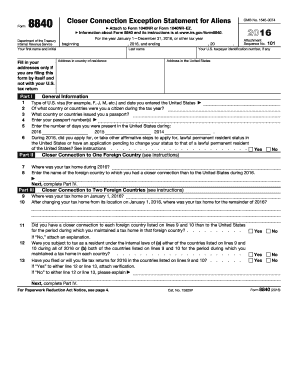

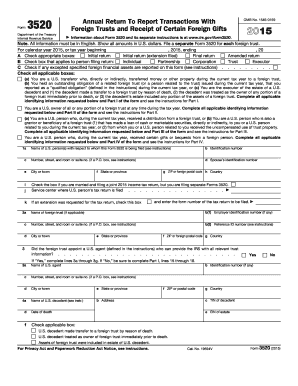

Get the free 3520 1 form

Get, Create, Make and Sign

How to edit 3520 1 form online

How to fill out 3520 1 form

How to fill out the 3520 1 form:

Who needs the 3520 1 form:

Video instructions and help with filling out and completing 3520 1 form

Instructions and Help about 3520 1 form

Hello I'd like to extend you a very warm welcome to this help out video my name is Carissa, and I'm a US service coordinator here to walk you through the form requirements for completing EPA form 35 20 — one for on-road use this form is used when you are shipping anything that has a gas or diesel engine in it and as for on-road use only and as you can see on page one here you need to fill out some information, and we're going to start with box one which is the port code this is the port the shipment is crossing you may not have this information that particular field can be left blank if you haven't it doesn't hurt to put it in there, but you can leave it blank entry date is the date that you think the shipment is going to be crossing this does not have to be inaccurate they just do to the best of your ability as to when the shipment will be crossing field 3 as the customs entry number this field can be left blank as the entry has not been created and filled for as the vehicle identification number this is where the EPA stickers on the engine will come in play you need to have that information, and it should be listed on the EPA form for the VIN number field 5 is the manufacturer date they need the month Amir and that should also be listed on your EP a sticker located on the engine of the item you are shipping manufacturer is box 6 the make that should also be listed on your EP a sticker as to the manufacturer and make box 7 as the model that should also be located on the EPA sticker for the type of model that you'll be shipping field 8 this is where an IC importer only may be required and if you kind of scroll down there are some boxes that you do have to read over that are like code because and it goes on to the second page this needs to be completed as to what type of engine or what is applicable to what you're importing on the engine which you can see a CJ and V is located so if your engine does not fall within those categories field eight does not need to be filled in for the ACI and now as we go back up box 9 as the EPA exemption number required for code LG i k and o and as you've seen from the previous you have to check box one of those boxes in order to fill out that particular field so if your engine does not fall within l GI k or o box 9 can be left blank we're going to move on to box 10 which is the importer code B must be certified holder or their agent for shipment of new vehicles prior to introducing into the Commerce and that field is only completed as you can see if your engine is applicable to coat a c Jr and that must be a CI so if your engine is not in those fields then you don't need to complete that box 10 box 11 is the owner who is the owner of the goods put in their information in this box field 12 is storage content or contact so if this is being stored somewhere you're going to put the contact information in this particular field box 13 is the signature then we need the signature of the person who is completing the EPA...

Fill form : Try Risk Free

People Also Ask about 3520 1 form

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your 3520 1 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.