also going to receive a good faith estimate and I will say the word a good faith estimate it is an estimate and by all means I want to let everybody know that first stage of disclosures the lenders are required to send out fee schedule now many of these fees and numbers are going to be general, and they're not going to be accurate why because the loan is probably not locked in yet and by law the lender has to give you an idea of what this loan is going to be all about it is important to sign the initial set the first stage but as a reminder the second stage will be along the way well let's say maybe to two weeks from the initial sentence what about the second set well when you get the second set it's typically around the time when you're ready to lock in the ring these disclosures are just as important to get the process rolling why well we've got closer to the numbers and the figures that you want to see so unlike the initial set the first set the second set is going to give you more accurate figures and numbers to work with by all means anytime you have a question pick up the phone call your loan officer to discuss the initial set as compared to the second set I will assure you the second set of disclosures are going to be a lot more accurate now in case of working with a mortgage banker or broker you might receive what's called a third set of disclosures and this typically happens when you get closer to signing loan documents it's the lenders way of making sure you have seen and read everything that's possible about understanding the interest rate and selected fees you are paying the loan amount that you've requested for more questions and any comments...

Fill borrower disclosure form : Try Risk Free

People Also Ask about disclosure to borrower form ontario

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your disclosure to borrower form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.