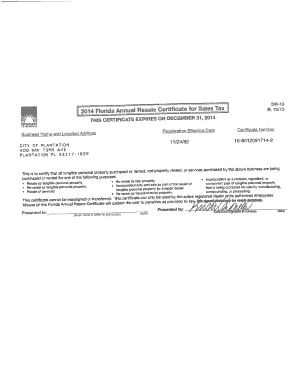

Get the free florida sales tax form

Show details

5050 W. Tennessee Street. Tallahassee, FL 32399-0120. DR-15EZ. R. 01/12. Rule 12A-1.097 ... City/St/ZIP. Please read the Instructions for DR-15EZ Sales and ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your florida sales tax form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your florida sales tax form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit florida sales tax form online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit florida sales tax form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

How to fill out florida sales tax form

How to fill out Florida sales tax form:

01

Gather all necessary information and documentation related to your sales transactions, including sales receipts, invoices, and records of taxable sales.

02

Read and understand the instructions provided on the Florida sales tax form. This will help you determine which sections are applicable to your business.

03

Begin by entering your business identification information, such as your Employer Identification Number (EIN) or Social Security Number (SSN), legal business name, and contact details.

04

Provide detailed information about the sales made during the reporting period, including the date of each sale, the amount of each sale, and the applicable sales tax rate for each item sold.

05

Calculate the total amount of sales tax owed by applying the appropriate sales tax rate to the taxable sales amount. Ensure accurate calculations to avoid any discrepancies or penalties.

06

Report any exemptions or deductions that your business may be eligible for. This could include exemptions for certain types of goods or services, sales made to tax-exempt organizations, or sales that occurred outside of Florida.

07

Complete any additional sections or schedules required by the form, such as reporting local sales taxes or surtaxes imposed by specific counties or municipalities.

08

Review all the information provided on the form for accuracy and completeness. Double-check calculations and ensure that all necessary fields are properly filled out.

09

Sign and date the form, certifying that the information provided is true and accurate to the best of your knowledge.

10

Keep a copy of the completed Florida sales tax form for your records.

Who needs Florida sales tax form:

01

Any business or individual engaged in selling tangible personal property, certain services, or taxable items in the state of Florida is generally required to file a Florida sales tax form.

02

This includes retail businesses, wholesalers, manufacturers, and service providers who meet the sales thresholds set by the Florida Department of Revenue.

03

Additionally, out-of-state sellers who have economic nexus in Florida, meaning they meet specific sales or transaction thresholds, may also need to file a Florida sales tax form.

04

It is important to consult with the Florida Department of Revenue or a tax professional to determine if you are required to file a sales tax form and ensure compliance with all applicable laws and regulations.

Fill form : Try Risk Free

People Also Ask about florida sales tax form

What form is used for Florida use tax?

Do Florida residents file a state tax return?

How do I file sales tax in Florida?

What is a Florida sales and use tax certificate?

What is a DR-1 form in Florida?

What tax form does Florida use?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is florida sales tax form?

The Florida sales tax form, officially known as Form DR-15, is a document that businesses in Florida use to report and remit sales and use tax to the Florida Department of Revenue. This form is used to calculate the amount of sales tax collected from customers during a specific reporting period and to report any taxable purchases made by the business. It is typically filed on a monthly or quarterly basis, depending on the business's sales volume.

Who is required to file florida sales tax form?

In Florida, businesses that meet certain criteria are required to file a sales and use tax return (Form DR-15) and remit sales tax to the state. If a business engages in selling or leasing tangible personal property, certain services, or renting accommodations in Florida, they are generally required to file a sales tax return. Additionally, businesses that make sales through the internet are also obligated to collect and remit sales tax. However, the specific requirements can vary based on the nature of the business and its sales volume. It is advisable to consult with the Florida Department of Revenue or a tax professional to determine individual filing obligations.

How to fill out florida sales tax form?

To fill out a Florida sales tax form, follow these steps:

1. Gather the necessary information - You'll need information on your sales and purchases, including the total sales made in Florida and any taxable purchases you made during the reporting period.

2. Choose the appropriate form - Florida uses different forms for different types of businesses. The most commonly used form is Form DR-15, Sales and Use Tax Return. However, depending on your business type, you may need to use a different form such as Form DR-15N, DR-15T, DR-15EZ, etc. Ensure you have the correct form for your business.

3. Reporting period - Determine the reporting period for which you are filing the sales tax return. The reporting period is usually monthly, but smaller businesses may file quarterly.

4. Calculate the sales tax liability - Calculate the amount of sales tax owed based on your taxable sales. In Florida, the sales tax rate can vary depending on the county or municipality, so be sure to use the correct rate. You can find the applicable tax rate for your location on the Florida Department of Revenue's website.

5. Report gross sales - On the sales tax form, report the total amount of gross sales made during the reporting period. This includes taxable and non-taxable sales.

6. Deduct exempt sales - If you made any exempt sales during the reporting period, deduct the total amount from the gross sales.

7. Calculate taxable sales - Subtract exempt sales from gross sales to find the total taxable sales.

8. Calculate sales tax owed - Multiply the total taxable sales by the appropriate sales tax rate to calculate the sales tax owed.

9. Report purchases - If you made any taxable purchases during the reporting period, report the total amount on the form. This will be subject to use tax.

10. Complete the form - Fill out all required fields on the sales tax form, including your business information, reporting period, sales and purchases, and the calculated amounts.

11. Sign and submit - Sign the form and submit it to the Florida Department of Revenue by the due date. You can file electronically through the Florida Taxpayer Access Point (TAP) or mail the completed form to the specified address.

Remember to keep a copy of the completed form for your records. It's also important to ensure the accuracy of the information provided to avoid any penalties or fines. If you have any specific questions or need further assistance, it's advisable to consult with a tax professional or contact the Florida Department of Revenue.

What is the purpose of florida sales tax form?

The purpose of the Florida sales tax form is to report and remit sales and use tax collected by a business entity in the state of Florida. It is used to calculate the amount of sales tax owed by the business to the Florida Department of Revenue. The form also helps in maintaining records of sales transactions, providing details of taxable sales, exemptions, and other related information required by the tax authorities. The sales tax form ensures compliance with Florida's tax laws and facilitates the accurate assessment and collection of sales tax by the state.

What information must be reported on florida sales tax form?

The information required to be reported on the Florida sales tax form varies depending on the type of business and sales activities. Generally, the following information must be reported:

1. Gross Sales: Sales made during the reporting period, which includes all taxable and non-taxable sales.

2. Taxable Sales: Total sales subject to Florida sales tax.

3. Sales Tax Collected: Amount of sales tax collected from customers.

4. Out-of-State Sales: Sales made outside of Florida that are subject to use tax.

5. Resale Exemptions: Sales made to resellers or for resale purposes.

6. Tax-Exempt Sales: Sales made to entities exempt from sales tax, such as government agencies or non-profit organizations.

7. Discounts: Any cash or trade discounts provided to customers.

8. Bad Debts: Total amount of bad debts uncollectible and charged off during the reporting period.

9. Local Option Tax: If applicable, the amount of local option sales tax collected.

10. Credits and Adjustments: Any credits or adjustments to previously-reported sales tax liabilities.

It's important to consult the Florida Department of Revenue or a tax professional to ensure accurate reporting based on your specific business situation.

What is the penalty for the late filing of florida sales tax form?

The penalty for late filing of a Florida sales tax form is typically 10% of the amount of tax due or $50, whichever is greater. If the failure to file is found to be intentional, the penalty can be up to 200% of the tax due. Additionally, interest may be charged on the unpaid tax amount. It's important to note that specific penalty amounts may vary depending on the circumstances, so it's advisable to consult the Florida Department of Revenue or a tax professional for accurate information.

How can I get florida sales tax form?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific florida sales tax form and other forms. Find the template you need and change it using powerful tools.

Can I create an eSignature for the florida sales tax form in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your florida sales tax form and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How can I edit florida sales tax form on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing florida sales tax form right away.

Fill out your florida sales tax form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.