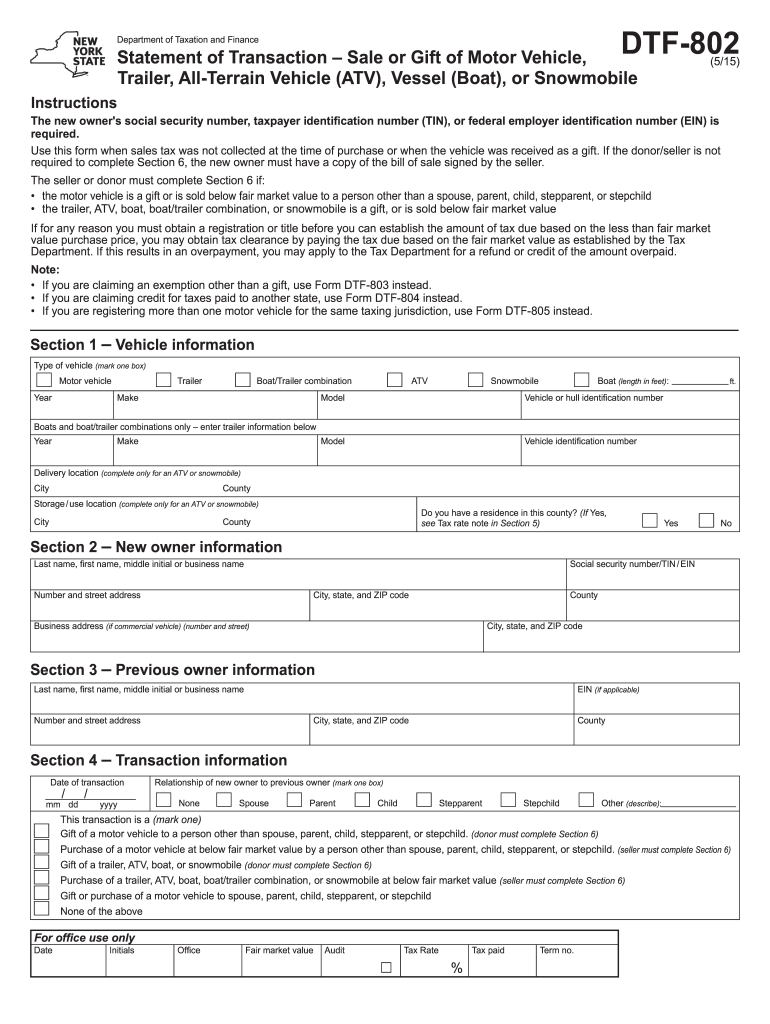

Who needs a Form DTF-802?

Form DTF-802 should be completed in order to report a purchase of a vehicle or boat when a sales tax was not collected at the time of purchase or when the vehicle or boat was received as a gift. If the donor or seller is not required to complete Section 6 of this form, the new owner must have a copy of the bill of sale signed by the seller.

If a person claiming an exemption other than a gift, they should use Form DTF-803 instead of this one.

If a person is claiming credit for taxes paid to another state, they should use Form DTF-804 instead of the 802.

If a person is registering more than one motor vehicle for the same taxing jurisdiction, they should use Form DTF-804 instead.

For motor vehicles, New York State provides a reciprocal credit for tax paid to a very limited number of states. If no reciprocal credit is available, use Form DTF-802.

What is Form DTF-802 for?

The form which is a New York State sales tax return contains information about a purchased vehicle and personal information of previous owner and buyer. This form is designed to provide financial details of the transaction including the type of relationship between a buyer and a seller. Also, if the vehicle is transferred as a gift, this fact is specified in the form.

Is Form DTF-802 accompanied by other forms?

There is no need to accompany the Statement of Transaction with any other documents.

When is Form DTF-802 due?

You should submit this form as soon as possible without exceeding the two-week term from the date of vehicle’s purchase.

How do I fill out Form DTF-802

You should provide information on following topics:

- - Vehicle Information,

- New Owner Information,

- Previous Owner Information,

- Transaction Information,

- Purchase Information and Purchaser Certification.

There is also one significant part of the document which is Affidavit of sale or gift of a motor vehicle. It should be signed by the seller or donor in cases which are specified in the document.

Where do I send Form DTF-802?

Completed and signed, this form should be directed to New York State Department of Taxation and Finance.