B) K Check box for whether the trust s transfers or loans have to be reported to Internal Revenue Service List A: Includes a trust s current distribution in a Form A — 1, and

Includes a trust s present distribution in a Form A — 2 or

Includes a transfer of more than 10,000 to a trust in an individual ____, J, S, or X form or by a trust that is not a qualified trust ; and

and Includes a transfer of a nonqualified stock within 6 months following the trust s death or a distribution of the nonqualified stock to a trust before the Trust is created or during the period after the Trust s first death before the Trust s first creation.

The trustee s method of insurance is the same as the tax method, if any, provided for under the beneficiary s election. The trustee s method of insurance includes the following trustees s insurance contracts, the trustee s method of insurance and the trustee s method of insurance as appropriate:

(1) If a taxpayer s trustee was the person named as the beneficiary of a trust during the year, then any insurance described in § 1.5011-4(b)(2) is not includible in the Trust s income for the year.

(2) Any insurance that is required by the trust s election of a trust to be reported to the Internal Revenue Service for purposes of Part 1A is includible.

(3) Any retirement plan s annuity, lump-sum or separate maintenance payment, or severance payment on the death of a participant, is treated as if it were received by the participant, and the Trust s capital account shall be credited as if the participant s death had occurred at the time the payment is received by the Trust.

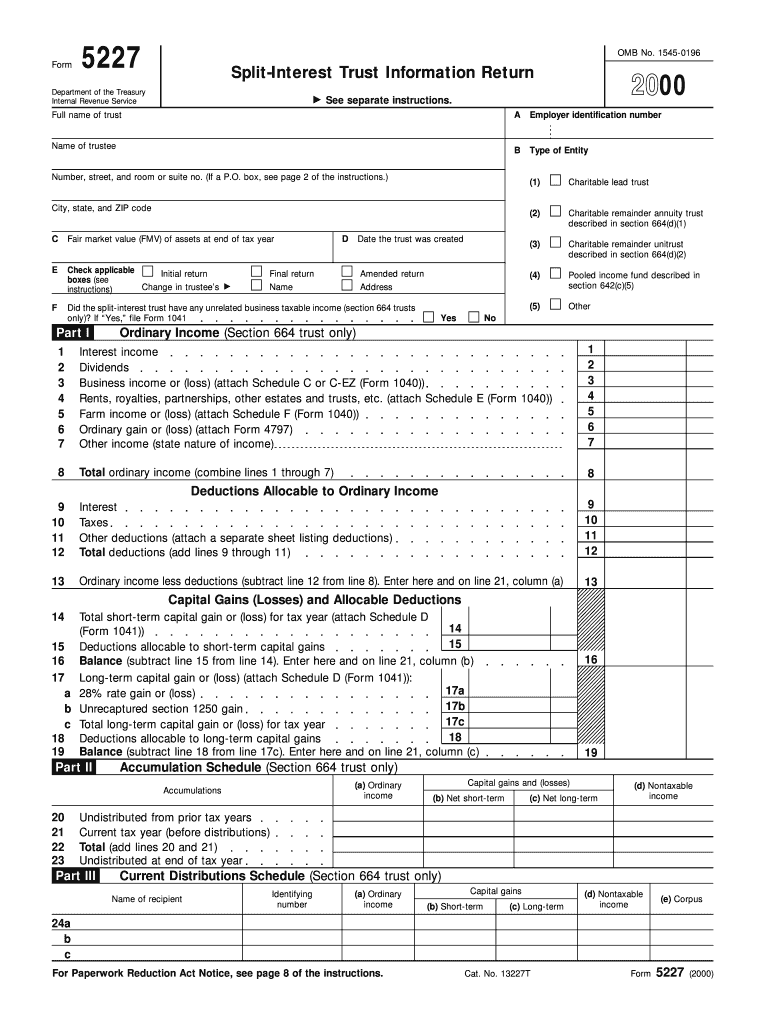

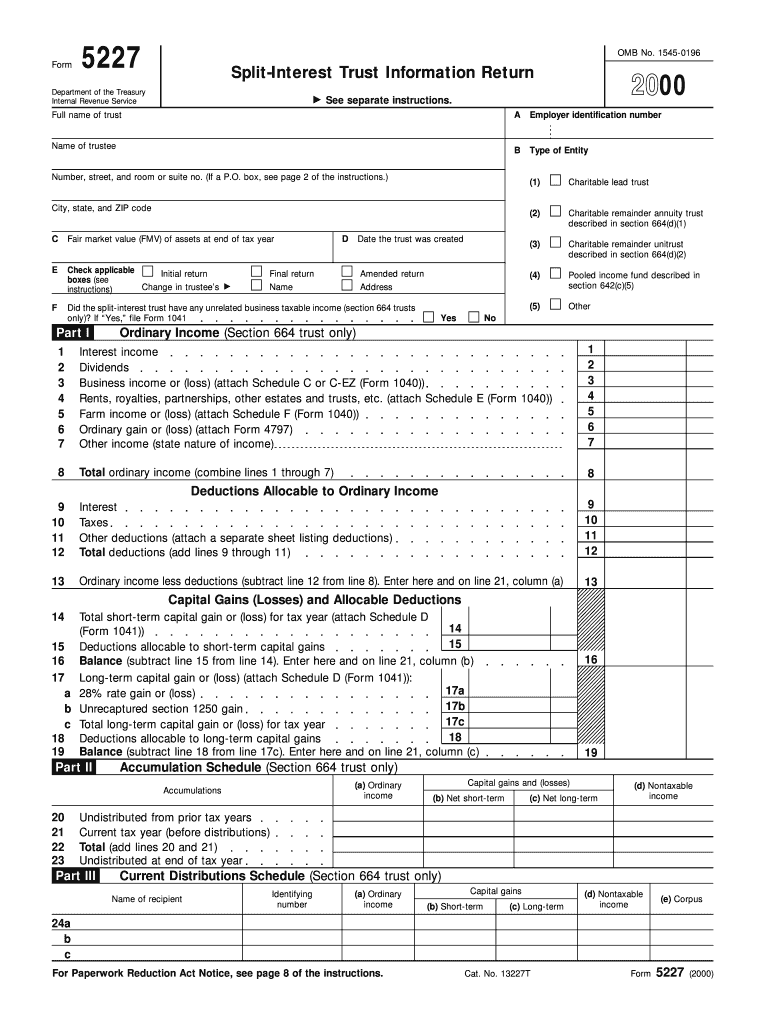

(d) Form 5227Omb

This section must be made on a Form 5227Omb (Form 5227-Omb for Trusts). Use Form 5227Omb to report income that is includible under section 72(t) in a qualified trust for a month if the trust had a value for this month of 1, 000 or more. Use Form 5227Omb if the trust had a value to which paragraph (d)(2), (3), or (4) does not apply.

Get the free Type of Entity - irs

Show details

Form 5227 OMB No. 1545-0196 Split-Interest Trust Information Return Department of the Treasury Internal Revenue Service 2000 See separate instructions. Full name of trust A Employer identification

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your type of entity form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your type of entity form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit type of entity online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit type of entity. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is type of entity?

Type of entity refers to the legal structure or form that an organization or business operates under, such as a corporation, partnership, or sole proprietorship.

Who is required to file type of entity?

Any organization or business that is required to register with the government or regulatory authorities must file their type of entity. This includes both for-profit and non-profit entities.

How to fill out type of entity?

Filling out the type of entity typically involves providing information about the legal structure or form of the organization or business. This information may be obtained through registration forms or by consulting legal advisors.

What is the purpose of type of entity?

The purpose of identifying the type of entity is to determine the legal rights, responsibilities, and obligations of the organization or business. It also helps in determining the applicable legal framework and regulatory requirements.

What information must be reported on type of entity?

The information reported on the type of entity typically includes the legal structure or form of the organization, such as whether it is a corporation, partnership, limited liability company (LLC), or sole proprietorship.

When is the deadline to file type of entity in 2023?

The specific deadline for filing the type of entity in 2023 may vary depending on the jurisdiction and applicable regulations. It is recommended to consult the relevant government authorities or legal advisors for accurate deadlines.

What is the penalty for the late filing of type of entity?

The penalty for the late filing of the type of entity may vary depending on the jurisdiction and specific regulations. Common penalties may include monetary fines, loss of certain legal protections, or other legal consequences. It is advisable to consult legal advisors or the governing authorities for precise information on penalties.

How can I send type of entity for eSignature?

When your type of entity is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I execute type of entity online?

Filling out and eSigning type of entity is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I edit type of entity on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign type of entity right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

Fill out your type of entity online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.