Get the free delaware 1120 amended form - revenue delaware

Show details

FORM DO NOT WRITE OR STAPLE IN THIS AREA REVENUE CODE 0042 2009 1100X 0101 AMENDED DELAWARE CORPORATION INCOME TAX RETURN This return is for calendar year or fiscal year ending / Reset Print Form

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your delaware 1120 amended form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your delaware 1120 amended form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit delaware 1120 amended form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit delaware 1120 amended form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

How to fill out delaware 1120 amended form

How to fill out Delaware 1120 amended form:

01

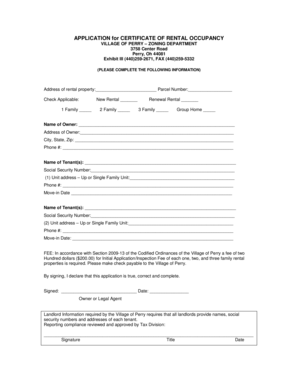

Obtain the Delaware 1120 amended form from the Delaware Department of Revenue website or by contacting their office directly.

02

Fill out the top section of the form with your business's name, address, taxpayer identification number, and the tax year being amended.

03

Review the original Delaware 1120 form that you filed for the tax year you are amending. Note any changes or corrections that need to be made.

04

Complete Part I of the amended form, which requires you to provide information about your business's income, deductions, and credits. Be sure to accurately report any changes from the original filing.

05

If you have any accompanying schedules or attachments, make sure to include them with the amended form and clearly indicate the changes being made.

06

Include an explanation of the changes made in Part II of the form. Describe the reasons for the amendments and provide any supporting documentation if necessary.

07

Double-check all the information provided on the amended form to ensure its accuracy. Any mistakes or missing information could lead to delays or issues with the amended return.

08

Sign and date the form in the designated areas to certify the accuracy of the information provided.

09

Make a copy of the completed Delaware 1120 amended form and all supporting documents for your records.

10

Submit the amended form and any required payment to the Delaware Department of Revenue by the specified deadline.

Who needs Delaware 1120 amended form:

01

Corporations that have previously filed a Delaware 1120 form and need to make changes or corrections to their original filing.

02

Businesses that have discovered errors or omissions in their original Delaware 1120 form and need to rectify them.

03

Companies that have experienced significant changes in their financials or operations since the original filing and need to adjust their tax return accordingly.

04

Corporations that have received notification from the Delaware Department of Revenue regarding the need for an amended return, such as in cases of audits or compliance reviews.

05

Any business entity that wants to ensure accurate and up-to-date tax filings and comply with Delaware's tax laws and regulations.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is delaware 1120 amended form?

Delaware 1120 amended form is a form used to make corrections or changes to a previously filed Delaware corporate income tax return.

Who is required to file delaware 1120 amended form?

Any business or corporation that needs to correct information on their previously filed Delaware 1120 form is required to file the amended form.

How to fill out delaware 1120 amended form?

To fill out the Delaware 1120 amended form, you will need to provide the corrected information in the designated sections of the form and follow the instructions provided by the Delaware Department of Revenue.

What is the purpose of delaware 1120 amended form?

The purpose of the Delaware 1120 amended form is to allow businesses and corporations to make necessary corrections to their previously filed tax returns.

What information must be reported on delaware 1120 amended form?

The Delaware 1120 amended form requires businesses to report corrected income, deductions, credits, and any other relevant financial information.

When is the deadline to file delaware 1120 amended form in 2023?

The deadline to file the Delaware 1120 amended form in 2023 is typically the same as the original filing deadline, which is usually March 1st.

What is the penalty for the late filing of delaware 1120 amended form?

The penalty for late filing of the Delaware 1120 amended form can vary, but typically includes fines and interest charges on any unpaid taxes.

Can I sign the delaware 1120 amended form electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your delaware 1120 amended form and you'll be done in minutes.

Can I create an eSignature for the delaware 1120 amended form in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your delaware 1120 amended form and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

Can I edit delaware 1120 amended form on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share delaware 1120 amended form from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

Fill out your delaware 1120 amended form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.