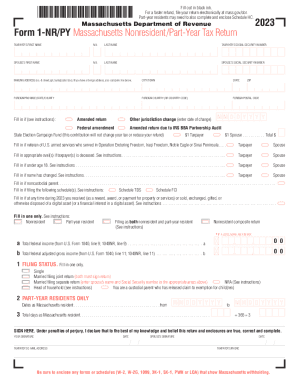

Who needs a 1-NR/BY form?

This form is completed in the state of Massachusetts by nonresident as well as resident taxpayers in case they live in the state and receive Massachusetts income source only for part of the year.

What is the purpose of 1-NR/BY form?

The Massachusetts Nonresident/Part-Year Resident Tax Return provides the information about the individual’s total income and exemptions for the previous tax year. These details are used by the Massachusetts Department of Revenue for tax records.

What other documents accompany the 1-NR/BY form?

This tax return form is usually accompanied by some other Massachusetts tax forms, such as W-2, W-2G, 2-G, OSHAWA, M-2210, LOA and 1099s, and Schedule HC (if applicable).

When is the 1-NR/BY form due?

This form must be filed before the 19th of April 2016. The estimated time for completing the form is 60 minutes.

What information should be provided in the 1-NR/BY form?

The taxpayer has to complete the following sections:

-

Filing status (nonresident, part-year resident, filing as both, nonresident composite return)

-

Total income

-

Exemptions

-

Income: wages, salaries, tips; taxable pensions and annuities; business/profession or farm income/loss; unemployment compensation)

-

Nonresident apportionment worksheet

-

Nonresident deduction and exemption ratio

-

Total deductions

-

Income after deduction

-

Income after exemptions

-

Interest and dividend income

-

Total taxable income

-

Total income tax

-

Credits

-

Income tax after credits

-

Overpayment

-

Refund

-

Tax due

This amount of tax is paid to Commonwealth of Massachusetts.

Where do I send the 1-NR/BY form after its completion?

The completed form is forwarded to the Massachusetts Department of Revenue, PO Box 7003, Boston.