AMP's core business is providing wealth management products and services to its members, which is a leading financial services provider in the Australia and New Zealand market. AMP also manages its shareholders accounts, offers asset management and investment programs for a select group of high net worth individuals and corporate clients. In 2016, the annual growth rate of AMP's financial products was 4.9%, which is in line with the Australian average and 2.6% higher than the overall market. AMP had 25.2 billion of assets under management at December 31, 2016, as reported in the Annual Review. In the quarter ended December 31, 2016, AMP recorded revenue of A7.8 billion. The company was also awarded a global Innovation, Technology & Growth Award on November 23, 2016. A Productivity Growth Strategy was released on November 22, 2016. The initiative was established by AMP to focus on efficiency, product and service innovation, and innovation of the culture at AMP. A Productivity Growth Strategy aims to improve the productivity of the business through targeted, innovative products, services and investment. A Productivity Growth Strategy is a combination of existing initiatives such as AMP Smart Accounts, AMP Online Advisory, and AMP Global Platform, among others. Further information about AMP is available at (Australia). . AMP's products include: Smart Accounts™, a wealth management product aimed towards young clients; AMP Global Platform, a cross-border solution for wealth management services for Australian and New Zealand customers; AMP Wealth Smart Accounts™ and AMP Smart Advisors, a wealth management product with a mobile app; and Asset Management Services™, a range of products that support institutional clients. AMP Capital Investors, AMP's global fixed income management business, is a privately-owned Australian private investment company and one of the largest investors in the equity market. AMP Capital Investors invests in all asset classes including global, emerging and domestic equities; fixed income securities and currency pairs; and corporate and private debt.

Innocent Wealth Advisors AMP Insolvency Services Pty Limited Australian National Securities Exchange: +61 2 9 Insolvency Services Pty Ltd can advise on insolvency matters for Australian and New Zealand investors. The company is an insolvency service provider that can be contacted on 1800 800 815.

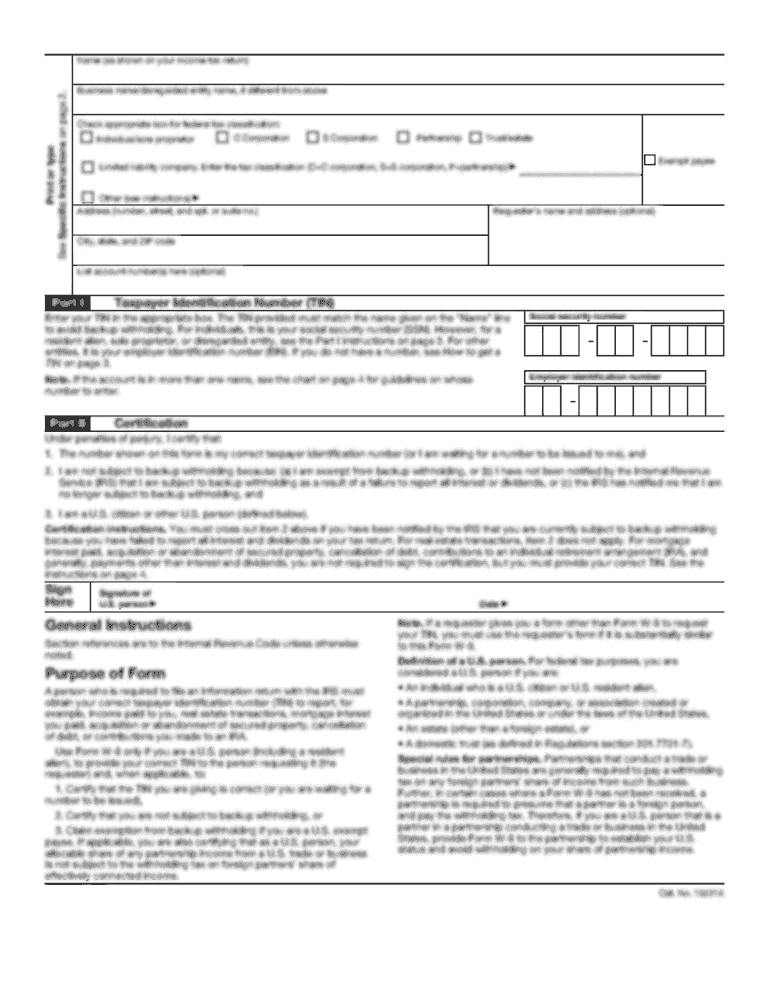

Get the free Australian Mutual Provident (AMP) - Adobe

Show details

SUCCESS STORY Australian Mutual Provident (AMP) AMP Improves Customer Service and Reduces Costs Using the Adobe Intelligent Document Platform AMP www.amp.com.au Australian Mutual Provident (AMP) is

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your australian mutual provident amp form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your australian mutual provident amp form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing australian mutual provident amp online

To use our professional PDF editor, follow these steps:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit australian mutual provident amp. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is australian mutual provident amp?

Australian Mutual Provident (AMP) is a financial company in Australia that offers a wide range of products and services, including superannuation, life insurance, investments, and banking.

Who is required to file australian mutual provident amp?

Individuals and businesses who have a financial relationship with AMP, such as policyholders, customers, and investors, may be required to file certain documents or reports with the company.

How to fill out australian mutual provident amp?

The specific steps for filling out any required forms or reports with AMP will depend on the particular document or report being filed. It is best to refer to the instructions provided by AMP or seek assistance from their customer service representatives.

What is the purpose of australian mutual provident amp?

The purpose of Australian Mutual Provident (AMP) is to provide financial products and services to individuals and businesses in Australia. This includes helping individuals save for retirement through superannuation, offering life insurance protection, facilitating investments, and providing banking services.

What information must be reported on australian mutual provident amp?

The specific information that must be reported on Australian Mutual Provident (AMP) documents or reports will vary depending on the type of form or report being filed. This may include personal or business information, financial data, policy details, or investment transactions.

When is the deadline to file australian mutual provident amp in 2023?

The deadline to file Australian Mutual Provident (AMP) documents or reports in 2023 will be determined by the specific requirements and timelines set by AMP. It is advisable to consult the relevant documentation or contact AMP directly for the exact deadline.

What is the penalty for the late filing of australian mutual provident amp?

The penalty for the late filing of Australian Mutual Provident (AMP) documents or reports will depend on the terms and conditions set by AMP. It is recommended to review the relevant documentation or contact AMP for information on any applicable penalties or consequences.

How do I edit australian mutual provident amp straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing australian mutual provident amp, you need to install and log in to the app.

How can I fill out australian mutual provident amp on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your australian mutual provident amp from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

How do I complete australian mutual provident amp on an Android device?

Use the pdfFiller app for Android to finish your australian mutual provident amp. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

Fill out your australian mutual provident amp online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.