Get the free bir form 1604 cf excel

Show details

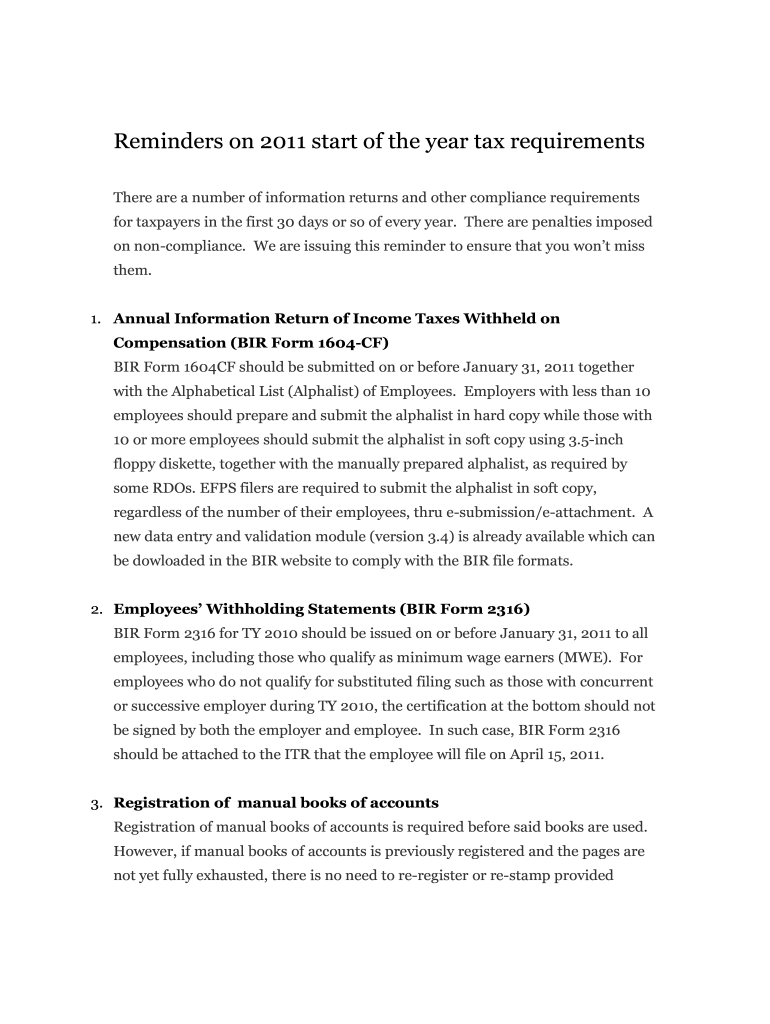

Reminders on 2011 start of the year tax requirements

There are a number of information returns and other compliance requirements for taxpayers in the first 30 days or so of every year. There are penalties

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your bir form 1604 cf form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bir form 1604 cf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit bir form 1604 cf excel online

To use the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit 1604c excel format. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

How to fill out bir form 1604 cf

How to fill out 1604cf form excel?

01

Open Microsoft Excel on your computer.

02

Create a new worksheet or open an existing one where you want to fill out the form.

03

Locate the 1604cf form excel template or create a new one based on the required format.

04

Enter the necessary information in the appropriate fields, such as name, address, TIN (Tax Identification Number), and other relevant details.

05

Double-check and ensure the accuracy of the entered data.

06

Save the filled-out form on your computer or a desired location.

Who needs 1604cf form excel?

01

Employers or businesses in the Philippines who are required to file monthly remittance returns of income taxes withheld on compensation.

02

Individuals or entities who have employees and are mandated to report and remit their taxes to the Bureau of Internal Revenue (BIR).

03

Professionals or self-employed individuals who have paid compensation to employees and need to comply with tax regulations.

Video instructions and help with filling out and completing bir form 1604 cf excel

Instructions and Help about bir form 1604 cf download

Fill 1604cf form : Try Risk Free

People Also Ask about bir form 1604 cf excel

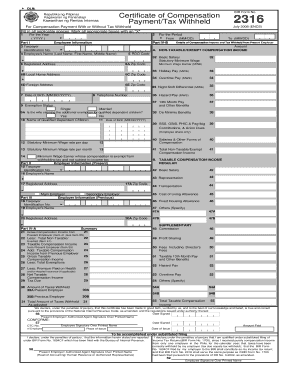

What is Form 1604CF?

What is the due date for 1604CF?

How do I file BIR 1604cf?

Who shall file 1604f?

How to file 1604CF 2022?

What is the meaning of 1604cf?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file 1604cf form excel?

The 1604CF form is an annual return/report that is filed by employers who are subject to the Commonwealth of Puerto Rico’s withholding tax. Employers who have employees who are residents of Puerto Rico, or who have income earned in Puerto Rico, are required to file this form.

How to fill out 1604cf form excel?

1. Begin by downloading the form from the Bureau of Internal Revenue (BIR) website.

2. Open the form in Microsoft Excel.

3. Enter the taxpayer’s details at the top of the form, including name, TIN, address, and contact information.

4. Enter the details of the tax return period in the appropriate fields.

5. Fill out the form by entering the required information in the applicable fields.

6. Review the form for accuracy and make any necessary corrections.

7. Save the form and submit it to the BIR for processing.

What is the purpose of 1604cf form excel?

The 1604CF form is an Excel document that can be used to report employee information to the Internal Revenue Service (IRS). It is used to report employee wages, tips, and other compensation, as well as federal income tax withheld. This form is also used to report state and local income taxes withheld, and other information related to the employee's wages.

What information must be reported on 1604cf form excel?

The 1604CF form requires employers to report the following information:

• Employer’s name, address, and Federal Employer Identification Number (FEIN)

• Employee’s name, Social Security Number (SSN), and address

• State of employment

• Year

• Wages paid

• State income tax withheld

• Local income tax withheld (if applicable)

• State disability insurance (SDI) withheld (if applicable)

• Local disability insurance (LDI) withheld (if applicable)

• Unemployment insurance (UI) withheld (if applicable)

• Any additional taxes withheld (if applicable)

• Total taxes withheld

When is the deadline to file 1604cf form excel in 2023?

The deadline to file 1604CF form excel in 2023 is March 31, 2023.

What is 1604cf form excel?

The 1604CF form, also known as the Annual Information Return of Income Taxes Withheld on Compensation, is a form used in the Philippines for reporting and remitting taxes withheld on compensation. It is applicable for all employers who withhold taxes on compensation payments to employees.

The 1604CF form can be prepared manually or using electronic formats such as Excel. Excel is commonly used to create a spreadsheet template that can automate calculations and generate the required details for each individual employee. The use of Excel makes it easier to organize and compute the data required for the 1604CF form, ensuring accurate reporting and compliance with tax regulations.

How do I edit bir form 1604 cf excel in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your 1604c excel format, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Can I create an electronic signature for signing my bir form 1604 c excel download in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your 1604 c excel format and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I fill out the 1604cf form excel form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign bir form 1604c excel and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

Fill out your bir form 1604 cf online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bir Form 1604 C Excel Download is not the form you're looking for?Search for another form here.

Keywords relevant to 1604cf form download

Related to 1604c form excel

If you believe that this page should be taken down, please follow our DMCA take down process

here

.