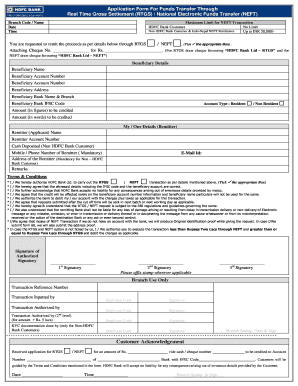

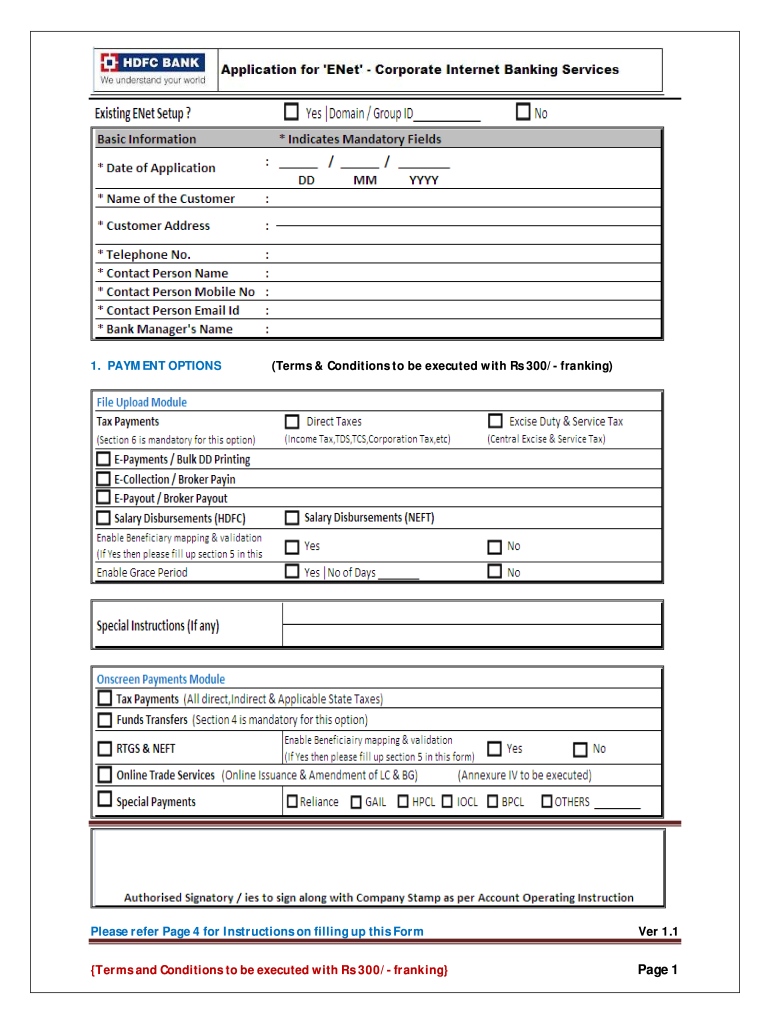

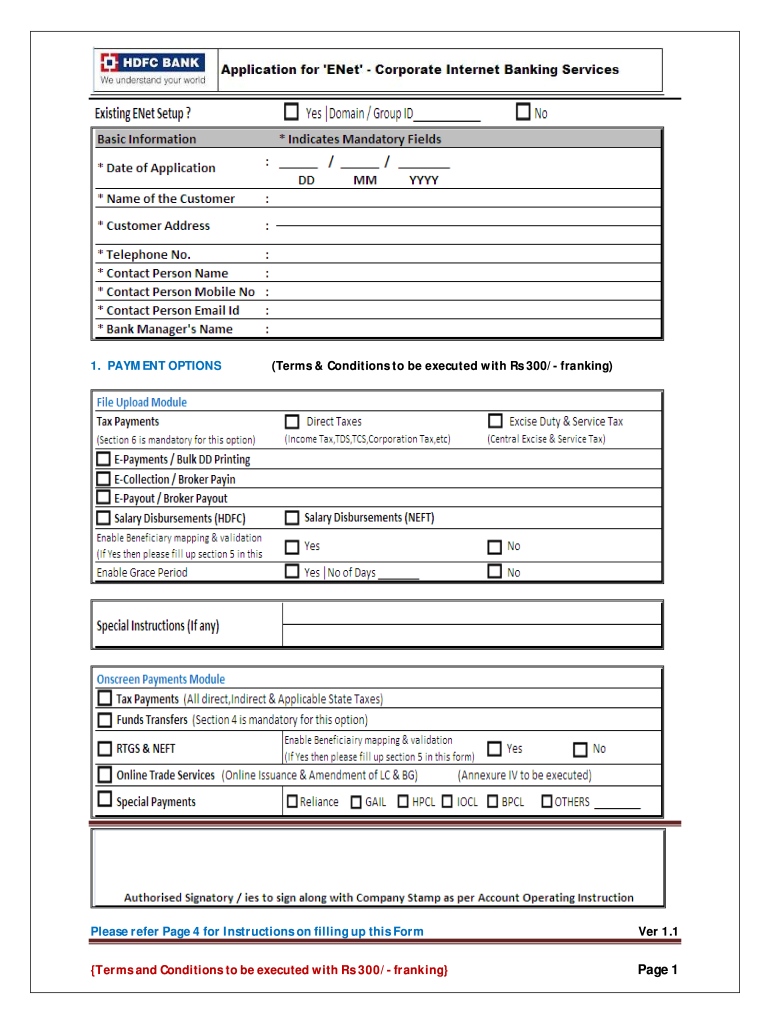

Get the free rtgs form

Show details

(A single request form will apply to all policies) Receipt Daytime: Stamp ... where the payout via NEFT cannot be processed by Decline, the payout may be ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your rtgs form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rtgs form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing rtgs form online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit hdfc rtgs form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

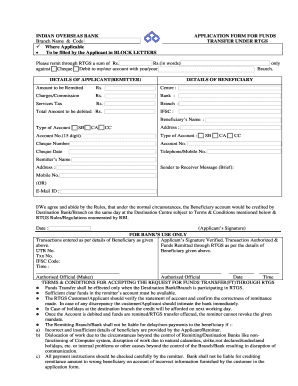

How to fill out rtgs form

Point by point, here is how to fill out an RTGS form:

01

Start by gathering the necessary information to complete the form, including the beneficiary's name, bank account number, and the amount to be transferred.

02

Next, provide your own banking details, such as your account number, name, and contact information.

03

Specify the purpose of the transfer, whether it is for personal reasons, business transactions, or any other appropriate category.

04

Double-check all the entered information for accuracy and completeness to avoid any errors or delays.

05

Once the form is filled out correctly, sign and date it.

Now, let's move on to the second part of the question:

Who needs an RTGS form?

01

Individuals or businesses who need to transfer a large sum of money quickly and securely may require an RTGS form. RTGS stands for Real-Time Gross Settlement, and it is a mechanism that enables real-time fund transfers between banks.

02

RTGS forms are commonly used for various purposes, such as making payments for real estate transactions, settling business invoices, or transferring funds for investments or loans.

03

Additionally, individuals or organizations that frequently make high-value transactions or require immediate fund transfers often find RTGS forms to be beneficial.

In conclusion, anyone who needs to transfer a significant amount of money promptly and securely can utilize an RTGS form, following the steps mentioned above to ensure a smooth and accurate process.

Video instructions and help with filling out and completing rtgs form

Instructions and Help about hdfc neft form

Fill hdfc neft form pdf : Try Risk Free

People Also Ask about rtgs form

What is RTGS full description?

What is a RTGS form?

What should I fill in RTGS form?

What are the details of beneficiary in RTGS form?

How to fill RTGS form for money transfer?

What do I fill out in RTGS form?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

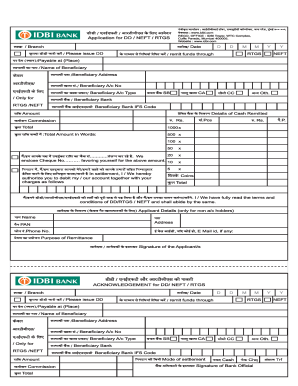

What is rtgs form?

Real Time Gross Settlement (RTGS) is a funds transfer system where the transfer of money or securities takes place from one bank to another on a "real time" and on a "gross" basis. RTGS transactions are typically high-value and time-critical payments. The RTGS form is an application form that is used to initiate an RTGS transaction. It includes details about the remitter, beneficiary and the funds being transferred.

How to fill out rtgs form?

1. Fill out the RTGS form with your details:

a. Enter your name, address, and bank account number.

b. Enter the amount of money you want to transfer in the RTGS form.

c. Enter the name and account number of the beneficiary.

d. Enter your bank's IFSC code and the beneficiary's bank's IFSC code.

e. Enter the purpose of the transaction.

f. Sign the form.

2. Submit the form to your bank:

a. Take the filled-out RTGS form to your bank’s branch.

b. Handover the form to the bank representative.

c. Pay the RTGS charges and any applicable taxes.

d. Take the receipt of the RTGS transaction.

3. Monitor the status of the transaction:

a. After you have submitted the form, you can track the status of the transaction online.

b. You can also contact your bank's customer service team for updates on the transaction.

What is the purpose of rtgs form?

The purpose of an RTGS form is to provide the necessary information required to facilitate a Real Time Gross Settlement (RTGS) transaction. The RTGS form contains details such as the beneficiary’s name, account number, IFSC code, address, and other details required to complete the transaction. The form is used to transfer funds from one bank to another in a secure and efficient manner.

What information must be reported on rtgs form?

The information that must be reported on a RTGS form includes:

* Name and address of the sender

* Name and address of the recipient

* Account number of the sender

* Account number of the recipient

* Bank details of the sender

* Bank details of the recipient

* Amount to be transferred

* Purpose of the transfer

* Date of the transfer

* Transfer reference number (if any)

When is the deadline to file rtgs form in 2023?

The exact deadline for filing RTGS forms in 2023 will depend on the individual bank or financial institution. Generally, RTGS forms must be filed by the end of each business day.

What is the penalty for the late filing of rtgs form?

The penalty for the late filing of RTGS form is Rs. 100/- plus applicable taxes.

Who is required to file rtgs form?

The RTGS (Real Time Gross Settlement) form is required to be filed by individuals or businesses making large value transactions that exceed the threshold set by the respective country's central bank or regulatory authority. The specific criteria for filing an RTGS form may vary by jurisdiction. It is important to consult local regulations or financial institutions for accurate information regarding who is required to file the form.

How can I edit rtgs form from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your hdfc rtgs form into a dynamic fillable form that you can manage and eSign from anywhere.

How do I edit hdfc bank rtgs form straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing hdfc rtgs form download.

How do I edit rtgs form hdfc on an iOS device?

Use the pdfFiller mobile app to create, edit, and share hdfc rtgs form pdf from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

Fill out your rtgs form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Hdfc Bank Rtgs Form is not the form you're looking for?Search for another form here.

Keywords relevant to rtgs full form

Related to rtgs form hdfc bank

If you believe that this page should be taken down, please follow our DMCA take down process

here

.