Get the free home appraisal checklist pdf form

Show details

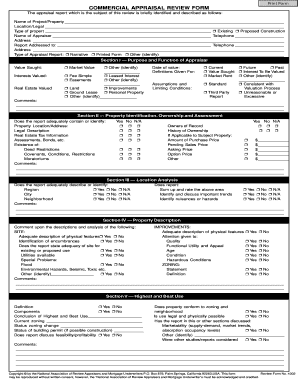

UNIFORM RESIDENTIAL APPRAISAL REPORT CHECKLIST For the review of the URAL, Fannie Mae 1004/Freddie Mac 70 For items below a No” response requires further analysis from the underwriter to determine

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your home appraisal checklist pdf form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your home appraisal checklist pdf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing home appraisal checklist pdf online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit home appraisal checklist form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

How to fill out home appraisal checklist pdf

How to fill out a home appraisal checklist pdf:

01

Start by gathering all necessary documents related to your home, such as property records, recent renovations, and maintenance receipts.

02

Carefully review each section of the home appraisal checklist pdf and ensure that you understand the purpose and requirements of each item.

03

Provide accurate and detailed information for each section, including the age and condition of various components of your home, such as the roof, electrical system, plumbing, and HVAC.

04

Take clear and high-quality photographs of the interior and exterior of your home, focusing on any unique features or improvements that may increase its value.

05

Double-check your responses and make any necessary corrections or additions before saving or printing the completed home appraisal checklist pdf.

Who needs a home appraisal checklist pdf:

01

Homeowners who are planning to sell their property and want to ensure they have all the necessary information and documentation for an accurate appraisal.

02

Real estate agents who want to assist their clients in preparing for a home appraisal and maximize the potential value of the property.

03

Potential homebuyers who want to evaluate the condition and value of a property before making an offer or completing a purchase.

Fill home refinance appraisal checklist : Try Risk Free

People Also Ask about home appraisal checklist pdf

How do I prepare my home for an appraisal?

What is checked during a home appraisal?

What do appraisers look for checklist?

How should I prepare for an appraisal?

What items affect home appraisal?

Does a messy house affect an appraisal?

What will fail a home appraisal?

What should you not say to an appraiser?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is home appraisal checklist?

A home appraisal checklist is a document or a set of guidelines used by professional appraisers to assess the value of a residential property. It outlines the specific factors that an appraiser considers when evaluating a home, including the condition of the property, its location, size, features, amenities, and overall market influences. The checklist typically includes items such as:

1. Property Details: This includes information about the property's address, legal description, lot size, and zoning.

2. Interior Features: This includes the number of bedrooms and bathrooms, square footage, layout, the condition of the flooring, walls, windows, plumbing, electrical systems, heating, and cooling systems.

3. Exterior Features: This includes the condition of the roof, siding, foundation, landscaping, and any other outdoor amenities such as a patio, deck, or pool.

4. Upgrades and Renovations: Any recent upgrades or renovations, such as a kitchen remodel or bathroom addition, are noted to assess their impact on the property's value.

5. Comparables: The appraiser will include a list of recently sold homes in the area that are similar in size, condition, and location to determine the property's market value.

6. Local Market Factors: The checklist may include an analysis of the local real estate market, including recent sales trends, supply and demand, and economic factors that could influence the property's value.

By using a standardized checklist, appraisers strive to provide an objective and accurate assessment of a property's worth, which is often used by lenders, buyers, sellers, and insurers to make informed decisions.

Who is required to file home appraisal checklist?

The homeowner or the person selling the property is typically required to file a home appraisal checklist. However, the specific requirements may vary depending on the jurisdiction and country in question.

How to fill out home appraisal checklist?

Filling out a home appraisal checklist typically requires attention to detail and thorough assessment of the property. Here are steps to help you fill out a home appraisal checklist:

1. Obtain the home appraisal checklist: Obtain the specific appraisal checklist from your lender, appraiser, or real estate agent. This checklist should cover all the relevant areas and aspects of the property that require evaluation.

2. Review the checklist: Familiarize yourself with the checklist by reviewing all the sections, categories, and items included. This can help you understand what aspects of the home you need to assess and evaluate.

3. Conduct a thorough examination: Inspect the property inside and out, paying close attention to the areas and items listed on the checklist. This may include checking the condition of the roof, walls, flooring, electrical systems, plumbing, HVAC systems, appliances, and more.

4. Provide accurate information: As you go through each section, provide accurate and objective information about the condition, quality, and functionality of the items listed. Avoid personal bias and give an honest assessment.

5. Consider comparables: If the checklist requires you to evaluate the property's value or marketability, research and include information about recently sold and similar properties in the area. This helps provide context and support your evaluation.

6. Take notes and document findings: While examining the property, take detailed notes of any relevant observations, issues, or improvements. These notes will help you accurately fill out the checklist, as well as provide essential information to support the appraisal.

7. Use appropriate terminology: Make sure you understand any specialized terminology used in the appraisal checklist. Accurate and precise descriptions of the property and its components are necessary to communicate effectively.

8. Provide additional comments if needed: The checklist may have space for additional comments or remarks. Use this space to add any pertinent information or explanations that may help the appraiser, lender, or others understand the condition or value of the property.

9. Double-check and review: Once you have completed filling out the checklist, double-check and review your entries for accuracy and completeness. Ensure you have covered all the required items and provided the necessary information.

10. Submit the completed checklist: Finally, submit the completed checklist as required, whether it is to your lender, appraiser, or real estate agent. Keep a copy for your records.

Note: It is important to remember that if you are not a licensed appraiser, the appraisal checklist you fill out may be used as supporting information, but the final valuation and appraisal should be conducted by a qualified professional.

What is the purpose of home appraisal checklist?

The purpose of a home appraisal checklist is to assess the value and condition of a property. It includes a detailed list of criteria that appraisers use to evaluate various aspects of a home, such as its size, layout, condition, amenities, and location. The checklist helps ensure that the appraisal process remains consistent and thorough, providing an objective and reliable estimate of the property's value. It also helps identify any potential issues or discrepancies that may affect the property's worth.

What information must be reported on home appraisal checklist?

The information that must be reported on a home appraisal checklist typically includes:

1. Property details: The address and legal description of the property, as well as the type of property (single-family home, condominium, etc.).

2. Property features: A detailed description of the property's physical characteristics, such as the number of bedrooms and bathrooms, square footage, lot size, and any additional amenities or features.

3. Interior condition: The overall condition of the interior, including the quality of construction, flooring, walls, ceilings, fixtures, and appliances.

4. Exterior condition: The condition of the exterior, including the condition of the roof, siding, foundation, driveway, landscaping, and any other exterior features.

5. Recent renovations or upgrades: Any recent renovations or upgrades made to the property, including information on the quality of the workmanship and materials used.

6. Comparable sales: A list of recently sold properties in the area that are similar to the subject property, including details such as sale prices, dates of sale, and any significant differences or similarities to the subject property.

7. Market analysis: An analysis of the local real estate market, including information on recent sale prices, market trends, and any factors that may impact the value of the property.

8. Photos: Photographs of the property, both interior and exterior, to provide visual documentation of the property's condition and features.

9. Appraiser's opinion of value: The appraiser's professional opinion of the market value of the property, supported by the data and analysis provided in the appraisal report.

It's important to note that the specific requirements for a home appraisal checklist may vary depending on the lender, location, and other factors.

What is the penalty for the late filing of home appraisal checklist?

The penalty for the late filing of a home appraisal checklist can depend on various factors, including the specific regulations and guidelines set by the relevant authority or organization.

In some cases, there may be no specific penalty for late filing, but the delayed appraisal can lead to delays in loan processing or other related transactions. This could result in inconvenience or additional costs for the parties involved.

However, if there are specific penalties outlined by the authority or organization, they may include financial penalties or fees. These penalties may vary in severity depending on the length of the delay and any mitigating circumstances.

It is essential to consult the specific guidelines or regulations provided by the relevant authority or organization to determine the exact penalties for the late filing of a home appraisal checklist in a particular jurisdiction or situation.

Where do I find home appraisal checklist pdf?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific home appraisal checklist form and other forms. Find the template you need and change it using powerful tools.

How do I fill out the appraisal checklist pdf form on my smartphone?

Use the pdfFiller mobile app to fill out and sign home appraiser checklist. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

How do I edit appraisal checklist template on an iOS device?

You certainly can. You can quickly edit, distribute, and sign property appraisal checklist form on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

Fill out your home appraisal checklist pdf online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Appraisal Checklist Pdf is not the form you're looking for?Search for another form here.

Keywords relevant to appraisal preparation checklist form

Related to printable home appraisal checklist

If you believe that this page should be taken down, please follow our DMCA take down process

here

.